The 104-year-old French company is in its second year of a turnaround effort that hinges on a yogurt renaissance

Making the yogurt of the future requires a cast of 21st-century helpers: machine learning, gut science and even a mysterious artificial stomach.

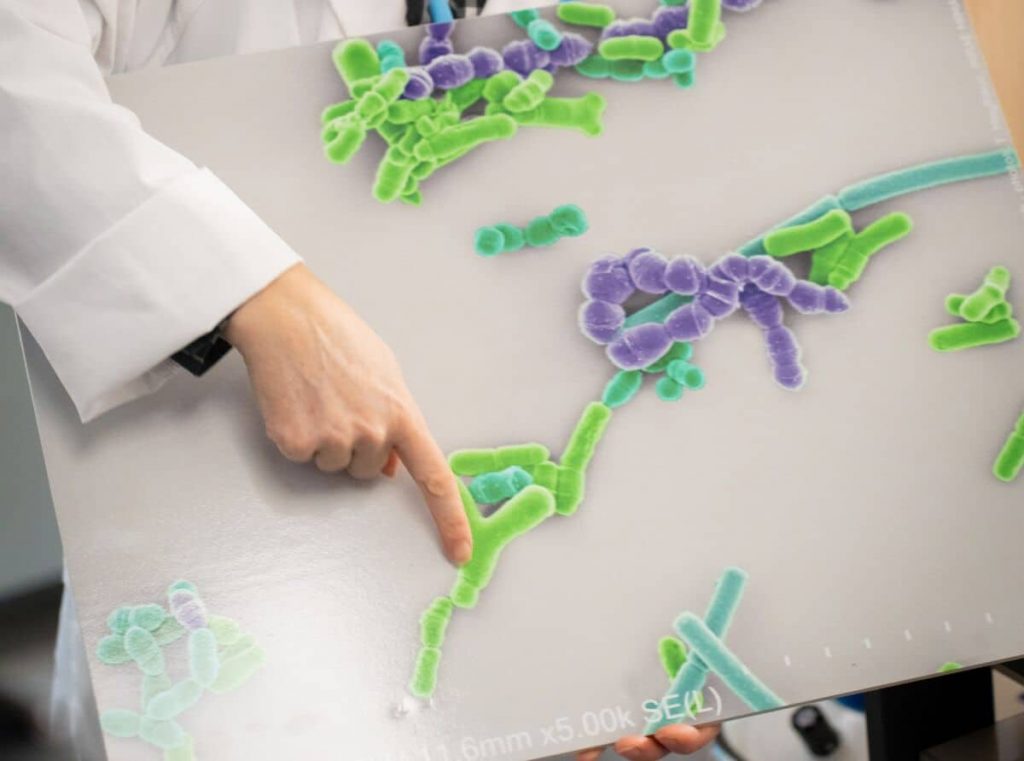

At a new Danone facility near Paris, researchers feed dollops of yogurt into globular glass vessels and plastic tubes designed to mimic the human gut. Once the bacteria inside show they can survive the digestive juices, artificial intelligence is put to work to probe their potential health benefits.

To consumers bombarded with claims about the supposed power of probiotics, the goal may sound familiar: souped-up yogurt. But the owner of Activia and Actimel is betting technology can yield answers on which friendly bacteria work best and why, giving its products a scientific edge at a time when revenue is lagging and consumers are growing wary of processed food.

“The long-term business strategy of Danone is very much about turning around dairy,” says Deputy Chief Executive Officer Juergen Esser. “Everything about bringing the right ferments, the right health benefits and making it shine to the consumer is critical.”

Whether it’s the start of a tech-powered food revolution or just another layer of savvy marketing intended to get consumers to pay more for a pot of yogurt, Danone needs it.

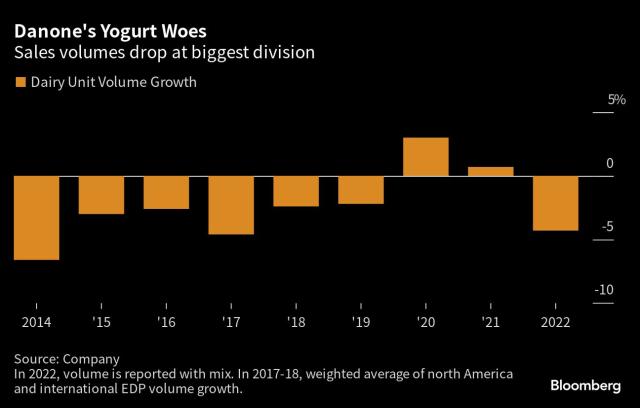

The 104-year-old French company is in its second year of a turnaround effort orchestrated by Esser’s boss Antoine de Saint-Affrique. The dairy unit has suffered falling volumes in seven of the last nine years. Sales volumes in the division — the company’s largest, with plant milks like Alpro as well — fell 4% last year as consumers traded down to cheaper brands in response to the cost-of-living crisis.

