High grain prices, a recent rise in fuel costs and increased labor expenses are all taking their toll as the price farms get for milk remains low.

“Nobody is thinking it’s going to be a great year,” said Chris Koval, co-owner with his brother, Adam, of Koval Brothers Dairy in Saratoga County. “Everybody’s belt is pretty tight.”

With 500 cows, this is the largest of the more than two dozen local farms that supply fresh milk to Stewart’s Shops, one of eastern New York’s largest convenience store chains with more than 335 locations.

The fifth round of the food box program began Jan. 19 and runs through April 30. It was funded through the latest stimulus bill for up to $1.5 billion, one of USDA’s last actions before the transition in administrations.

“The program has been helpful to move a lot of excess food, getting it into the hands of people who need assistance while also paying farmers for what they produce,” said Steve Ammerman, a New York Farm Bureau spokesman. “It was especially beneficial in lifting up commodity prices after they plunged last year in the beginning months of the pandemic when so many food service providers shut down. It certainly was a lifeline all the way around.”

But it’s especially critical to dairy, which has received 20% of the more than $5 billion spent on the program since its inception last year.

Farm to Families Food Box Program Could Lead to Bull or Bear Year

In a recent Farm Credit East-sponsored webinar, Cornell University ag economist Chris Wolf said the food box program is one of the main factors that could determine whether the year ahead is bullish or bearish for dairy.

Food box funding helped offset revenue lost from closures in the food service sector, which remains far below pre-pandemic demand.

For U.S. agriculture as a whole, about 40% of net farm income came from government payments last year.

In addition to food box purchases, direct payments from the Coronavirus Food Assistance Program bolstered farm revenue, and there was a major increase in demand for The Emergency Food Assistance Program and the Supplemental Nutrition Assistance Program.

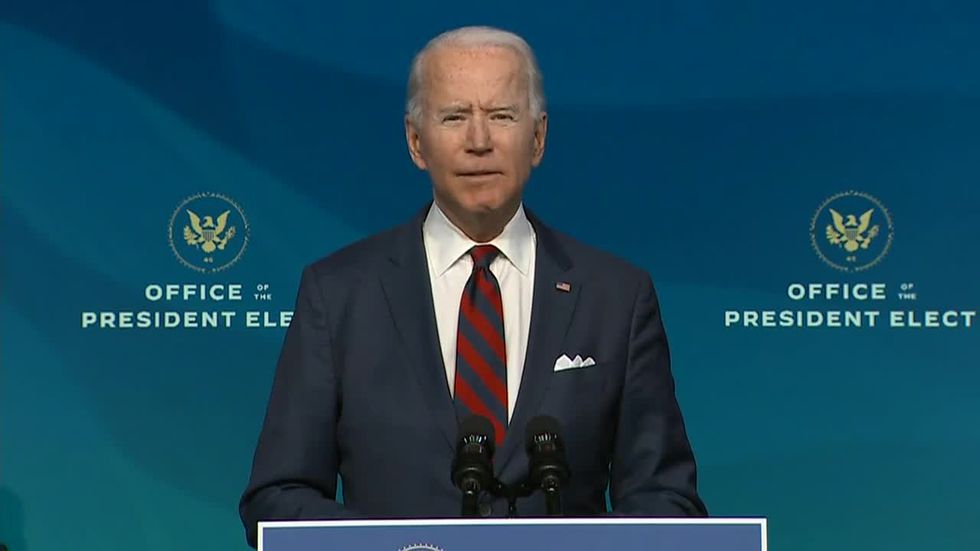

The big question now is whether the Biden administration will keep using the food box program or will reroute funding to SNAP, which may not be as lucrative for dairy.

SNAP “would also increase dairy consumption, but it won’t be so focused on dairy,” Wolf said. “So it won’t help quite as much.”

Aside from direct financial benefits to farms and families, Koval said, the food box program provides employment in the packaging, transportation and distribution sectors.

“So you get all these other effects,” he said. “It really props up the whole system.”

Favorable weather, demand from China and southeast Asia, and a sooner-than-expected end to the pandemic would all help dairy considerably, Wolf said.

On the flip side, Mexico is the largest importer of U.S. dairy products, and its economy is struggling.

“Also, the European Union and New Zealand have significantly lower prices than we do,” Wolf said. “Our powder is competitive, but cheese in particular is not competitive. Anything that lowers cheese prices here is going to lower overall milk prices because cheese is a primary driver of overall milk prices.”

Events of the past 12 months might affect dairy’s fate significantly in 2021.

“A lot of where we’re going to be going depends on where we’re coming from, more so than in previous years,” Wolf said. “We came into 2020 looking at a good farm milk price year for the first time since 2014. It was kind of refreshing to talk about having a good year in 2020. Dairy markets seemed fairly well balanced. We seemed to be at the end of some of the trade issues that were going on, that we would be getting back into China, and markets were going to be fairly healthy. We were looking at the possibility of averaging $18 for Class III milk, which primarily drives the overall milk price in this country.”

Then, of course, COVID-19 hit and unemployment rate — which had been humming along at an historically low 3.5% to 4% — skyrocketed to 14%, its highest figure since Great Depression, all in one month. Almost half (11 million) of the 23 million lost jobs haven’t been restored.

“That means a lot of lost buying power,” Wolf said. “Consumption is two-thirds of GDP in this country. There was a 20% decline in personal expenditures. It’s bounced back up but is still below norm.”

Thanks to delivery services, at-home food sales have risen dramatically, but not enough to offset food service business that was down 26%, 49% and 35% last March, April and May, respectively.

“This has led to bankruptcies, loss of restaurants, many of which may not be back,” Wolf said.

That’s why dairy producers in particular are following Biden administration policies closely, to see what help may or may not be forthcoming to get through this extremely difficult time in industry history.