The fourth generation dairy farmer in the county of Armagh, Northern Ireland produces 1.4 million liters of milk per year. The grain his cattle eat, when not eating grass or silage, is imported from Great Britain.

But those grain imports could become a nightmare for him under Boris Johnson’s new bill to unilaterally rewrite Brexit trade rules for the region. Farmers say the Prime Minister’s initiative threatens the dairy sector, which is worth £1.5 billion a year in Northern Ireland and part of the largest integrated industry on the island.

The bill provides for a dual regulatory regime, whereby goods entering the region can be produced to UK or EU standards. But if the rules diverge and the grain Haffey feeds his cattle is grown with pesticides not allowed in the EU, he could no longer send his milk to the Republic of Ireland for processing.

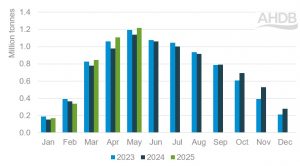

That would do more than just harass a farmer who was happy to vote for Brexit. The region doesn’t have enough factories to process all the milk it produces, meaning the 800 million liters a year produced by Northern Irish farmers processed south of the border – a third of the region’s production – had nowhere to go except Great Britain.

Milk from the north and south is also blended together so that butter, cheese, Baileys Irish Cream liqueur, baby food and other products are made with supplies from both jurisdictions.

Haffey objects to customs controls in the Irish Sea for British goods entering the region under the post-Brexit trade arrangements known as the Northern Ireland Protocol. “We are part of the UK so business should flow just as freely to Northern Ireland as it does to Wales,” he said. “I think pressure needs to be put on the EU.”

But even he isn’t calling for the protocol — which London says poses “danger” to social and political conditions in the region — should be scrapped altogether for one simple reason. As Alan Cleland, a farmer in County Down put it, “A lot of bits and pieces of protocol are problematic. But from our milk standpoint, it seems to be working.”

London’s bill to give ministers the power to tear up parts of the protocol is already undermining the industry’s image, said Gerry O’Reilly, a dairy farmer south of the border in County Cavan and a shareholder of Lakeland Dairies, a large processor.

Northern Irish milk, also from Haffey, keeps Lakeland stocked, especially at the end of the year when herds like his aren’t producing, he said. “In fact, damage has already been done,” O’Reilly said. “If you’re an international buyer, you’d say, ‘I want a steady supply for five to ten years, but you’ve got all this political nonsense’. It immediately weakens us.”

In order to preserve the Good Friday Agreement of 1998, which ended three decades of conflict, the protocol left the region within the EU’s internal market for goods and subject to EU rules and supervision, rather than customs controls on on a land border that is now largely invisible.

But union officials say the customs controls imposed in the Irish Sea are instead undermining the region’s status as part of the UK. The Democratic Unionist party has paralyzed local political institutions to push through its demands for the abolition of the border with the Irish Sea.

Dairy is Ireland’s flagship product. It is mental what is presented

Trading on its image of rolling pastures, dairy has become one of the most emblematic industries on all the islands in the quarter of a century since the Good Friday Agreement.

“Dairy is Ireland’s flagship product,” said Conor Mulvihill, director of Dairy Industry Ireland, a trade association. The industry is worth €13 billion to the Republic of Ireland and employs 85,000 people on both sides of the border. “It’s mental what is presented.”

Whiskey is another industry with north-south supply chains that has boomed since the Good Friday Agreement, from just twenty-four years ago to 42 distilleries. Malt and grains cross the border every day, as does newly distilled spirits to mature.

“It’s very important that we have one set of rules,” said William Lavelle, director of the Irish Whiskey Association. “If the protocol is in any way undermined or disapplied . † † it would just bring a whole new set of headaches.”

But other industries complain that the protocol creates costly bureaucracy, making it difficult for some products, such as sausages, to be sold in Northern Ireland.

This week’s bill aims to introduce a “green lane” without customs controls for goods from Britain residing in Northern Ireland and end scrutiny of the rules by the European Court of Justice.

Mike Johnston, head of the Dairy Council for Northern Ireland, welcomed London’s recognition that there is no “one size fits all” approach.

But he said the law could mean in the worst case scenario that “we should just stop buying grain” from Britain. The industry buys 400,000 tons a year, so “British grain farmers could lose . † † a lot depends on this.”

British officials were divided on the extent of the potential crisis. One said there were “misconceptions” and that industries selling to the bloc would go ahead with EU regulations.

There is clearly no solution. They are full. The dual regulatory regime can never work for the agricultural sector

But another said: “There is clearly no solution. They are full. The dual regulatory regime can never work for agri.”

Dairy farmers said the risks were very real. the UK in 2021 authorized the use of an insecticide banned by the EU though London says it was ultimately not used, and UK gene editing standards deviate from EU rules.

Charlie Weir, another farmer in County Armagh, regretted voting to leave the EU “because it was one lie after another” from London. “Why, if the protocol is so bad, is Northern Ireland the only region in the UK to grow in the first quarter?” he said.

“We could be left with higher costs and lower prices,” said another Armagh farmer who voted to stay in the EU and declined to be named because of the deep, lingering divisions in the region.

“The protocol is incredibly good for Northern Ireland – it’s just the best of both worlds,” he said.