Find out why New Zealand’s real money-makers are the banks, not Fonterra. Want to know how financial institutions are earning more than dairy farms? Keep reading.

When examining New Zealand’s primary industries, Fonterra is often cited as a typical example of agricultural strength, boosting exports and greatly enhancing national GDP. Nonetheless, a more muted “milking” method flourishes in the urban cores of financial hubs rather than on the lush pastures. New Zealand’s economy’s actual “milkers” are the banks, not Fonterra. Although dairy farming is lauded for its financial rewards, the financial sector’s tactics are as, if not more, significant. Banks use lending strategies, interest rates, and other fees to extract income from all levels of society, from large corporations to individuals. This fact warrants careful consideration, especially considering the significance of financial literacy.

Fonterra: A Pillar of New Zealand’s Economic and Agricultural Landscape

Fonterra is the largest dairy company in New Zealand and a significant global player. It was formed in 2001 by merging the New Zealand Dairy Group, Kiwi Cooperative Dairies, and the New Zealand Dairy Board. Fonterra handles thirty percent of all dairy exports globally. Almost 10,000 farmers own it, which is critical to New Zealand’s agricultural economy, directly contributing more than 3% of GDP.

Fonterra employs thousands and offers processing, packaging, and shipping. Its effect extends to over 140 countries, creating billions in export revenue. Fonterra ensures New Zealand’s continued dominance in the dairy sector and raises its global prominence via strategic collaborations and new dairy technology. From milk powder to nutritional formulas, its diverse product portfolio reflects its commitment to quality and sustainability—both locally and globally.

The Oligopoly of New Zealand’s Banking Sector

The four core Australian-owned banks that dominate the New Zealand banking industry are ANZ, ASB, Westpac, and BNZ. Together, these institutions control over 85% of all bank lending in the nation, forming an oligopoly with significant influence over the financial landscape. This dominance influences interest rates, loan conditions, and banking fees, impacting the economy as a whole.

ANZ, the biggest of these banks, with a net profit of $2.8 billion in the most recent fiscal year. It continuously leads the market in lending and deposits, utilizing its size to provide competitive yet profitable interest rates and fees. ASB follows closely, with billions of dollars in revenues from digital banking services and a significant mortgage portfolio. Westpac and BNZ also record multibillion-dollar profits, concentrating on long-term fixed loans to ensure consistent income and client loyalty.

The combined profits of these institutions demonstrate their financial strength. In 2024, the sector’s revenue was $59.96 billion, supported by fees that, despite criticism, offer steady cash flow. Their dominance in digital banking strengthens their position, providing ease to clients while lowering overhead expenses for banks.

These financial behemoths hold considerable power throughout New Zealand’s economic environment. Their strategic lending strategies and sophisticated digital infrastructure allow them to operate with more financial agility, increasing their market impact. They are the leading financial institutions in New Zealand, outperforming even huge agricultural cooperatives like Fonterra in terms of economic effect and profitability.

Financial Titans: Fonterra vs. The Banking Sector – A Comparative Analysis

When comparing New Zealand’s financial behemoths, Fonterra and the banking industry stand out. Fonterra, a cooperative dairy firm, generates money from dairy products. The collaborative approach capitalizes on group output, resulting in considerable worldwide revenues. Fonterra’s income is derived directly from selling milk, cheese, butter, and other products, which drives a yearly billion-dollar export business. Banks earn from interest rate differentials, service fees, and better digital banking. This diverse strategy increases earnings by lowering operating expenses.

Analyzing their profit margins shows a fascinating contrast. The banking industry has constant margins owing to diverse income and long-term assets such as mortgages, which account for 63% of their lending. This constancy in profit margins reflects banks’ financial stability, which is crucial for preserving customer trust. Fonterra’s margins are unpredictable due to global dairy pricing and environmental considerations. While Fonterra may be lucrative, it confronts significant risks and uncertainties that banks, with their consistent income base, often avoid.

From an economic standpoint, both are important, but they function differently. Fonterra has a tremendous impact on rural areas and New Zealand’s export economy. On the other hand, banks serve as the financial ecosystem’s foundation by supporting corporate, consumer financing, and housing markets. They are crucial in ensuring financial stability and economic prosperity, deeply ingrained in the New Zealand economy. This role of banks in encouraging economic growth provides a cause for optimism about New Zealand’s financial future.

