The National Milk Producers Federation says “Positive aspects of the current dairy situation include a 4.7% annual increase for total commercial use of milk in all products, domestic and export, during March to May, when measured on a milk equivalent of total solids basis. Of total use, domestic use was 1.9% higher, while exports grew over 19%.”

NMPF admits that while many year-over-year comparisons are currently less informative than usual given last year’s pandemic, growth in total commercial use exceeded growth in both milk and milk solids production during the March to May period. That growth, plus the heat and drought situation in the western states, should start to improve milk prices and margins, although the current situation continues to reflect higher production earlier in the year,” NMPF concludes.

Thank God for pizza. Pizza uses a tremendous amount of cheese and remember it takes about 10 pounds of milk to produce one pound of cheese. One of the biggest names in the pizza business today is Domino’s, but Domino’s has seen growth nearly six times faster in international markets than in the U.S., according to the July 23 Dairy and Food Market Analyst (DFMA).

“The company reported that it opened 203 restaurants in foreign markets but only 35 in the U.S. in second quarter 2021. Growth was concentrated in China, Japan, the United Kingdom, Germany, Mexico and Turkey,” according to the DFMA, “with impressive sales growth as well. The company said its total second quarter sales rose 17% year over year, driven by much-higher sales in international markets with same-store sales up 14%. Same-store sales in the U.S. grew just 3.5%, “lapping a difficult-to-beat increase of 16% in second quarter 2020.”

Speaking in the August 2 “Dairy Radio Now,” DFMA analyst and editor Matt Gould pointed out that it’s not just pizza driving cheese sales, but credited quick service restaurant sales in general, which have soared, as we came out of the pandemic.

McDonalds reported U.S. sales were up 26% from a year ago, he said, and global sales were up 41%, although that’s measured against weak comparables a year ago. He said that “People are getting out, getting together, and going thru drive-thrus.” Considering overall cheese consumption, the sales are quite strong, he said. Comparable sales are also occurring in other chains, according to Gould, such as Burger King, Wendy’s, Chipotle, Papa Johns, Little Caesars, and others are “performing on all cylinders right now,” he concluded.

The July 26 Daily Dairy Report adds that “Nestlé, which makes DiGiorno, Tombstone, Jack’s, and California Pizza Kitchen pizzas, saw high single-digit growth in its frozen category last year, with DiGiorno called out as a key category.” Staffing is one of the big issues they face, according to the DDR.

Back on the farm, “Heat advisories lit up weather maps again this week,” according to StoneX Dairy’s July 29 Early Morning Update, “but this time the largest swath of heat was over the Great Plaines and Midwest. Washington State was, however, put back on an excessive heat warning once again as temperatures surge in that area of the country. All of this hasn’t meant much to the price of milk or corn for that matter,” says StoneX. “The prevailing belief is that heat will knock us down to where we ought to be as opposed to causing any great shortage. In slow demand markets, supply takes center stage. When demand improves, it’s almost all about demand,” StoneX concludes.

The cash dairy markets didn’t have a lot to feed on the last week of July. There were no major USDA reports that the trade actively monitors so weather, emotion, and rumor ruled.

The Cheddar blocks climbed to $1.6350 per pound Tuesday and stayed there, up a nickel on the week but 61.75 cents below a year ago when they plunged 28.75 cents.

The barrels hit $1.4175 Monday but rolled downhill from there to Friday’s close at $1.39, 1.25 cents lower on the week, 84.50 cents below a year ago, and 24.50 cents below the blocks. There were 3 sales of block on the week and 22 for the month of July, down from 82 in June. Barrel sales totaled 16 for the week and 111 for the month, down from 126 in June.

Packaging issues on the block side is creating an additional supply of barrels, according to StoneX. Meanwhile, Dairy Market News reports that Midwestern cheese producer’s sales remain generally healthy. Italian style cheesemakers say sales remain robust. Some Cheddar makers reported generally steady and healthy sales, but some customers have grown a little more hesitant as prices soften. Milk availability, after showing signs of increased prices the previous week, slipped back to the $5 under realm. A number of cheesemakers were running flush with internally sourced milk but cheese stocks are not burdensome.

