This week’s announcement of the sale of a portfolio of well-known Australian dairy brands, including Dairy Farmers, Big M and Pura to, China’s second largest dairy company, China Mengniu has captured headlines well beyond the financial pages. The $A600 million transaction marks the end of Japanese-owned Lion Dairy & Drinks foray into the dairy business.

Now that it’s been announced that the new owners are Chinese, the prospect of foreign ownership of brands stacked in Australian supermarket fridges has raised the expected alarm and criticism. It’s also raised the question: just what constitutes an “iconic” Australian brand?

Last week, HK-listed China Mengniu received Australian government approval to acquire Tasmanian baby formula brand Bellamy’s Australia for A$1.43 billion. China Mengniu, which is part-owned by the Chinese government, was founded in Mongolia in 1999. The Chinese government established its stake in the business in 2009. Up until recently, Mengniu focused solely on the China market but, as with every major global dairy company, is looking to expand its reach.

Bellamy’s an Australian icon?

A burning issue which hovers around foreign ownership is how appropriate is it for Australian companies to fall into foreign hands? Australia’s Foreign Investment Review Board was established in 1976 to answer such questions. For brands considered part of the national identity, the idea of control and profits heading offshore is not palatable to some.

Whether China is grabbing iconic brands at a greater or more alarming rate than any other nation is a question of debate. However, Arnott’s Tim Tams, Rosella Tomato Soup, Bushell’s Tea and Uncle Toby’s Oats are among a host of Australian icons hived off by foreign owners, long before China’s economic rise.

Yet the Foreign Investment Review Board’s (FIRB) approval of China Mengniu’s takeover of, Tasmanian company, Bellamy’s raised questions by a number of people in both media and politics.

In particular, federal independent Tasmanian MP, Andrew Wilkie, who rose in the parliament, prior to the FIRB review, saying,

“Many Australians will be wary for all sorts of reasons… we don’t want Bellamy’s Australian workforce to be gutted.”

He added the FIRB should be

“prepared to stop the sale if need be.”

After the sale received Australian Government approval, he told Sky News he supported foreign investment but opposed the deal because Bellamy’s is “an iconic Australian company”. A cursory look at the company’s brief history suggests otherwise.

Not a cow in sight

Simon Evans of the Australian Financial Review profiled the company earlier this month, under the telling headline “Building Bellamy’s without a single cow nor blade of grass”.

Evans’s take: “Peer closely behind the curtains at infant formula company Bellamy’s Australia and there’s not a lot to see when it comes to physical assets.

“The infant formula group to be swallowed by a Chinese firm is capital light, which means it is a front-end marketing business … it has one of the more extreme versions of the capital light model,” wrote Evans.

Bellamy’s has been a listed entity for just five years – its IPO conveniently timed to come just weeks ahead of the signing of the China Australia Free Trade Agreement. The company was established 15 years ago; does not actually produce any infant formula, instead sources it mainly from Europe; and has less than 150 employees.

Though the Bellamy’s website boasts an Our Farms section across its home page navigation bar, a careful reading of that section reveals that Bellamy’s sources milk products from farms but doesn’t make reference to the company actually owning one. Nor is there a suggestion that it owns any of the pictured cows lazily grazing across the meadows.

Says stockbroker Morgan’s agriculture analyst, Belinda Moore,

“It is a brand and marketing company that used to source all its milk powder from Europe and is now trying to source more powder from Australian producers. From a foreign investment standpoint, Bellamy’s is hardly a strategic asset.”

The latest China Mengniu deal

In simplistic terms, this latest deal represents the transfer of ownership of an Australian milk company from a Japanese beer company to a Chinese milk producer. The value of the cash sale, subject to ACCC and Foreign Investment Review Board approval, is A$600 million.

Lion Dairy is ultimately owned by Tokyo-listed Kirin Holding’s Co., Japan’s second largest beer brewer. It acquired its Australian dairy portfolio five years ago, but the company has been looking for a buyer/s of its dairy assets for more than a year.

