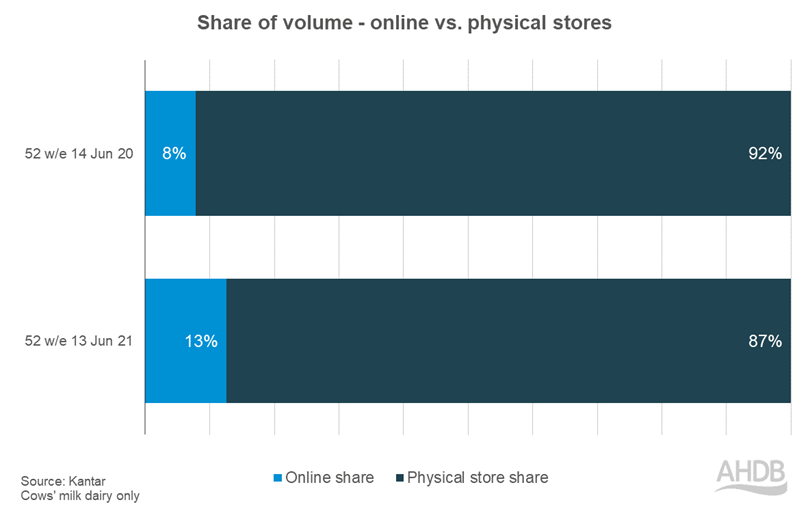

As a staple in British households, dairy has seen significant growth online, and 13% of dairy (made from cows’ milk) is now sold via this channel (Kantar, 52 w/e 13 Jun 21).

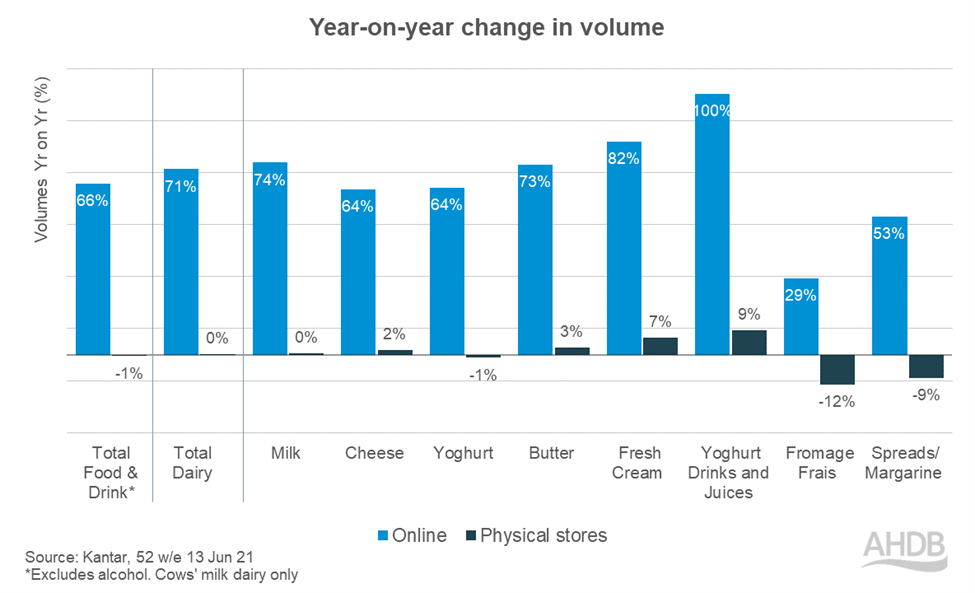

Across all dairy categories, volumes sold online have grown faster than those in physical stores.

In the past year, 34% of shoppers bought cows’ milk dairy products online – up from 24% pre-pandemic (Kantar, 52 w/e 13 Jun 21 vs 52 w/e 23 Feb 2020). Not only are there more shoppers buying dairy online, but they are also making those purchases more frequently.

