How Montana regulates milk production in its already declining dairy industry is outdated and does not reflect the current demand for milk, which may be costing dairy producers money, a new legislative audit found.

“The disparity between the current quota system and recent production decreases the value of owning quota and negatively affects producers,” the report found. Basically, Montana milk farmers “own” a certain amount of pounds of milk they can produce each day.

Montana uses a quota system to regulate how much milk each producer in the state may produce; however, the amount of milk being produced is outpacing demand. The situation forces producers to sell their milk out-of-state at a lower price, the audit found. And when that milk is sold at the lower out-of-state price, it drives down how much producers get paid.

“The Board of Milk Control’s quota system is outdated and ineffective for maintaining Montana’s milk supply,” the report said. “If producers keep producing in excess of state demand, due to high quota balances, and surplus becomes a larger percentage of the uniform price calculations, there could be a negative impact on the entire industry as producers may not receive funds to continue operating their farms.”

The quota system is meant to bring stability to the milk market and is a way to avoid over-saturation. When quota was first awarded to Montana farmers, the balances were based on production records of the individual farmers. Now, quota balances of individual farmers in the state range from 300 to 51,000 pounds per day. In total, Montana producers own a quota of over 1.24 million pounds of milk per day.

The report found milk processing plants only process around 75% of their producer’s quota on average. Additionally, through interviews, auditors learned one processing plant was only in operation two or three days a week at the beginning of 2021 due to a low milk supply.

“As production has fallen far below current quota balances, the quota system cannot regulate the milk supply without a decrease in quota,” the audit said.

To solve the problem, the report suggested the board update its administrative rules to allow it to decrease quotas, which has not been done since 2001. The report is on the agenda Wednesday of the Legislative Audit Committee.

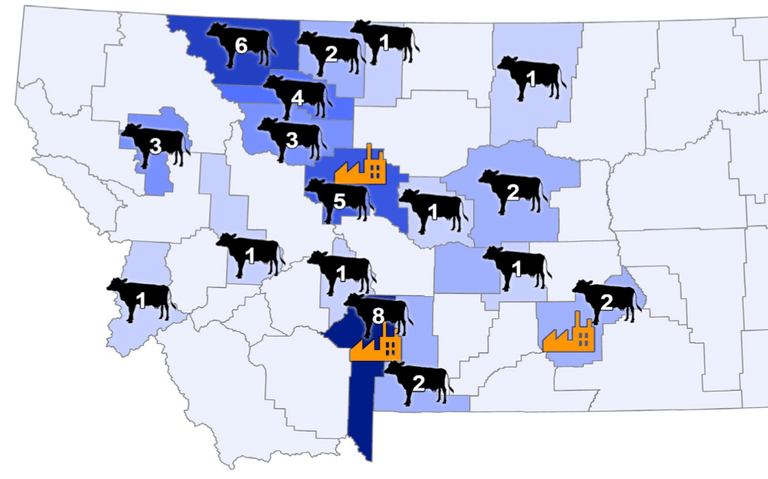

Montana is one of few states in the country to use a quota system for regulating milk markets and has a small milk industry compared to other states. At the time of the audit, there were 54 milk farms spread out over 19 counties, three producer distributors, three in-state distributors, 41 out-of-state distributors and 27 wholesalers in Montana. Additionally, there are two milk processing organizations in Montana — Meadow Gold and Darigold. Between the two, they operate three plants in Great Falls, Billings and Bozeman.

Since 2018 Montana, has lost 11 dairy farms, and from 2015 to 2019, milk production declined by 13%.

During that same period, consumption only fell 2%, the report found. “This is likely because Montanans are consuming less drinking milk, but more cheese and butter,” the report said. The Bureau of Milk Control also noted in a 2019 report that the state’s increasing population has curbed the decrease in demand seen in other parts of the country.

Farm loss trends in Montana mirror national-level trends as well, the report found. Between 2015 and 2020, the United States Department of Agriculture estimated the number of dairy farms in the country decreased by about 40,000 farms. While the number of farms is falling, the report found the ones remaining in Montana are growing. “Even though there are fewer farms in operation today than in previous years, the number of dairy cows has increased significantly, especially in 2018,” the report said.

Quotas, set by the Montana Board of Milk Control and the Milk Control Bureau, were established in 1935 after the passage of the Montana Milk Control Act. Many states passed laws like the Milk Control Act during the Great Depression as a way to regulate pricing and milk supply to stabilize the market.

Under the board’s current administrative rules, it can only decrease quotas when 83.5% of the milk received is non-surplus or if the utilization of milk products in the state has increased from two years prior to the proceeding years. But due to decreasing trends in production and consumption, those requirements have not been met, and the board has not changed quota balances since 2001.

In response to the audit, Mike Honeycutt, executive officer of the Board of Livestock, said in the report the department is “willing to work collaboratively with the Board of Milk Control and Bureau staff to explore options that address the milk quota system.”

During interviews with auditors and members of the milk board, board members said updating rules to decrease quotas has not been a priority. And in a survey of 29 milk producers, most farmers said they produce from 75 to 100% of the quota, and no producers said they felt the quota was too low.

“Montana producers may view their quota as a property right or use their quota as collateral with banks. This creates some conflict with the board when determining how to decrease quota,” the report read. The conflict, the report said, has deterred the board from acting on changing its rules to allow for a decrease in quota.

“Improving administrative rules by including provisions to decrease the amount of quota, and then doing so, would better position the Board of Milk Control to act on industry needs and changing markets,” the audit said.