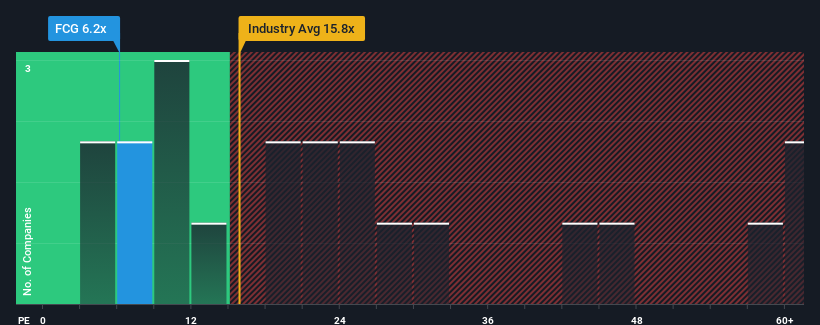

Fonterra Co-operative Group Limited’s (NZSE:FCG) price-to-earnings (or “P/E”) ratio of 6.2x might make it look like a strong buy right now compared to the market in New Zealand, where around half of the companies have P/E ratios above 21x and even P/E’s above 36x are quite common. Nonetheless, we’d need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

For instance, Fonterra Co-operative Group’s receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won’t do enough to avoid underperforming the broader market in the near future. However, if this doesn’t eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Fonterra Co-operative Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.

Is There Any Growth For Fonterra Co-operative Group?

In order to justify its P/E ratio, Fonterra Co-operative Group would need to produce anemic growth that’s substantially trailing the market.

Taking a look back first, the company’s earnings per share growth last year wasn’t something to get excited about as it posted a disappointing decline of 5.7%. Even so, admirably EPS has lifted 130% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Comparing that to the market, which is only predicted to deliver 19% growth in the next 12 months, the company’s momentum is stronger based on recent medium-term annualised earnings results.

With this information, we find it odd that Fonterra Co-operative Group is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Fonterra Co-operative Group’s P/E?

We’d say the price-to-earnings ratio’s power isn’t primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Fonterra Co-operative Group revealed its three-year earnings trends aren’t contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K