The earnings range has changed from the previously forecast $175 million to $190 million, to be between $160 million and $190 million.

The update has spurred a further decline in Bega’s share price, to $3.25 at close of trading on Thursday, July 15. Share trading also leapt to a high volume not seen in more than 12 months.

The price has fallen from $5.13 in mid-April.

Dairy processors have been pushing up the price paid to suppliers to record highs, in some cases up to 25 per cent above last year’s figures.

The company remains positive on profit forecasts despite the interruptions to international supply, the impact of the Ukraine war, COVID-19 and floods in some dairy supply regions of Australia.

In a statement released on July 13, the company referred to ongoing cost pressures of robust competition among dairy processors for milk.

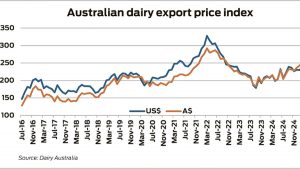

“While milk prices vary throughout Australia, the largest supply region, Victoria, was expected to experience a farm gate milk prices increase for the 2023 financial year, in the range of 15 to 20 per cent based on the stability and strength of global dairy commodity markets and currency relativities,” the statement said.

“Initial milk price announcements by Bega Cheese and other dairy companies on June 1, reflected this level of expected milk price increases.

“However after the release of those initial prices there has been particularly strong competition amongst milk processors during June and July and farm gate prices in Victoria for financial year 2023 have further increased to a level of approximately 30 per cent higher than financial year 2022 prices.”

Bega said the price increases would benefit farmer suppliers, impact all Australian dairy companies and the increases were already being reflected in higher product prices in the retail markets.