Western cheese demand, both retail and food service, held steady this week and the lower prices remain favorable to international buyers. Port congestion continues to delay loads which are building in warehouses due to a shortage of truck drivers and limited available shipping supplies, according to DMN.

Butter fell to $1.6225 per pound Wednesday, lowest since Feb. 26, but rallied some Friday to close at $1.6425, down 5.25 cents on the week but 3.50 cents above a year ago. 6 sales were reported on the week and 55 for the month, down from 90 in June.

Butter producers continue to say summer sales lag week to week but they are not overly concerned as orders are generally in line with seasonal expectations. Cream availability is sporadic, but butter plant managers are able to clear cream if they are open to paying freight costs from Western states. That said, they say spot cream availability is up one week and down the next. Lighter ice cream production, seasonally, is assisting in availability week to week.

Cream is tightening in the west, according to DMN, but available to meet needs. Transporting cream remains a challenge as tankers and drivers are still in high demand with limited availability. Some plants are reducing butter output while others are maintaining active schedules. Inventories are heavy though much is under contract. Retail sales are steady but down from last year’s pandemic baking buys. Some grocers are advertising promotions to move more butter. Food service orders are level but, in light of recent CDC guidance, public health officials in several counties have issued, or considering mask recommendations again for indoor settings. It remains to be seen what impact that might have.

Spot Grade A nonfat dry milk hadn’t seen much movement in recent sessions until Thursday’s 1.50 cent jump. It added another 0.25 cents Friday to close at $1.2675 per pound, up 1.50 cents on the week and 29 cents above a year ago. CME sales totaled 6 for the week and 34 for the month, down from 76 in June.

Butter fell to $1.6225 per pound Wednesday, lowest since Feb. 26, but rallied some Friday to close at $1.6425, down 5.25 cents on the week but 3.50 cents above a year ago. 6 sales were reported on the week and 55 for the month, down from 90 in June.

Butter producers continue to say summer sales lag week to week but they are not overly concerned as orders are generally in line with seasonal expectations. Cream availability is sporadic, but butter plant managers are able to clear cream if they are open to paying freight costs from Western states. That said, they say spot cream availability is up one week and down the next. Lighter ice cream production, seasonally, is assisting in availability week to week.

Cream is tightening in the west, according to DMN, but available to meet needs. Transporting cream remains a challenge as tankers and drivers are still in high demand with limited availability. Some plants are reducing butter output while others are maintaining active schedules. Inventories are heavy though much is under contract. Retail sales are steady but down from last year’s pandemic baking buys. Some grocers are advertising promotions to move more butter. Food service orders are level but, in light of recent CDC guidance, public health officials in several counties have issued, or considering mask recommendations again for indoor settings. It remains to be seen what impact that might have.

Spot Grade A nonfat dry milk hadn’t seen much movement in recent sessions until Thursday’s 1.50 cent jump. It added another 0.25 cents Friday to close at $1.2675 per pound, up 1.50 cents on the week and 29 cents above a year ago. CME sales totaled 6 for the week and 34 for the month, down from 76 in June.

StoneX reports that “Grains traded slightly higher on Thursday led by the wheat market as export sales continue to run strong. North Dakota yields were projected at 29.1 bushels per acre versus 43.6 for the 5 year average. That was an eye opener and gives insight to how poor the corn/bean crop likely is out west.” “That should mostly be priced in at this point,” says StoneX. “Supply still has some concern but demand looks like it’ll be the key driver for prices soon.”

Checking the international scene, HighGround Dairy reports that New Zealand had a record 2nd quarter for dairy exports, mainly due to the jump in volume to China. Whole milk powder exports were up 82%, though some of those gains were offset by steep losses to the Middle East and North Africa.

