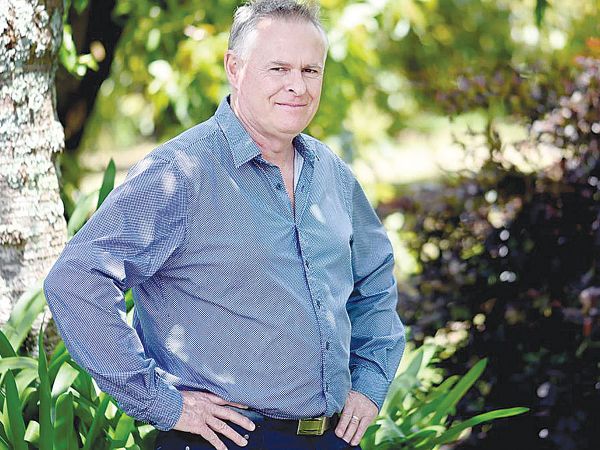

The warning was delivered by chairman Peter McBride last week as he unveiled a revised capital structure proposal to farmer shareholders.

The revised proposal has key changes including a minimum shareholding requirement for farmer suppliers, allowing sharemilkers, contract milkers and farm lessors to buy co-operative shares and easier exit and entry provisions for supplier.

McBride and the board will take the new proposal back to shareholders in the coming weeks for further consultations.

He’s confident of farmer support.

McBride says changing the co-operative’s capital structure is a critical decision and not something the board and senior management are taking lightly.

“We are confident that thhis proposal would support the sustainable supply of New Zealand milk that our long-term strategy relies on.”

McBride notes that Fonterra’s future success relies on its ability to maintain a sustainable milk supply in an increasingly competitive environment.

“We see total New Zealand milk supply as likely to decline, and flat at best. Our share of that decline depends on the actions we take with our capital structure, perfomance, productivity and sustainability.

“If we do nothing, we are likely to see around 12-20% decline by 2030 based on the scenarios we have modelled.”

Key changes are:

- New minimum shareholding requirement would be set at 33% of milk supply (around 1 share per 3kgMS), compared to the current compulsory requirement of 1 share per 1kgMS.

- New maximum shareholding requirement would be set at 4x milk supply, compared to the current 2x milk supply.

- More types of farmers could buy shares, including sharemilkers, contract milkers and farm lessors.

- Exit provisions would be extended and entry provisions would be eased.

Unhappy Investors

Investors holding units in Fonterra Shareholders Fund are unhappy with the co-op’s proposal to cap the listed fund.

In a letter to unit holders, the fund’s chairman John Sherwin says retaining the fund, but removing features that support growth, liquidity, and relevance to investment markets, could put downward pressure on unit pricing.

The price of the units has declined about 25% since early March, when Fonterra published results of a shareholder survey that showed high support for farmer control and little interest in raising external capital.