The climate in the UK is already changing. That was the sobering message from Mike Kendon, author of a report by the Royal Meteorological Society, published in July.

Last year was the UK’s third-warmest, fifth-wettest and eighth-sunniest year on record, according to the society’s State of the UK Climate 2020 report. And while many people still saw climate change as a problem for the future, it was happening right here, right now, Kendon said.

His comments were followed by a landmark UN report in August, which warned the world was warming far quicker than initially feared. The study, by the UN’s Intergovernmental Panel on Climate Change (see box, below), found global warming could reach 1.5C higher than pre-industrial levels far earlier than the previously estimated 2040. It was described as a “code red for humanity”.

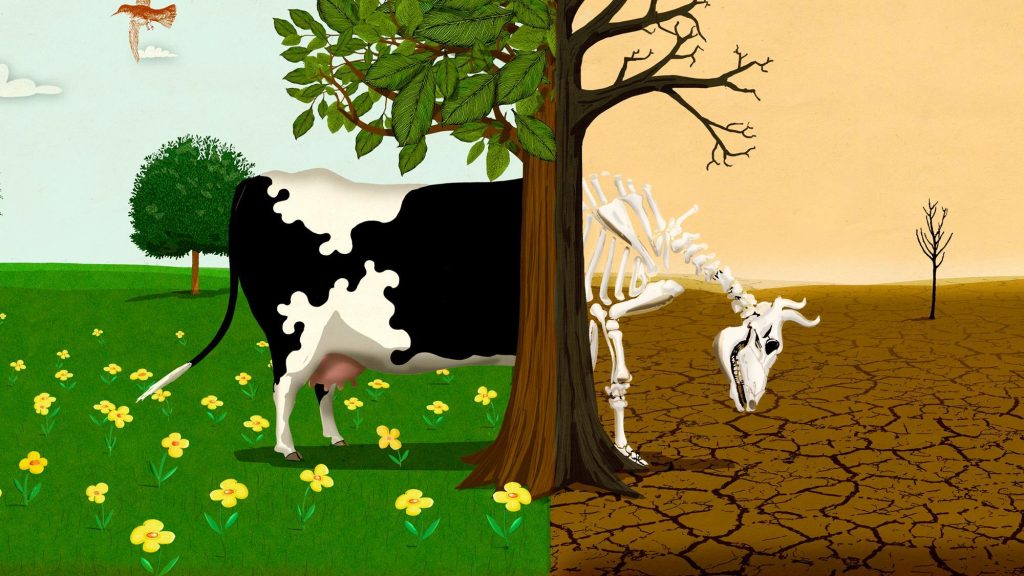

This all adds up to an increasingly alarming narrative, one in which food and farming faces growing scrutiny over its impact on the climate. And dairy, due to its reliance on livestock, is one of the key sectors in the firing line.

So, what is dairy’s contribution to the world’s unfolding climate disaster? And what is the industry doing to address it?

‘Code red for humanity’ warns chilling IPCC report

With large parts of the planet seemingly on fire, under water or suffering crippling heatwaves this year, it should come as no surprise the UN is warning time is running out to address the climate crisis.

The latest report by its Intergovernmental Panel on Climate Change (published on 9 August) isn’t the first to ring the alarm bell that the climate is warming faster than we initially thought. But in the context of ever-worsening climate volatility, its warnings are now more alarming than ever.

Described as a “code red for humanity” by UN secretary-general António Guterres, the report warned every global region will face the effects of climate change, with the average global temperature already 1.1°C warmer than pre-industrial times.

What’s more, it estimated the Earth would cross the 1.5°C warming level within 20 years in all scenarios, and “unless there are immediate, rapid and large-scale reductions in greenhouse gas emissions, limiting warming to close to 1.5°C or even 2°C will be beyond reach”.

Climate change at this level would bring multiple changes in different regions, the report added, including a worsening in droughts, heatwaves, flooding and more extreme weather patterns – in addition to crop failures, mass extinctions and a collapse in biodiversity. And all this means food shortages could become the new normal.

“This report is a reality check,” said IPCC working group co-chair Valérie Masson-Delmotte.

“Greenhouse gas emissions from fossil fuel burning and deforestation are choking our planet,” added Guterres, as he called on all nations to “join the net-zero emissions coalition” and “reinforce their commitments with credible, concrete and enhanced nationally determined contributions and policies before COP26 in Glasgow”.