In providing an update on the potential sale in April of this year, Lion CEO Stuart Irvine confirmed the company had taken a A$530 million write down on the dairy business — hardly an indicator of stellar performance.

The Lion Dairy & Drinks business employs around 2,300 people across Australia with some people based in Singapore, Malaysia and China. Its portfolio includes Dairy Farmers, Pura, Dare, Farmers Union, Yoplait, Daily Juice, The Juice Brothers and Berri.

Much of the Australian media reporting has been built on the showcasing of these iconic brands under somewhat alarmist headlines of potential Chinese ownership. For the most part, mention of the brands already being owned by a Japanese company is buried in the text. Some stories didn’t mention the current owners were Japanese at all.

Lion’s cheese deal smelling like roses

Last month Lion Dairy’s Japanese owners sold the company’s Australian cheese business to Canadian dairy giant Saputo Inc, acquired through its subsidiary, Saputo Dairy Australia.

Among the iconic Australian brands served up on the cheese deal were King Island Dairy, Tasmanian Heritage, Mersey Valley and South Cape. That $280 million transaction, however, hardly raised a concern outside of Tasmania, home to its two production facilities and 400 employees.

In August, China Mengniu’s major competitor, Yili Group completed its takeover of financially troubled NZ dairy co-operative Westland Milk for NZ$588 million. Unlike Bellamy’s, Westland can lay claim to being an iconic company; in stark contrast to the bovine-starved Bellamy’s operation, Westland’s original co-op members have somewhere in the vicinity of 200,000 cows.

With the co-op already relying on NZ government loans, the deal was “bittersweet” according to dairy farmer and former Westland Milk director Katie Milne, who is also president of Federated Farmers. However, on average each farmer walked away with around NZ$500,000, which the co-op’s former chairman Pete Morrison called a competitive payout which could not have been delivered any other way.

There were foreign ownership concerns expressed in New Zealand but nowhere near the commentary generated by China Mengniu in Australia.

A global dairy M&A every second day

There is nothing out of the ordinary with China Mengniu’s corporate activity.

According to a leading global dairy industry report, produced by Rabobank, in 2018 there were 111 mergers and acquisitions globally, with 127 transactions in 2017. In the last 18 months there have been 196 mergers and acquisitions, 109 of which are cross-border or regional transactions. This roughly translates to a global dairy industry merger and acquisition every two and half days for the past three years.

Rabobank found that of the Global Dairy Top 20 companies (China Mengniu ranks 10th) all but one was involved mergers, acquisitions and disposals. In total, those 19 companies completed more than 75 transactions in the 18 months to August 2019. According to report co-authors, Saskia van Battum and Mary Ledman,

“None of the deals, however, was a real game changer.”

As for China they say,

“Increasingly fierce competition in the domestic market forces Chinese Yili (China’s number one dairy) and Mengniu (China’s number two) to look overseas for growth.”

How big is China’s piece of Australia?

In talking down China Mengniu to Sky News, federal MP Andrew Wilkie claims, “They’re (China) now only second to the United Kingdom as far as foreign investment in this country.” That statement does not bear up to scrutiny. Mr Wilkie’s office was contacted by APAC News, asking if he wished to clarify his remarks, however at time of publication, there has been no response.

Australian Department of Foreign Affairs (DFAT) statistics show, as of the end of 2018, the United States remains far-and-away the biggest foreign investor in Australia. Britain is ranked second and China is down the list, only ranking ninth.

China’s investment in recent years has accelerated enormously but it still only accounts for 1.8% of total accumulated foreign investment. While US investors have 26.7% of the pie, followed by British investment which is 16.4% of the total.

Belgium is third on the list of foreign investors in Australia, the tiny Western European nation has five times the level of investment in Australia’s economy as does China. Other small nations, Singapore, Netherlands and Luxembourg all hold bigger stakes in Australia’s economy than China.

Who owns shares in Australia’s biggest companies?