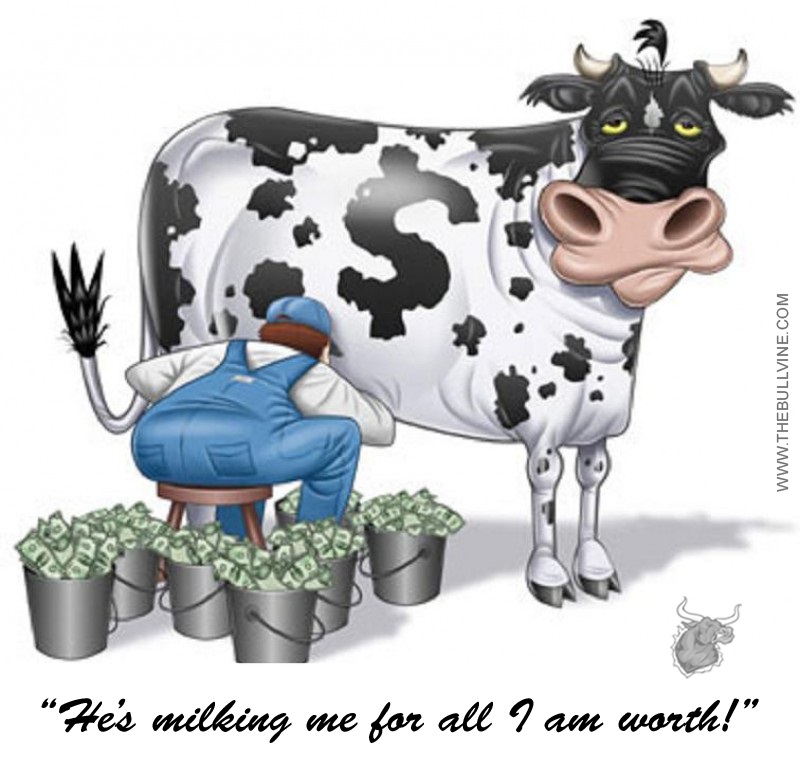

Milking Consumers: The Financial Gains of Banks Compared to Fonterra’s Production-Based Model

In this context, ‘milking’ refers to extracting financial advantages that primarily benefit banks while imposing considerable economic penalties on customers. While the word is often linked with dairy farming, it is a metaphor for how banks employ multiple processes to make large profits. This ‘ milking’ occurs via excessive interest rates on loans and credit cards, resulting in significant long-term expenditures for borrowers. Furthermore, banks charge additional fees for account maintenance, overdrafts, and international transactions, which adds to clients’ financial burdens.

In sharp contrast, Fonterra’s business strategy is focused on dairy production, processing, and exportation. Their earnings are generated via the production and sale of physical things, consistent with conventional industrial and agricultural operations. Fonterra’s revenue is based on physical outputs, whereas banks earn from leveraging financial instruments and consumer reliance on credit facilities. This contrast exposes the exploitative aspects of the banking industry’s profit plans with the value-added strategy of New Zealand’s top dairy cooperative.

Human Faces Behind the Numbers: The Struggles of Ordinary Consumers in New Zealand’s Banking Maze

John and Mary, a couple from Wellington, confronted the painful reality of increasing mortgage rates. Their relatively competitive house loan from 2019 experienced a significant increase in interest rates within two years, as stated in the small print of their agreement. This increased their monthly payments by hundreds of dollars, requiring them to cut down on spending. They are not alone: around 63% of bank lending in New Zealand is related to long-term, often variable mortgages that put pressure on households.

A small company owner, Fiona, found ‘hidden fees’ on her bank accounts concealed in convoluted terminology. These costs added up over three years, restricting her company’s development. Fiona’s example demonstrates how more New Zealanders should know their banking practices.

In 2020, an investigation revealed that central banks in New Zealand were charging secret foreign currency markup fees. Tom, an expatriate who remitted money to the UK, unwittingly paid more due to these concealed markups, which cost him hundreds of pounds over the year. Banks use opaque transaction tactics to milk customers without informed permission.

A Tale of Two Titans: Fonterra’s Community Roots vs. Banking’s Corporate Profits

A complicated picture emerges of the economic effect of New Zealand’s banking industry. The growth of mortgage loans—49% to be re-priced within a year and 23% fixed for lengths of more than two years—emphasizes the structural burden on homeowners. This financial uncertainty, worsened by fluctuating interest rates, dramatically strains families. With 11% of mortgages floating, economic shocks may quickly worsen family financial troubles.

In contrast, Fonterra’s economic contribution is based on production and employment. It employs about 29,000 people and significantly contributes to the rural and urban economies. The cooperative’s export income supports local development and agricultural communities. Fonterra remains an essential economic driver despite shifting dairy prices and environmental concerns.

Meanwhile, the banking sector’s earnings rose to $6.91 billion, highlighting a worrying imbalance. While banks build money for shareholders and executives, regular Kiwis confront financial difficulties. This contrast between Fonterra’s community-focused strategy and the banks’ profit maximization paints a striking picture of New Zealand’s economic reality. It’s a world characterized by people’s daily suffering juxtaposed against financial organizations’ riches.