The report’s findings demanded “urgent attention from key policymakers”, said the Commons Environmental Audit Committee’s chairman, Philip Dunne MP, who argued it also strengthened COP president designate Alok Sharma’s hand in pressing for updated pledges at COP26.

The IPCC report was the “starkest warning yet” human behaviour was accelerating global warming, Sharma said.

All eyes will now be on Glasgow, and whether Sharma and Boris Johnson can seal the commitments needed to avert a climate catastrophe.

Granular data on the precise impact of dairy sector emissions is difficult to isolate, with the majority of global research grouping meat and dairy together. However, Oxford University-based scientific journal Our World in Data states agriculture, forestry and land use represented 18.4% of global emissions in 2016, with livestock and manure representing 5.8%.

According to a 2019 report by the UN’s Food & Agriculture Organization, dairy production in 2015 was estimated to have emitted 1.7 billion tonnes of CO2-equivalent – a unit of measurement used to standardise various greenhouse gases. With total global emissions currently around 50 billion tonnes of CO2-eq, dairy emissions equate to about 3.4% – almost double the impact of aviation (1.9%).

By far the biggest source of those emissions is from methane, according to the FAO report, with 59% emanating from enteric fermentation emissions.

As global consumption of dairy has increased (it’s up 96.5% since 1990, according to FAO data), the industry’s environmental footprint has similarly widened. Research last year by US thinktank the Institute for Agriculture & Trade Policy revealed the total combined emissions from the world’s 13 largest dairy businesses grew by 11% between 2015 and 2017.

To cut those emissions and reduce dairy’s impact on the climate, one drastic solution, of course, would be to simply eat less dairy. This was precisely the argument made in a study by academics Joseph Poore and Thomas Nemecek, published in the journal Science in 2018 and cited in Henry Dimbleby’s National Food Strategy. It made its case in stark terms: avoiding consumption of animal products altogether delivered “far better environmental benefits than trying to purchase sustainable meat and dairy”.

“Food and drink is responsible for at least a quarter of the world’s greenhouse gases – and it’s only going to get worse”

Unsurprisingly, it’s a view plant-based brands are keen to push, positioning dairy-free alternatives as an easy way for consumers to do right by the planet. Oatly’s ‘Help Dad’ advert from January is a case in point. It showed young people criticising their fathers for drinking milk, and claimed the dairy and meat industries emitted more CO2 than the world’s transport systems combined.

Flora owner Upfield, meanwhile, said in July it had helped consumers and chefs avoid an estimated six million metric tonnes of CO2-eq in emissions in just one year – based on the assumption those who bought its plant-based products had chosen them as an alternative to dairy products.

But to reduce the climate debate to a “ditch dairy” message is simplistic and potentially misleading, say defenders of the industry. For starters, many global studies do not reflect that much of the dairy produced in the UK is based on pasture-fed systems – meaning less reliance on industrially manufactured cattle feed.

John Allen, director at agricultural consultancy Kite, takes particular issue with Poore and Nemecek’s claim that the average carbon footprint of milk is 3.2kgCo2-eq/litre, when UK data shows a carbon footprint for milk of around 1.2kgCo2-eq/litre.

Other research suggests there is plenty of scope for cutting emissions without dramatic cuts in consumption. The UN’s Global Methane Assessment, published in April, found that currently available measures – such as developments in animal feed technology and a reduction in emissions from manure – could help cut emissions from livestock by as much as 45% (or 180 million tonnes a year) by 2030. This could help reduce overall emissions by 0.3C of global warming by the 2040s. It’s why several feed suppliers are now making significant investments in new emission-reducing feed technologies.

Pressure from retailers

Still, there’s no doubt the dairy industry faces huge pressures – not least from its retailer customers. The BRC announced its plan last November for the retail industry to reach net zero by 2040. There have also been a raft of pledges by individual retailers to accelerate sustainability commitments.

July also saw a major pledge, announced by Wrap, for a new industry-wide Courtauld Commitment to bring a 50% absolute reduction of greenhouse gas emissions associated with food and drink by 2030.

Against this backdrop, the dairy industry needs to demonstrate it’s not running away from a difficult debate but facing up to it – and taking action.