“The only way that Danone can revive its business is by investing in a superior product that would support better pricing power,” says Bruno Monteyne, an analyst at Bernstein.

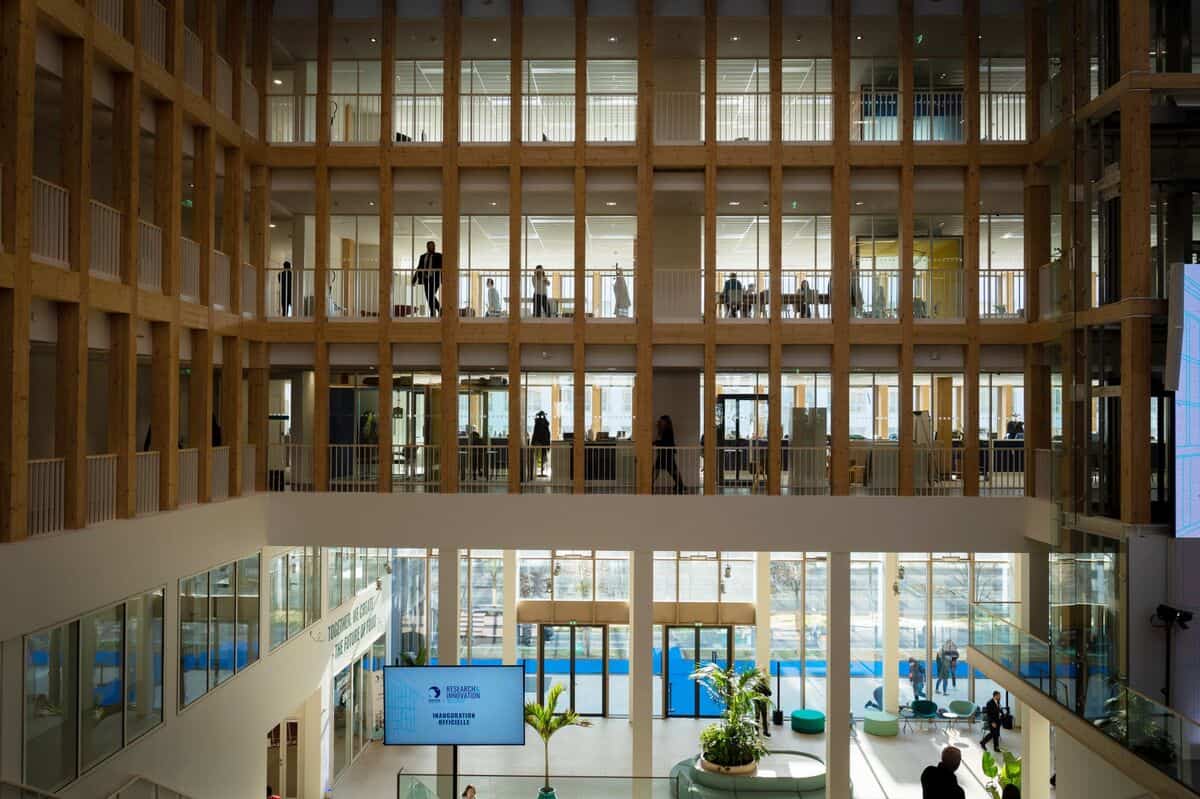

Danone is betting its dairy experience and its own library of bacteria will give it an edge over rivals like Nestle SA. The company spent about $100 million on the new facility that opened in February, bringing together the research lab that houses the robot stomach, co-working spaces and a consumer-testing area in a suburb best known for its nuclear research.

The labs have gained access to patient samples and health profiles for the AI to sift through with collaborations, including one project with the University of California at San Diego and another closer to home called Le French Gut that aims to analyze the microbiome of 100,000 volunteers.

At the root of the approach is fermentation, a chemical process that has been around for millennia. But not all bacteria and yeasts are created equal, so Danone’s artificial stomach tracks the journey the probiotics take after they leave the yogurt pot.

Contained in a torso-sized glass case, the stomach simulates the absorption of food during the digestive process. It helps Danone to determine which candidates endure stomach acids and enzymes, assessing their ability to settle in the gut.

“If you are studying a probiotic, it has to survive,” explains Raish Oozeer, Danone’s director of microbiome and probiotics research.

The promising bacteria will get studied further to see how they interact with fibers and vitamins in food. Danone won’t allow the stomach, developed with Dutch firm TNO, to be photographed because its workings are top secret. The reporter is ushered on before being able to make a sketch.

Machine learning takes over afterwards to find connections between the chosen bacteria and health conditions. The AI pores over stool samples, medical histories and past scientific findings, searching for links to anything from weight loss to immunity.

“The technological advances help a great deal,” says Jan Knol, senior director of research and innovation at Danone. “It’s a hugely complex ecosystem that we can only understand by measuring a lot of things, and then we have to make sense of all these data.”