Whole milk powder exports to China jumped 147% in June alone, according to HGD, and first half of the year exports have been record high for WMP, fluid milk and cream, cheese and lactose. China’s cheese consumption is growing says HGD, “whether in the form of pizza or as a lollipop,” and “Demand is expected to grow further as the Chinese dairy industry promotes cheese as nutritious, aligned with the country’s growing focus on health.”

Thankfully for New Zealand, the milk production season started strong with June output up 1.8% from last season and up 1.6% on a milksolids basis. DMN says “For the most part, dairy regions have had favorable weather leading into the new milk season. However, heavy rains in parts of western New Zealand have led to flooding. Significant losses of cattle and damage to pastures have been reported but it is not clear how much impact this will have on the milk shed.”

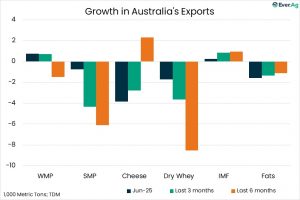

With only a few weeks into the new Australian milk season, DMN says “It’s hard to tell what the year will hold. But that said, industry participants expect stable domestic dairy demand and relatively supportive global fundamentals in the first half of the year will get the milk season off to a good start. If food service demand can return to pre-pandemic levels, the domestic sales may help further support market prices. In the previous weeks, some dairy cooperatives and processors increased the offering prices made to farmers to assure the supply of milk will be sufficient to meet processing needs,” says DMN.

Cooperatives Working Together (CWT) member cooperatives accepted nine offers of export assistance this week to help capture sales contracts for 1.5 million pounds of American-type cheese and 774,000 pounds of whole milk powder. The product is going to customers in the Asia, Central America, the Middle East and North Africa, and Oceania from August through October.

CWT’s 2021 export sales now total 30.8 million pounds of American-type cheeses, 11.4 million pounds of butter (82% milkfat), 5.1 million pounds of anhydrous milkfat, 17.8 million pounds of whole milk powder, and 8.0 million pounds of cream cheese. The products are going to 27 countries in six regions and are the equivalent of 872.6 million pounds of milk on a milkfat basis.

In politics, National Milk Producers Federation (NMPF) Executive Committee member Allan Huttema testified at a Senate Finance Committee hearing this week on the impact of the U.S.-Mexico-Canada Agreement (USMCA). He said “USMCA enforcement is essential for the agreement to reach its potential for U.S. dairy farmers.”

“NMPF and the dairy producers it represents are grateful to the Senate Finance Committee for inviting Allan to discuss the benefits that the USMCA has brought U.S. dairy producers and cooperatives,” said Jim Mulhern, President and CEO of NMPF. “But as Huttema said so well, adequate enforcement is necessary to ensure American dairy producers are provided the access promised in the agreement. We are grateful to the Committee members for their advocacy in support of the recently initiated dispute settlement proceedings over Canada’s dairy tariff rate quotas (TRQs), a critical step in enforcement of this agreement.”

Huttema operates an 800-cow dairy in Parma, Idaho and serves as chair of the Darigold and Northwest Dairy Association boards, both of which are NMPF and U.S. Dairy Export Council (USDEC) members.

The International Dairy Foods Association (IDFA) called on the U.S. government and European Commission (EC) to “quickly resolve a regulatory dispute that threatens the export of dairy ingredients produced in the U.S. and used to make infant formulas and critical adult nutrition products in European Union member states and other nations. Unless the U.S. and EC resolve the issue in the coming weeks, the supply chain for global infant formulas will be thrown into chaos resulting in product shortages, job losses, and price increases,” IDFA warned.

“IDFA member companies make and supply medically important specialized nutritional products for infants and adults that are made exclusively for European companies or shipped through EU member states. Now the EC is seeking to revise import certificates on U.S. goods to include onerous animal health attestations that run counter to World Organization for Animal Health (OIE) guidance,” says IDFA in a Monday press release.

The IDFA also announced that registration is now open for Dairy Forum 2022. The Forum will be live and in person January 23-26 at the J.W. Marriott Desert Springs Resort and Spa in Palm Desert. The Forum will offer the latest thinking on leadership, policy, technology, people and workforce, economics, and innovation, according to the IDFA.