“We’ve been slow off the blocks on the issue as a [wider] food and drink industry – from farming to retail,” says Wyke Farms MD Rich Clothier. “Food and drink is responsible for at least a quarter of the world’s greenhouse gases, and that figure is only going to get worse as other sectors such as energy and transport improve their performance.”

“We’ve been slow off the blocks on the issue as a [wider] food and drink industry – from farming to retail”

Indeed, the signs so far have not been overly promising. Kite Consulting warned in February that half the UK’s meat and dairy suppliers were underprepared for tougher scope 3 climate reporting rules, which call for greater oversight of emissions across entire supply chains.

The FDF, meanwhile, warned in April a third of food and drink companies still have no climate change plan.

Suppliers must take action now, Kite’s Allen stresses. Retailers have laid out their ambitions “and are telling suppliers ‘just sort yourselves out’”, he adds. “We’re very much in compliance mode now.”

Many retailers are understood to be telling suppliers to lay out their plans for the next five years now, give their current numbers on emissions by next year (with validation to follow the year after) and reduce emissions within three years, Allen says. If they fail to deliver, they face losing supermarket business, or at the very least, “they won’t be able to pay a leading milk price as they will have to start picking up the tab on behalf of their farmers by buying carbon credits instead”.

Some suppliers have looked to make quick emission reductions using carbon credits, but Allen says they should be seen as a last resort given the high cost. For example, a company producing 500 million kg of cheese product a year, at current prices, would need to spend an “unsustainable” £30m a year on credits to become net zero, he points out.

How industry is attempting to make cows less farty

Cows and their much-maligned digestive habits have long been highlighted as a major contributor to the dairy sector’s emissions. According to April’s UN Global Methane Assessment, manure, burps and farts represent 32% of the world’s total methane emissions.

But with the same report suggesting as much as 45% of those enteric fermentation emissions can potentially be eradicated via technology, a host of potential solutions to the issue are now being rolled out across the dairy sector.

By adding compounds from garlic and extracts of citrus into cow feed, a Welsh-developed supplement made by Swiss startup Mootral cut enteric emissions by up to 38%, while also “naturally increasing yield and enabling the production of climate-friendly milk and beef”.

After a successful trial of its Mootral Ruminant supplement at Lancashire-based Brades Farm, Mootral partnered with coffee chain Gails in April to sell the milk. The company is now ramping up its operations to work with more partners at scale.

Other similar feed additive projects include Dutch corporation Royal DSM’s Bovaer supplement, which in tests earlier this year at Wageningen Livestock Research in Leeuwarden, the Netherlands, delivered emission reductions of between 27% and 40% in 64 cows under trial.

Elsewhere, a 16.1 million kroner (US$2.6m) project funded by the government-backed Innovation Fund Denmark kicked off at Aarhus University in June, with the aim of developing a new feed additive which is hoped will be fed to up to 80% of Danish dairy cows by 2025, with a capacity to inhibit methane emissions by 50%.

But it’s not just in feed where the dairy sector is seeking to reduce emissions. The UK’s AHDB announced a new genetics project in August, designed to help breed more environmentally-friendly cows. EnviroCow gathers information in an index scoring cows on the best environmental credentials.

Combined with a new Feed Advantage Index (incorporated in EnviroCow) – which helps dairy producers identify bulls with the greatest tendency to transmit good feed conversion on to their daughters – the two projects reflected “the important role cattle breeding can play in helping the farming industry reach its goal of net zero emissions”, said AHDB head of animal genetics Marco Winters.

Carbon reduction plans

Ornua Foods UK MD Bill Hunter agrees net zero ambitions can often be “muddied” by an over-reliance on offsetting and credits. “What’s more authentic are [detailed] carbon reduction plans,” he says.

With 88% of consumers concerned to some degree about sustainability, according to our exclusive research from Harris Interactive, authenticity around climate change action is going to count.

Ornua, “like the majority of the UK’s major processors” is awake to the challenge, says Hunter. The processor is making solid progress towards achieving a 20% reduction in scope 3 emissions by 2030, he adds. By investing in supply chain efficiency, the business has reduced energy usage by 36% over the past three years.