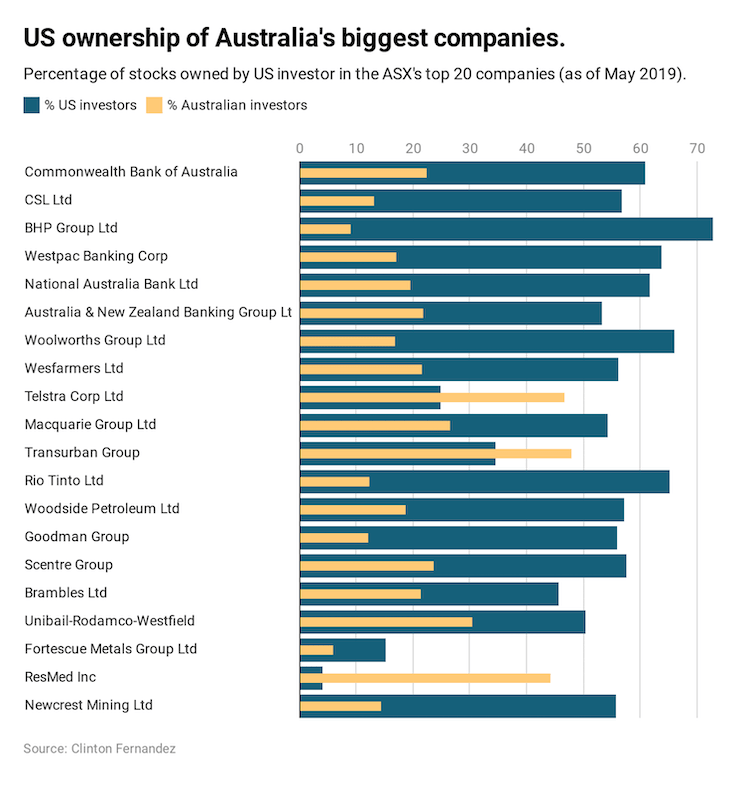

Shortly after the May 2019 Federal Election, Professor Clinton Fernandes of UNSW analysed which Australian listed companies had significant US ownership. Looking at the 20 largest companies listed on the ASX, he found that 15 were majority owned by US investors, while three others were 25% owned by US investors.

Fernandes found that Australia’s four major banks – which directly hold eight out of every ten residential mortgages in Australia – are all majority owned by US-based shareholders. The 20 companies he reviewed make up almost half of the value of all companies listed on the ASX.

Among the ASX20, he found that Woolworths has the second highest level of US share ownership. That company is one of the main retail outlets of milk in Australia.

China ownership concerns

China is engaged in a trade war, albeit one in which is a resolution is likely, with the United States. Thus, any company with the support or partial shareholding of a government, has a possible advantage in international trade. Tariffs, quotas and import duties are managed by governments, who should be striking deals in their national interest.

In that context, cross border acquisitions involving companies with part-Chinese government ownership should be open to scrutiny. This is presumably one of the key factors that Australia’s Foreign Investment Review Board examines when approving cross-border deals.

However, unlike the US, Australia and China already have a comprehensive free trade agreement in place. Prior to ChAFTA’s signing, one of the clear understandings of that agreement – to both Australian government and business – is that China is a state-planned economy where the state has significant ownership in commercial businesses.

China Mengniu’s biggest shareholder is the state-owned China Oil and Food Corporation (COFCO) but it is a publicly listed company with shares traded on the Hong Kong Stock Exchange. Financial data analysts, Simply Wall Street published a report which estimates 28% of Mengniu stock is held by retail investors with 31% owned by private companies. While its business is concentrated in China, the company has followed the lead of many multi-nationals through its incorporation in the tax haven of the Cayman Islands.

Though not necessarily an impediment to the China Mengniu transaction, the announcement of the Lion Dairy purchase comes at a time of strained diplomatic relations between Australia and China. Against this backdrop, heightened media and regulatory scrutiny is to be expected.

Marcus Reubenstein is the editor of business website APAC News.