Australian cheese consumers are purchasing artisanal varieties in greater numbers as the cost of a block of grocery store cheese reaches a two-year high.

The change in consumer behaviour comes as inflation and volatility in the dairy industry, including the rising cost of milk, drive up prices at the checkout.

Dairy Australia analysis and insights manager Eliza Redfern said, over the past 24 months, the average price of a block of cheese had risen by 23 per cent, while total sales had declined.

She said speciality varieties sold in smaller quantities had also seen a per kilo average price increase.

“If we look at the 12 months to January 28, the average for every day [cheese] is $16 and for entertaining [cheese] it’s $31,” she said.

“Two years ago it was $13 for every day and then entertaining was $26.

“The growth that we’ve seen over the past two years has almost solely been driven by those increased ticket prices because, during that time, we’ve seen the volume sold has declined.”

Good cheese hard to replicate

While volatility in the market had seen the cost of cheese rise, an independent producer in Western Australia said they had been largely unencumbered.

“We had to do a price adjustment at the beginning of this year to keep up with the rising costs of inputs, specifically milk and our packaging and cultures, but it’s in line with normal inflation,” said Harvey Cheese general manager Pieter Loitering.

The cheesemaker from Wokalup in WA’s South West said the business, which produces “artisanal” and “hand-made” varieties, had avoided significant price hikes by limiting competition with larger producers.

“Because it’s labour-intensive and doesn’t scale well, it’s hard for them to produce or to compete at a scale in a way that would be satisfying to their investors,” Mr Loitering said.

“On the other side, when it comes to hard cheeses like cheddar or tasty cheese, they can produce a volume that needs a level of capital investment that makes them competitive with which we would never be able to compete.”

Mr Loitering said the business also kept costs down by partnering with independent suppliers and supermarkets over industry giants Coles and Woolworths.

“Strategically we are deciding not to because the level of pressure that they will put on us and the small margin will make portions of our business sustainable,” he said.

“The prices, which we then have to deliver to them, and the volumes that we have to deliver for them, will have to change the way we make cheese quite fundamentally.”

Speciality cheese on the rise

The change in consumer behaviour was noted in a report by market analysis IBIS World, which found more people were turning to speciality and dairy-free products.

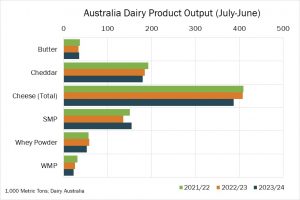

According to the report, revenue for the past five years fell by 2.2 per cent, with consumers moving away from traditional cheddar varieties in favour of goat, feta, and plant-based varieties.

“Domestic per capita cheese consumption has increased over the past five years. However, local consumer preferences have shifted from traditional cheddar varieties towards speciality cheeses,” the report said.

It also found traditional markets could expect to face strong competition from plant-based variants that were seen as healthier for consumers.

IBIS projected domestic revenue across all cheese varieties would rebound by 0.2 per cent over the next five years, with one of the country’s largest producers, Bega, having already made inroads into plant-based alternatives in March last year.

Bega was contacted for comment.

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K