It’s also made good strides in tackling plastic packaging, another big source of carbon emissions. After switching Pilgrims Choice to its thinner and longer Megablock format – which uses 40% less plastic – last summer, Ornua and Tesco rolled out the format across the retailer’s own-label cheese range, saving around 740 tonnes of plastic a year.

Müller’s emissions reduction plan puts a similar emphasis on reducing energy and plastic waste. Müller UK & Ireland now sources 100% renewable energy, says Jon Jenkins, CEO of its Müller Milk & ingredients subsidiary. The business has already hit its target to reduce its carbon footprint by 40% on 2015 levels, having implemented a number of key changes to its manufacturing network, which are now “in the right locations, use less energy and produce less waste”, he says.

It has also embarked on a gradual process to ‘lightweight’ its packaging and bring plastic bottle manufacturing in-house and pledged to move to 100% recyclable packaging by 2025, with 30% of its packaging made from recycled plastic by the same date.

Saputo, meanwhile, is aiming to reduce emissions by 20% by 2025. It unveiled an industry-first TerraCycle recycling scheme for Cathedral City and Davidstow last summer, made big investments in solar energy and is planning for all its customer-facing packaging to be 100% recyclable by 2022.

“Without a standard [industry] recycling solution, many consumers are unsure what they can recycle and where,” says Saputo Dairy UK business unit director Andy Saitch. “Our partnership with TerraCycle aims to address this confusion, making it easy to recycle at a local collection point.”

Beyond recyclable plastic film, the plastic trays used in Cathedral City Slices and its Vitalite dairy-free cheese alternatives are widely recycled in kerbside schemes. And since the spring of 2021, Cathedral City Slices trays are now made of 80%-100% recycled content, Saitch adds.

Similarly, Lactalis UK & Ireland is working on a strategy to promote the circular economy via responsible packaging, claims procurement director Matt Friel. The company is developing “alternative, easily-recycled materials, which includes moving to mono-materials and removing plastic trays”, he adds.

Smaller companies such as Scottish ice cream maker Mackie’s – which became carbon positive in 2007 – can also make a difference, suggests its sales director, Stuart Common. By investing in renewables at its Aberdeenshire HQ, the brand now “generates four times more energy than it consumes”. By the end of 2021, it will have further reduced energy costs and emissions by 80%, thanks to new low-carbon refrigeration technology.

This is all making an impact. And despite Clothier’s suggestion the sector hasn’t been quick enough to respond to the climate challenge, dairy-related emissions have fallen by 24% over the past decade, according to Dairy UK.

How regenerative farming looks set to take off

Regenerative farming practices “that work with nature instead of against it” are championed as a key tool for reducing the farming sector’s emissions in Henry Dimbleby’s National Food Strategy.

The NFS recommends between £500m to £700m per year from the government’s Environmental Land Management scheme (which replaces direct payments through the EU’s Common Agriculture Policy) should go towards “paying farmers to manage the land in ways that actively sequester carbon and restore nature”.

The NFU is also in favour of these techniques, claiming they will play a key role in achieving its target of making UK farming climate neutral by 2040 by keeping carbon in the ground. And the dairy sector is now beginning to take note.

Yeo Valley Organic owner Tim Mead says the brand has launched a new, five-year soil carbon programme – where it is trialling multiple carbon sequestration work streams – on 20 farms in its supply chain. The business is already working with experts including farmer-led social enterprise The Farm Carbon Toolkit to begin the soil measurements over a five-year period (the minimum time frame for measuring changes in soil carbon sequestration), Mead points out.

In field trials at the Yeo Valley family farm in Somerset, the company reported an average increase of 0.23% of soil organic matter each year.

This data shows by using regenerative methods, the farm has the potential to lock away 1.5 times more carbon per year than it emits, he adds, making soil carbon sequestration a valuable alternative to the practice of offsetting.

“Carbon offsetting isn’t for us, and we only considered ourselves regenerative organic farmers once we began increasing our soil carbon stocks,” Mead says. “Nobody has all the answers, but we believe this is the best step forward.”

Cornwall-based Trewithen Dairy is among a handful of other dairy processors to undertake similar research. MD Francis Clarke says its trial of a minimum tillage and diverse cropping system – which sees it grow a variety of different grasses – has “huge potential” and means the fields promote better biodiversity and require less ploughing. This allows it to “put carbon in the soil and keep it in the soil”, he says. The aim is for Trewithen’s trial farms to be a “testbed for the rest of our farms”.

