The a2 Milk Company, which has taken investors on a rollercoaster ride where its shares were as high as $19.83 in June 2020 and then slipped to $4 in May last year, owns nearly 20 per cent of New Zealand-based Synlait, which supplies its infant formula.

Both companies are heavily dependent on infant formula sales into China.

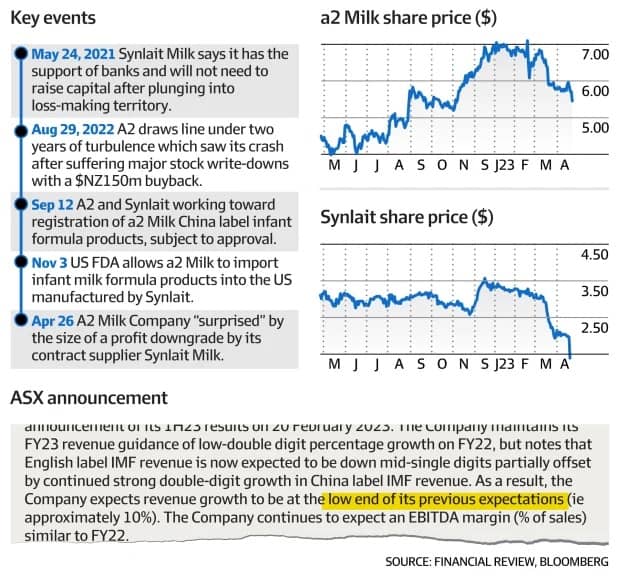

A2 Milk shares dropped 5 per cent on the ASX on Wednesday after it warned that its own revenue growth was likely to be at the low end of guidance, although it held firm on its own previous profit forecasts. In contrast, Synlait shares crashed by 26.5 per cent as it came out of a trading halt and revealed a cut in profit expectations of about $NZ20 million ($18.5 million). It blamed reduced demand for infant formula from one of its customers for most of the slide, and higher supply chain and financing costs.

Synlait didn’t name the customer.

But a2 Milk did say that the continued weakness in the Australasian daigou reseller market for infant formula tins with English language labels was a drag, and revenue from that segment would be down by a mid-single digit percentage level.

The daigou market, where Chinese students, tourists and professional operators buy up products such as infant formula and vitamins and sell them online in China, has been hit hard by the pandemic.

However, Chinese label infant formula tins were delivering “strong double digit growth”. The duelling forces mean that a2 Milk now expects its revenue growth to be at the low end of expectations, which now sit at about 10 per cent.

The daigou reseller market in Australasia was down about 49 per cent in the last quarterly figures by market research group Kantar.

E&P consumer analyst Phil Kimber said he expected that a2 Milk was frustrated that its own “English Label volume was indirectly referred to in Synlait’s profit warning”. He expects that consensus profit forecasts for a2 Milk across the market might fall by between 1 and 2 per cent.

A2 Milk made reference in its announcement to forecasts it had supplied to Synlait since that company updated its profit guidance on March 17: that its English-labelled infant formula production volume needs for March through to June had been cut by 1650 metric tonnes. But that equates to less than 5 per cent of Synlait’s total nutritional sales volumes for the 12 months ended January 31.

A2 Milk expressed surprise at Synlait’s downgrade

“In response to Synlait’s announcement, which indirectly refers to a2MC, the company is surprised at the extent of the reduction in Synlait’s guidance range,” a2 Milk said in a statement.

Analysts have also been expecting that Synlait could benefit from extra volumes it will produce for a mystery customer it has been referring to as “Customer S”. Most believe it is United States nutrition company Abbott.

Synlait in its profit warning on Wednesday said for the year ended July 31 it could end up reporting a $NZ5 million loss in a worst-case scenario, or a $NZ5 million profit. Five weeks ago, the company also pointed to internal issues stemming from the installation of a new software system which had caused problems in shipping orders.

China makes up more than half of the world’s infant formula market, valued at about $28 billion, and generates most of a2 Milk’s sales and profits.

On a positive note, the company said the process for Synlait securing crucial SAMR registration for China under the new national food safety standards for infant formula being implemented by the Chinese government was on track. The approval is expected to come in the June quarter.