Inflation and Primary Production: The Rising Cost of Inputs

Surging costs for essential inputs like animal feed grains and fuel have squeezed profit margins for dairy farmers, curbing their ability to expand operations. Reports highlight a drop in the average price per liter of milk paid to Brazilian producers, discouraging investments in technology and improved practices.

This scenario has led to an increased reliance on government programs like PAA Leite, aimed at mitigating the economic impact on small-scale farmers. However, inflation exacerbates inequalities within the sector, as smaller producers struggle to compete with more structured farms.

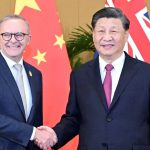

Brazil and New Zealand: Strategic Dairy Partnerships and Market Opportunities

Insights from eDairyNews warn that this disparity risks further consolidating the market, with a shrinking number of players able to endure economic pressures.

Industry and Processing: Balancing Competitiveness

The dairy processing sector faces similar challenges. Rising energy and logistics costs collide with a consumer base increasingly sensitive to price. Additionally, hikes in state-level ICMS taxes undermine the competitiveness of local products against imports, fueling debates about tax reform and subsidies for the industry.

Without a long-term solution to inflation, growth in Brazil’s domestic market remains constrained, forcing companies to reassess their strategies. For international exporters, this environment presents both challenges and openings.

Consumption Trends: Accessibility and Innovation

Brazilian consumers are adjusting their purchasing habits. Premium dairy products such as aged cheeses and functional yogurts are losing ground to more affordable alternatives. However, there is a parallel surge in demand among higher-income groups for innovative products offering added value, including those with functional or sustainable attributes.

This dual behavior creates opportunities for companies capable of adapting their portfolios to meet diverse consumer needs. Yet, economic constraints may limit access to these products in lower-income segments, hindering broader market penetration.

International Trade: The Role of Imports

Despite being a significant producer, Brazil relies heavily on dairy imports, particularly powdered milk and cheeses. In 2024, imports of these products increased due to the domestic industry’s inability to meet internal demand at competitive prices.

eDairyMarket: Digital stores and malls, the present of the global dairy ecosystem

Regional suppliers like Argentina and Uruguay remain dominant, solidifying their positions in the Brazilian market. For global exporters, including those from New Zealand, understanding Brazil’s market dynamics is crucial. Inflation, by driving up local production costs, may create openings for imported products to bridge domestic supply gaps.

Global and Regional Market Updates: Insights from GDT and SDT

Recent updates from the Global Dairy Trade (GDT) and South Dairy Trade (SDT) highlight shifting trends in international dairy markets. A notable dip in global dairy prices, driven by softening demand from key markets like China, contrasts with steady gains in premium categories such as organic and value-added dairy. These dynamics resonate with Brazil’s growing appetite for differentiated products despite economic challenges.

The SDT’s report underscores the importance of regional cooperation in South America. Argentine and Uruguayan exporters’ ability to maintain competitive pricing in the face of fluctuating currency values has bolstered their market share in Brazil, setting a benchmark for other international players.

Projections for 2025: Scenarios and Strategies

Looking ahead to 2025, the trajectory of Brazil’s dairy market will depend on how effectively the country addresses inflationary pressures. Possible scenarios include:

- Economic Reforms and Recovery: Should Brazil implement effective economic measures, increased purchasing power could drive domestic consumption growth, spurring investments in both primary production and processing.

- Status Quo: Persistent inflation would likely focus the market on more affordable products, deepening reliance on imports and government support programs.

- Innovation-Driven Growth: Sustained demand for sustainable and innovative products among middle- and upper-class consumers could provide a lifeline for the sector, even amid economic headwinds.

Strategic Insights for International Stakeholders

For global dairy exporters, monitoring Brazil’s economic and social trends is essential. The intersection of inflation, shifting consumption patterns, and import dynamics offers both risks and opportunities. Adapting strategies to align with these evolving conditions could prove decisive for market success.

To stay informed about the latest developments in Brazil and Latin America’s dairy sector, explore in-depth analyses on eDairyNews.

Valéria Hamann

EDAIRYNEWS