No silver bullet

But, ultimately, there is no single “silver bullet” in dealing with the climate crisis, and much more needs to be done at farm level, says Ornua’s Bill Hunter. “When it comes to scope 3 plans, more than 90% of emissions in a typical supply chain are on farm, so we can do a lot of good work in terms of energy consumption, more efficient transport and the rest, but that’s the low hanging fruit,” he adds.

“You’re not talking about one factory, you’re talking about hundreds or thousands of farmers. Getting them to all change is the biggest challenge for dairy.”

With that in mind, Ornua and supply chain partners including First Milk are also engaged in a number of grassland management and carbon capture projects, Hunter says.

Others, such as Wyke Farms, Müller, Yeo Valley and Arla, have also launched similar on-farm projects.

Müller’s Advantage programme, launched last December, incentivises farmers with a 1p per litre premium for a raft of measures, including the sustainable sourcing of animal feed, reductions in energy and water use, plus recycling and enhancing biodiversity.

Arla has announced similar incentives, such as a scheme to harness the power of cow poo by turning it into biofuel, while its Arla 360 farm assurance plan incentivises farmers to boost biodiversity.

Meanwhile, the dairy co-op’s Climate Check programme – a third-party audited “climate database” aimed at speeding up CO2 reduction – found its farmers produced 1.15kg of CO2 emissions per kilogram, less than half the FAO’s global average of 2.5kg. The data will now be used to shape a blueprint for driving further reductions on farms.

“You’re talking about hundreds or thousands of farmers. Getting them to all change is the biggest challenge for dairy”

The challenges in meeting the new climate targets of processors at farm level has led some dairy farmers to cut ties with suppliers such as Müller, but most are “up for the challenge” claims NFU chief dairy adviser James Osman.

“They are cautious about some of the tools and metrics used to measure and reduce emissions as well as carbon credits,” he says. “But there is an appetite to make changes and communicate with consumers, so we’re heading in the right direction.”

Biodiversity, soil health and regenerative farming practices are also high on the industry agenda. Arla launched a partnership with charity Buglife in June to give away more than 100,000 seed packs in a bid to encourage consumers to “safeguard a special bee plot in our gardens”.

Meanwhile, regenerative farming techniques championed by the likes of Danone and General Mills in the US and Canada in recent years are being adopted by suppliers in the UK.

But while individual businesses are making strides on reducing emissions through research and technology, more needs to be done to support industry-wide progress, says Clothier at Wyke Farms – a pioneer of renewable energy through its anaerobic digestion (AD) operation.

Regenerative agriculture: why PepsiCo, McDonald’s and Waitrose are jumping on regen ag

“We need to be able to produce dairy in a more environmentally conscious way,” he says. “There’s a deeper industrial strategy piece around scientific solutions like AD, slurry pits and feed additives that can all reduce emissions. The government should set incentives for these projects, particularly AD plants, as they can lower emissions while creating highly skilled jobs in rural areas. There’s only so much industry can do on its own,” he adds.

Elsewhere, some dairy farmers who have adopted low-carbon systems, such as Sion Davies of Carmarthenshire-based Coomb Farm, say many retailers and processors are still ignoring producers “on the grounds of simple logistics”. Davies told The Grocer in June that his farm – which had a carbon footprint “significantly below” the industry average – had been ignored by the mults due to its distance from major processors near the M25 and M6 corridor.

While it’s clear more work needs to be done, Dairy UK chairman and Arla UK MD Ash Amirahmadi says the trade body’s membership have all signed up to industry-wide environmental standards via the Dairy Roadmap (in partnership with the NFU, AHDB and Defra), with newer more ambitious targets expected to be announced in the run-up to COP26.

“New regulation is coming around health, packaging, carbon and on-farm, which can be overwhelming,” Amirahmadi says. “But how processors have committed to these standards has been really significant. It shows dairy is taking more responsibility.”

And, as Kite’s John Allen says, the dairy sector is far ahead of the red meat industry in setting carbon reduction targets. “At least they are in control of their supply chains, the processors know who their farmers are and can act, so that’s a big positive,” he suggests. “Things can initially seem impossible. But the sooner you start, the sooner you will get there.”