The U.S. Department of Justice has been meeting with retailers and farmers about how the deal would be received, and how it would affect competition in the industry.

“We are investigating Dairy Farmers of America’s potential acquisition of Dean Foods and the potential loss of competition for selling raw milk,” a Justice Department antitrust attorney said.

Dean, which is based in Texas, recently was forced to get protection from bankruptcy after years of struggling, mostly due to Americans drinking less milk. Consumption of milk has declined about 40 percent in the last four years, and production has shifted to smaller plants.

In November, the two entities announced they were looking into making a deal with each other.

Dean is the largest milk processor by sales, selling $4.8 million in 2018. DFA said about one-third of the milk in the U.S. is marketed by them. DFA has a number of milk-bottling plants as well as consumer dairy brands.

Overall dairy consumption in the country is rising because of people are eating more cheese and yogurt, but low milk prices continue to affect revenue, as companies are paid more for raw milk.

Large stores like Walmart and Kroger have also undercut big brands with their own varieties, and built their own bottling plants as well.

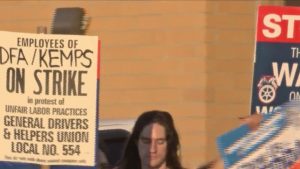

A couple of farm groups have expressed concern that the deal would concentrate milk buyers in different parts of the country.

Whether the deal is allowed to go through could affect dozens of Dean plants.

Monica Massey, DFA’s executive vice president, said the deal was subject to regulatory approval.

“When the largest processor of raw milk in the world files for bankruptcy, we have an obligation to do what we can to secure those markets and work to minimize disruption to our members and other farmers,” she said. “If a deal is reached, we will fully cooperate with DOJ officials, as we have done with past transactions.”