The chief executive of Arla Foods has told Agriland that he is “very cautious” when it comes to his outlook for global dairy markets for the remainder of the year.

Peder Tuborgh said that he would be “very happy” if the markets could achieve stability for the rest of 2023.

However, he warned that it is “very difficult” to predict how the current situation involving China and New Zealand will play out.

New Zealand’s largest dairy company, Fonterra, recently announced that it had reduced down its 2023/24 season milk-price forecast for the second time this month.

It followed a 10.9% drop in whole milk powder (WMP) prices in the latest Global Dairy Trade (GDT) trading event.

The GDT index now stands at 850, the lowest index figure since November of 2018.

Miles Hurrell, the chief executive of Fonterra, said that reduced demand from key importing regions, which would include China, for whole milk powder has continued to “weigh on prices”.

Arla

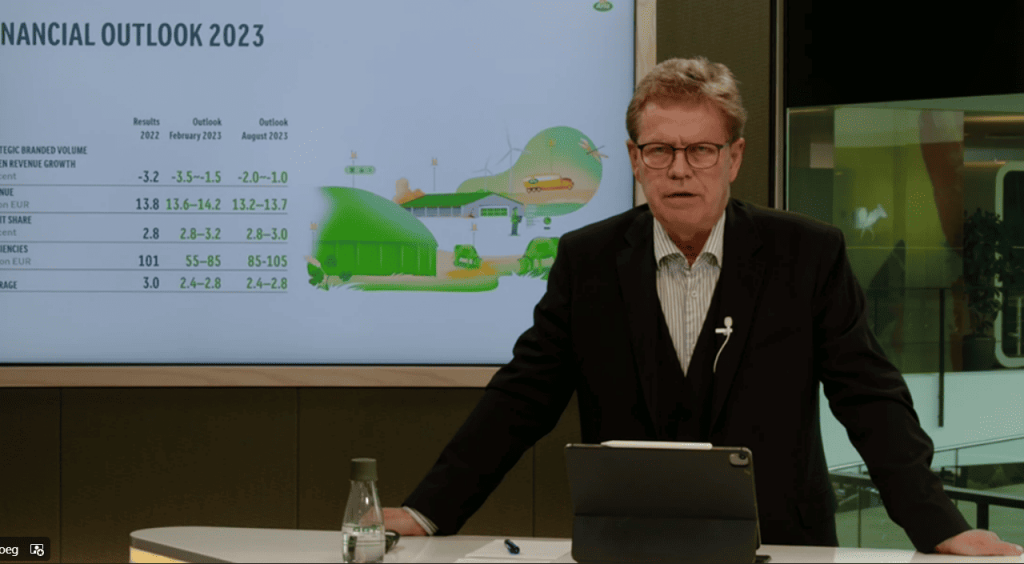

Speaking as Arla Foods announced its financial results for the first half of 2023 today (Tuesday, August 29), the dairy co-op’s chief executive noted the change in the dairy commodity market in the past three weeks.

Around a month ago, Peder Tuborgh said there was a “general consensus”, backed by analytical data, that suggested that “a new balance” had been found in the commodity area which would have probably led to a “slight rebound”.

However, he said that the recent decision by Fonterra had taken the market by surprise, as Chinese imports had not lived up to expectations.

Tuborgh noted that China’s post-Covid 19 comeback has not bounced back as everybody, including the Chinese, had expected.

That has led to “a rather significant drop” in whole milk powder prices over the last three weeks, he said.

“It remains to be seen to what extent that will play out in other commodity areas and in other geographies.

“If you look at the markets in Europe, outside of China, Asia, South America and Africa, we should be in a balance at the moment with supply and demand.

“But we have this very special China and New Zealand situation that may rock the boat more to the negative than to the positive.

“So I think we should be cautious here and if stability played out the next six months, I would be happy, let me put it that way,” Tuborgh said.

Arla, a dairy cooperative, owned by more than 8,400 farmers from Denmark, Sweden, the UK, Germany, Belgium, Luxembourg and the Netherlands, reported group revenue of just over €7 billion for the first half of 2023.

This is an almost 11% increase when compared to €6.3 billion for the same period last year and was primarily driven by previous price increases in Arla’s retail and foodservice.

As had been expected, the company said that the first half of 2023 was dominated by continued inflationary pressure, declining dairy commodity prices, and a shift in consumer behaviours.