Perception vs. Reality: How Media Narratives Shape the Stories of Fonterra and NZ Banks

Fonterra and the banking industry are giants in New Zealand, yet their public impressions and media representations are vastly different. Fonterra, regarded as a national pride emblem, is admired for increasing the GDP and assisting thousands of farmers. Despite occasional references to environmental consequences and shifting milk costs, the media often highlights the company’s sustainability and community activities.

In contrast, the banking industry, which Australian corporations predominantly dominate, is under increased scrutiny. It is often seen as favoring business over people, with criticism for exorbitant fees, digital difficulties, and squeezing mortgage holders. While banks offer critical financial services and credit, concerns over profit margins and lending practices typically overshadow these benefits.

The perceived gap between these industries affects public opinion and legislation. Fonterra’s strong image strengthens its lobbying power, resulting in more favorable legislation and government backing. In contrast, banks’ unfavorable image encourages public support for tighter restrictions, influencing their operations and profitability.

Thus, whereas Fonterra benefits from national symbolism, banks face a contested image, with media depiction influencing their regulatory and economic environments.

Regulatory Stewardship: Balancing Stability and Fairness in New Zealand’s Banking and Dairy Sectors

The regulatory framework in New Zealand’s banking and dairy industries is vital for ensuring stability and fairness. The Reserve Bank of New Zealand (RBNZ) supervises the banking industry and enforces prudential requirements to maintain systemic stability. Recent measures like higher capital requirements are intended to insulate the banking sector against financial shocks. Proposed changes aim to improve openness and accountability, reduce risks, and protect customers.

In contrast, the Ministry for Primary Industries (MPI) oversees the dairy sector to ensure product quality, environmental sustainability, and biosecurity. Fonterra, the most significant participant, follows the Dairy Industry Restructuring Act (DIRA), which regulates milk supply and price. Amendments to DIRA promote competition and innovation among smaller dairy farmers.

Both industries have seen extensive government involvement to safeguard consumers from market abuses. The Financial Markets Authority (FMA) supervises the banking industry’s capital markets and financial services, and environmental rules for dairy address the industry’s ecological effect. The dual emphasis highlights the comprehensiveness of New Zealand’s regulatory regimes.

The Bottom Line

The banking industry, not Fonterra, is the true driving force in New Zealand’s economy. While Fonterra is important in agriculture for increasing GDP and creating employment, banks significantly influence the financial well-being of average Kiwis. The banking sector, dominated by heavyweights such as ANZ, BNZ, ASB, and Westpac, controls more than 70% of industry income and directly impacts customers. Fonterra’s community-focused operations are in stark contrast to banks, which prioritize corporate profits above customer interests, leaving many New Zealanders with exorbitant mortgage rates and financial insecurity due to banking regulations. Regulatory measures are critical for maintaining stability and fairness in both industries. The narrative that portrays Fonterra as the vital economic beneficiary has to be reevaluated. Banks tremendously impact our financial well-being and should be scrutinized more closely due to their enormous economic ramifications. It’s more than just supporting local dairy; it’s about confronting established practices that affect our financial health. By creating a more educated worldview, we can advocate for fairer policies and legislation prioritizing people above profits. It’s time to identify the true milkers and demand better.

Key Takeaways:

- Banks in New Zealand derive substantial profits from financial services, overshadowing the agricultural industry’s earnings.

- The narrow banking sector oligopoly leverages market power, impacting consumers with higher fees and interest rates.

- Despite Fonterra’s significant contributions to the economy, its community-centric approach contrasts starkly with banks’ profit-driven motives.

- Ordinary New Zealanders face financial strain from banking practices, highlighting the need for more consumer-friendly regulations.

- Media narratives often obscure the real economic impacts of banking profits versus agricultural revenues.

- Regulatory efforts must balance the economic stability provided by banks with the fairness required for consumer protection.

Summary:

Fonterra, New Zealand’s largest dairy company, handles 30% of global dairy exports and contributes over 3% to the country’s GDP. Owned by nearly 10,000 farmers, Fonterra employs thousands and offers processing, packaging, and shipping services to over 140 countries. The company ensures dominance in the dairy sector through strategic collaborations and new dairy technology. The four core Australian-owned banks, ANZ, ASB, Westpac, and BNZ, control over 85% of bank lending in New Zealand, forming an oligopoly with significant financial strength. The sector’s revenue was $59.96 billion in 2024. Fonterra generates money from dairy products, while banks earn from interest rate differentials, service fees, and digital banking. The banking industry in New Zealand is complex and controversial, driven by long-term, variable mortgages. Regulatory stewardship is crucial for stability and fairness in both sectors.

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K