Dairy prices rise; US housing starts leap; US retail sales stay positive; Canadian CPI eases; RBA minute warnings ignored; UST 10yr 3.92%; gold up and oil stays up; NZ$1 = 62.7 USc; TWI-5 = 70.8.

Here’s our summary of key economic events overnight that affect New Zealand, with news of some more suggestions that the global hard landing may be even further away. The ‘soft landing’ has actually happened and that’s despite wars, China’s stumbles and trade tussles.

But we start today with the results of the final dairy auction of the year and the results are somewhat mixed. The headline change is a good +2.25% rise overall in USD terms. The key WMP price rose +2.9% and the foodservice commodities rose much more with cheddar cheese up +6.9% and butter up a strong +9.9%. But volumes offered and sold were on the lowish side. And the whole event was somewhat undermined by a sharp rise in the NZD at the same time so that in NZD terms there was essentially no change from the last auction. Overall, the story is somewhat similar – from a year ago prices are now little-changed which isn’t that great when you realise that prices this time last year were -20% lower than the prior year (even if they were unusually high in 2021). At least today’s result is better than another retreat.

In the US, housing data has surprised with new housing starts soaring. Bolstered by low inventories and now lower mortgage rates, they jumped unexpectedly by almost +15% in November from October to an annualised rate of +1.56 mln starts, the highest rate in six months, and well above market forecasts of 1.36 mln. Starts for single-family homes jumped +18%, the highest level since April 2022, and those for buildings with five units or more went up +8.9%. It is certainly an eye-catching move. But we should note that residential building consent levels did not jump, so the housing start data may just be a one-off catch-up.

American retail sales last week rose +3.6% at bricks & mortar stores on same-store basis, so those gains above inflation are holding and a good sign for holiday retailing. Early indications however are that online shopping is performing better than in-store this year.

Meanwhile, consumer inflation in Canada eased in November to be +3.1% higher than a year ago. A year ago it was running at well over double that. Still, that is stubbornly above their central bank’s inflation target. Canadian producer prices are still falling however, down -2.3%, so perhaps the Canadian CPI has more falls to go.

The Bank of Japan maintained its key short-term interest rate at -0.1% and that for 10-year bond yields at around 0% in a final meeting of the year and by unanimous vote. There are no surprises here and that was widely expected. The central bank also left unchanged a loose upper bound of 1.0% set for the long-term government bond yield. The yen fell -½% after the announcement, vs both the USD and the NZD.

Yesterday the release of the RBA minutes brought a fresh perspective to their ‘warning’ that rate rises may be needed if inflation doesn’t cool further there. However those warnings are being ignored in wholesale markets, who are pricing in rate cuts in late 2024, not rises. And that is because the RBA also has an employment mandate, so markets don’t believe its hawkish inflation-fighting talk.

We should also note that the Icelandic volcano near Grindavik has suddenly exploded. But this time there are no major ash emissions. Still, natural events like this (and the 2022 Tongan explosion) can have lingering global atmospheric implications.

Of more immediate concerns are the security issues for shipping in the Red Sea. An international military effort to keep the routes open is underway. Now giant Chinese shipping company COSCO is avoiding the area. Freight rates and the cost of many essential raw materials will likely rise because of all this.

The UST 10yr yield has slipped -4 bps today, now at 3.92%. The key 2-10 yield curve is marginally more inverted, now by -53 bps. And their 1-5 curve inversion is still inverted by -103 bps. And their 3 mth-10yr curve inversion is also marginally more inverted at -143 bps. The Australian 10 year bond yield is now at 4.09% and down -2 bps from yesterday. The China 10 year bond rate is up +1 bp at 2.65%. And the NZ Government 10 year bond rate little-changed from yesterday at 4.61%.

Wall Street is up +0.4% on the S&P500 in Tuesday trade. Overnight, European markets closed bookended by Frankfurt’ rise of +0.6%, and Paris’ rise of +0.1%. Yesterday, Tokyo rose a strong +1.4% in Tuesday trade, Hong Kong fell -0.8%, while Shanghai was essentially unchanged. The ASX200 ended its Tuesday session up +0.8% whereas the NZS50 managed a lesser but still goo +0.5% gain.

The price of gold will start today up +US$21 at just on US$2043/oz.

Oil prices are holding higher at just on US$74/bbl in the US although they had been lower in between. The international Brent price is now at US$79.50/bbl.

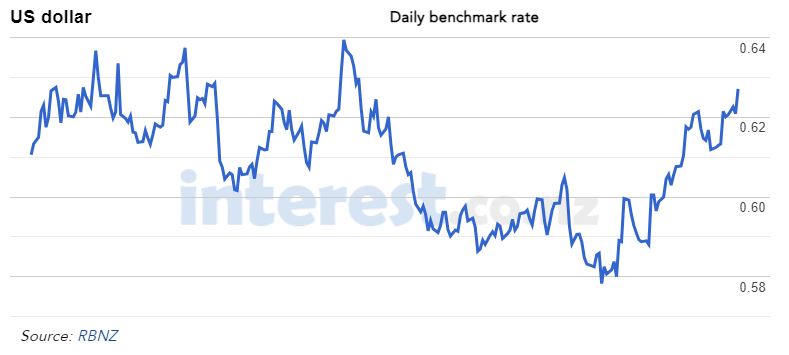

The Kiwi dollar starts today at 62.7 USc and up more than +½c from yesterday. Against the Aussie we are holding at 92.7 AUc. Against the euro we are up at 57.1 euro cents. That all means our TWI-5 starts today just on 70.8, up +40 bps from yesterday and back to more than a six month high.

The bitcoin price starts today at US$42,329 and up +2.1% from this time yesterday. Volatility over the past 24 hours has been moderate at +/- 2.5%.

Please note that we have the final of these Breakfast Briefings tomorrow (Thursday). Then we publish our content at a lesser intensity, more focused on holiday reads, reviews, and catch-ups. The advertising that powers much of our sustainability is already on holiday-mode, so this is when we really appreciate the vital support of readers. If you can support us during this commercially fragile time till the end of January, the team at interest.co.nz will be very appreciative.