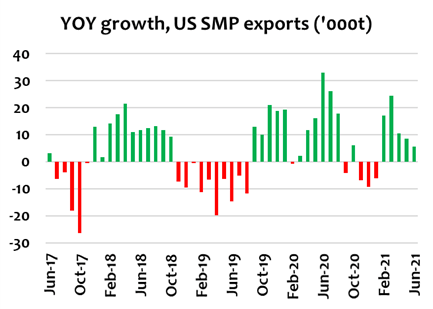

US exporters exported 18.1% of June milk solids, down on the 18.9% observed in April and May but ahead the 17.6% shipped in the same month in 2020 NFDM/SMP exports drove the YOY growth for the month – shipments were reported at 81,435t, the third highest figure on record. Most of the growth in NFDM/SMP exports during June was in Mexico (+28% or 7,552t), but also with stronger shipments into China (+51%) and SE Asia (+7%). Port congestion will likely remain an issue for at least until the rest of this year, but stronger exports in YOY terms are still expected by local industry observers. A lot of product has already been sold to overseas buyers and now sits in warehouses ready to be shipped.

Dry whey shipments were also stronger at 45,555t, with China accounting for most of the expansion during the month – up 37% YOY, compared to the overall 13% YOY growth in June. Pork prices in China have now collapsed and dry whey import demand for US-origin product has reportedly slowed – going forward, shipments are likely to be subdued relative to what was observed in the first half of 2021.

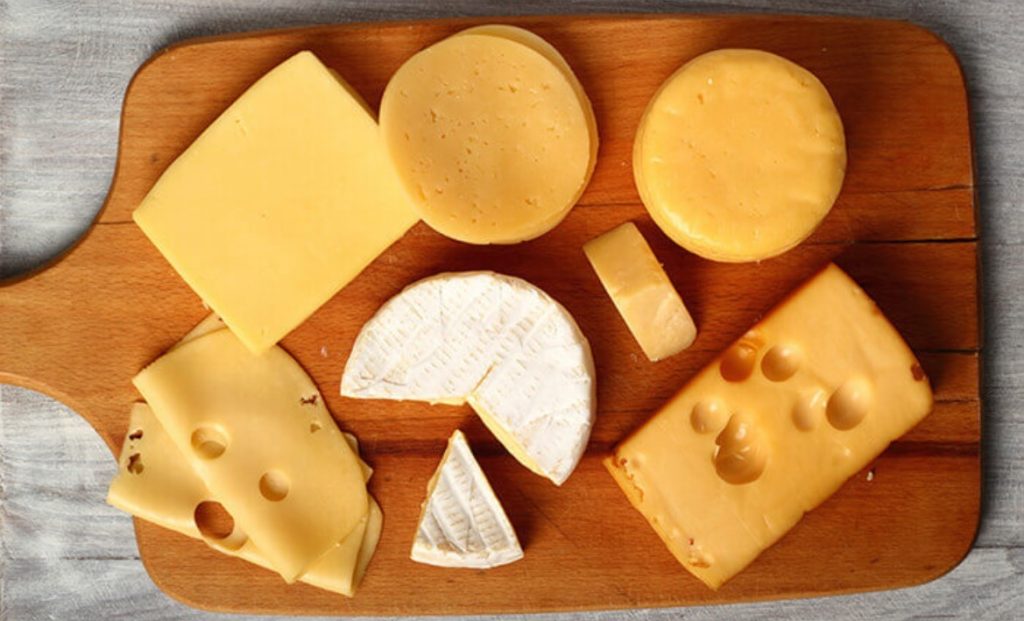

Cheese exports fell 13% YOY to 33,461t in June (reflecting strong prior year comparables). Stronger exports to Latin America were more than offset by weaker sales into Mexico, Japan and South Korea.