Dairy farmers globally continue to be impacted by elevated feed prices, which increased significantly during the early stages of the war in Ukraine. According to commodity prices and market intelligence data firm Mintec, global feed ingredient prices slid back down during H2 2022, but remain higher than in January 2022. Corn and wheat availability is also expected to be tight in 2023, with Russia and Ukraine accounting for 70% of the global supply and dry US weather expected to result in lower crop yields.

Fertilizer prices have also started to recover, in large part thanks to easing in natural gas cost during Q4 2022 and into 2023. According to World Bank, natural gas prices in Europe have slid by more than 18% from January to February 2023, while in the US, the reduction has been even larger, at more than 27% month on month. World Bank’s commodities price data from March 2, 2023 shows that fertilizers fell 5.6% overall, with urea from Eastern Europe trading at $357.5/mt in February 2023 compared to $443.8/mt in January. DAP and TSP prices have also fallen ($612.5/mt vs $631/mt and $547.5/mt vs $569.4/mt respectively). For comparison, in December DAP fell to $625/mt from a high of $954/mt in April 2022; and urea was around $519/mt, down from $925 in April 2022.

In the US, DTN reported this week that all fertilizers have experienced double-digit price reductions compared to a year ago, with lower prices for DAP (by 10%), MAP (by 14%), potash (by 20%), UAN32 (26%) and UAN28 (28%).

But some industry players have complained that the lower prices are not being passed down to farmers quickly enough. In the Republic of Ireland, the price of granulated urea fertilizer has remained elevated compared to both the UK and the US, prompting the president of the Irish Farmers’ Association, Tim Cullinan, to issue a warning to merchants.

“Farmers need fertilizer and they feel they are being held over a barrel by the fertiliser industry,” he said. “If we don’t see immediate and substantial price reductions, we have a clear mandate to take whatever action is required.”

Dairy commodities prices: a bearish outlook

Following a year of high milk output and ingredients production, major dairy commodity prices have been slipping since October 2022 due to weak demand and high levels of production. Mintec predicts a bearish outlook for milk, cream, powders, butter, cheese and fats for the first quarter and a half of 2023 in Europe and the US. The analysts attribute the new market trend largely to decreased consumer purchasing power.

The price volatility in the liquid milk market during 2022 was followed by significant price reductions in Q4 2022, as mild winter weather led to high production levels.

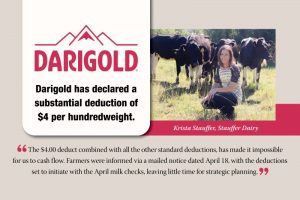

In Europe, Mintec observed that the wide price difference between the spot market (around €350/mt) and at farmgate level (around €600/mp) is putting processors under pressure to reduce farmgate milk prices further. Prominent industry figures, such as Arla Foods UK’s Ash Amirahmadi, have warned against drastic price cuts that could spook farmers into producing considerably less milk.

In the US, powder markets are generally bearish, according to the most recent USDA Agricultural Marketing Service report. Domestic demand for non-fat dry milk is steady while for whole milk powder demand remains ‘quiet’. Demand for dry whey is firm, however, with higher prices in the Central and East US regions. WPC prices were also steady to lower, with some brands in higher demand than others.

In Europe, skimmed milk powders have experienced price reductions during H2 2022 due to limited demand, with buyers opting to wait for lower prices. According to Mintec, just over the last two weeks of January, prices for skimmed milk powder declined around $500/mt. Low buying interest from China has also impacted the European skim powder market.

The outlook is similarly bearish for whole milk powder, where inflation has rendered European products uncompetitive globally and the lack of demand domestically gives producers little incentive to increase production.

Cheese has also followed a similar trend, with prices sliding in H2 2022 and into 2023. This is due to limited consumer demand, with a similar picture for butter, where limited buying interest has driven Q4 prices down.

The downward trend in dairy commodity prices was also highlighted in the recent Food and Agriculture Organization of the United Nations Dairy Price Index, which slipped 2.7% in February, driven by lower prices across all dairy products, particularly butter and skim milk powder, as well as low import demand and higher domestic production during the winter.

High production and lower import demand are likely to remain key factors in a weaker global demand for dairy in the first half of 2023. But with farmgate milk prices being reduced month on month, there’s potential to see lower milk production rates after the Spring flush, which could further influence pricing in the second half of the year.