While frequency of purchasing dairy online has increased, from 16 trips to 21 trips per year (Kantar, 52 w/e 13 Jun 21 vs 52 w/e 23 Feb 2020), it remains well behind the frequency of purchase made in physical stores – at 94 trips. This is mainly driven by milk, although all dairy categories see physical store frequency exceed online. Combined with the fact that 99% of households buy dairy from a physical store at least once throughout the year, physical stores still take the bulk of sales. This share of volume, at 87%, is exactly the same level that physical stores take of total food and drink sales (excluding alcohol).

However, on each ‘trip’ online, shoppers do stock up on a lot more dairy products, buying on average 5 units vs 2.5 units* in physical stores. Therefore, encouraging shoppers to shop online more often and add dairy to their virtual baskets, could see significant incremental growth. Incentivising via omnichannel offers (such as receiving a voucher in-store for an online shop) or via promotions could be one way to do this, with our previous report showing that promotions have a far more important role to play online than they do in physical stores.

Retaining family shoppers

One cohort of shoppers that could be most attracted to dairy via price promotions is families. Dairy products of particular relevance to them include mild cheddar (where they account for over 50% of sales), snack/lunchbox cheeses and fromage frais.

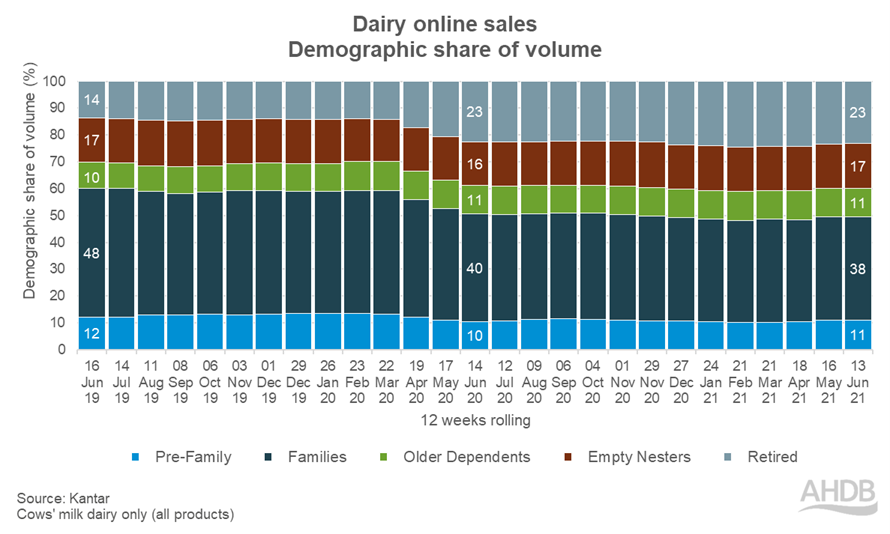

While families still account for 38% of online dairy volumes, this proportion has scaled back during the pandemic, as more older, retired shoppers started shopping for dairy online for the first time. While the online channel has managed to retain much of these new retired dairy shoppers, the same cannot be said for family households.

Retaining and attracting back these family shoppers is important as families do spend more on cows’ milk dairy products when they buy online, spending on average £194/yr, compared to £164/yr for the average shopper.

Alternatives take bigger share online

For cows’ milk dairy products, alternatives pose a greater challenge online than they do in physical stores, accounting for 7% of total dairy (animal and alternative) online volumes, compared to 5% in physical stores (Kantar, 52 w/e 13 Jun 21).

Despite families being hugely valuable to cows’ milk in the online channel, this is also true for alternatives. Therefore, careful consideration should be given to how to encourage these shoppers to purchase cows’ milk dairy, without losing them to alternatives.

Price promotions are again going to have a role to play, with 35% of alternative milk volumes sold via price promotion, compared to just 10% for cows’ milk, with the greater presence of brands in dairy alternative milks being a big influence on this gap.

However, it’s also important to continue to reassure shoppers on the nutritional benefits of cows’ milk when shopping online, for example via banners and incorporating health messages featured as part of AHDB’s Eat Balanced campaign.