Some of the AI is still in development for different but related research, like evaluating the quality of babies’ gut flora based on pictures of their stools with a view to improving the quality of infant formula. Danone partners include Microsoft Corp.’s Azure platform and Amazon.com Inc.’s Amazon Web Services.

Researchers have toiled for years on the interactions between microbiome and immunity. But as it mines years of data, Danone doesn’t need to invent anything. Evidence to frame a marketing message that connects bacteria to benefits may be enough for a new yogurt or baby milk to command a premium.

“It’s not like a drug that has to undergo very rigorous testing,” says Kim Barrett, who has studied the microbiome and is vice dean for research at the University of California Davis’s School of Medicine. “Pretty much anybody can make a claim about anything, because these types of products are generally recognized as safe.”

Barrett praises companies like Danone and Nestle for investing in research to document the health benefits of their products.

Their efforts come as the food industry faces something of an identity crisis. Having eradicated the variety and freshness that fed a thriving gut microbiome, companies have turned to probiotics to supercharge their products with beneficial bacteria now that scientists recognize how crucial the community of trillion of organisms living every person’s bowels are to immunity, aging and even mental health.

Archer-Daniels-Midland Co., which supplies ingredients across the industry, invested more than $30 million in a Spanish facility producing probiotics earlier this year. Nestle sells more than a dozen different forms of the supplements through its Garden of Life brand. Beverage companies have also jumped on the bandwagon with drinks like kombucha, a fermented tea. But the probiotics badge isn’t always enough to guarantee success. Kellogg Co. dropped a version of its Special K cereals with probiotics added last year, saying it hadn’t garnered enough loyal fans.

At Danone, the yogurt renaissance resonates. Founder Isaac Carasso was a doctor from the Balkans who began selling yogurt to pharmacies in Spain, concerned about the malnutrition and gut disease among local children. He named the firm Danone after his son Daniel. The company went global after Daniel, who moved to the U.S. from France during World War II, bought a small yogurt shop in New York City and added a layer of jam to its plain offerings.

The sweeter product was a hit, and Carasso renamed the local branch Dannon. The reformulation is emblematic of the tension between making food healthy and making it sell. For years, companies enticed consumers with sugar, contributing to a global obesity epidemic. The trend is showing signs of reversal but some still view the industry’s latest efforts as an attempt to solve the problems it helped create — and doing so by offering another layer of processed foods.

Tim Spector, a British author and microbiome researcher, advises eating thirty different plants a week instead, including nuts and seeds. Food manufactured by the likes of Danone and Nestle may have a “nice health halo,” he says, but “half of their products are poisoning us and the other half are pretending to make us healthy.”

Most of Danone’s dairy products are low in sugar and salt — the company points out its high score on a global nutrition index. But like other big food groups, Danone uses additives like corn starch and sweeteners like sucralose, which has been linked to poor gut health.

What Danone does bring to the table is heft. Isabelle Esser, who is in charge research and innovation at the company, says it’s hard to effect change without catering to the masses.

The enthusiastic Belgian engineer joined the industry precisely because creating impact requires volume, she says, and she dreams that the company could one day come up with a product to help people with diabetes.

The goal is “you take it every day and it’s not a pill, it’s food as medicine,” says Esser, who is not related to Danone’s deputy CEO. “And then over time we’ll build either you immunity or build your resilience.”

The science could also spare Danone some mishaps of the past. The company was ordered to change the labeling and marketing for its Activia yogurt and DanActive dairy drink about 15 years ago in the U.S. to drop “exaggerated health claims.’’ It had to pay as much as $35 million to reimburse customers who argued Danone’s U.S. subsidiary was charging a premium for scientific assertions it could not back up, such as relief against constipation. A year later, it faced restrictions in the European Union, where regulators also clamped down on health assertions, limiting its ability to advertise specific benefits.

The new push to “make sure that we have substance,” as Saint-Affrique has described it, set off a licensing race to lock up therapeutic claims. Nestle, which has its own bacteria cultures, has patented a strain that’s in the same species as the one present in Danone’s Actimel, zeroing in on a heat-treated form that offers the advantage of a longer shelf life and documenting its ability to increase the production of interleukin-10, a protein key to inflammation and immunity.

Danone researchers, meantime, showed that consuming its yogurt reduced the development of insulin resistance and fatty liver in obese mice. The study sponsored by the company pointed to an increase of beneficial compounds in the animals’ livers, prompting it to secure patents that allow it to tout liver and sugar metabolism benefits for at least three types of these ingredients.

The French company says there’s more to come from this burgeoning space at the intersection of food and medicine.

“If we want to make sure that the consumer is finding our products superior to others, we need to make sure that we have the right arguments underpinned by the right science,” says Esser, the deputy CEO who oversees finances and technology at Danone. “You will see, it will make a difference.”