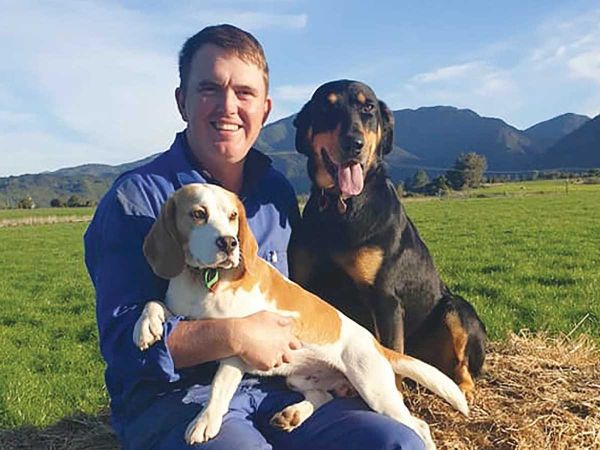

That’s the message from Federated Farmers vice president and Golden Bay dairy farmer Wayne Langford.

With the first Global Dairy Trade (GDT) auction of 2023 recording a drop in all seven products on offer, Langford says the milk price is facing significant pressure.

Add to this soaring interest rates, high input prices, a shortage of staff and a possible global recession, Langford says farmers are facing “challenging headwinds”.

“I’m an optimistic guy, however even I can see the pressures oming in 2023,” he told Rural News.

“Dairy farmers need to plan now, saving some cash in the bank to get through the challenging times coming at us. The potential for a significant lowering of the milk price and rise in interest rates is real,” Langford adds.

“Take time to enjoy your family and friends, enjoy the cows and green grass as there could be a few bumps in the road ahead.”

The first GDT auction of the year saw the flagship whole milk powder prices drop 1.4% to $3,208/metric tonne. One year ago, WP prices were over $4,000/MT.

Dairy companies believe China’s Covid policy has forced domestic production of WMP, which added to their inventory levels.

Open Country Dairy chief executive Steve Koekemoer says it will take some time to work through this over the coming months but expectations are that China’s increased participation at the last few auctions round means an increase in Chinese demand while NZ’s seasonal supply drops off.

“This should translate into some further strengthening in price,” he predicts.

Langford notes that there is significant pressure on the milk price from overseas markets.

Economies across the world are under huge strain and Covid is still having a large impact. At the same time consumers household budgets are being purposely limited to curb inflation.

Another worry for farmers is rising interest rates.

Langford points out interest rates have risen significantly and will continue to rise in 2023.

“With many farmers floating their rates, it will not be uncommon to see a 9% rate. This is $1.50-$2/kgMS more than only a short time ago for the average dairy farm,” he adds.

The labour market is still extremely tight, with many farms choosing lowering productivity because of not being able to find staff.

Langford says with the milk price coming back, farmers are still yet to see the main farm input prices coming back like fertiliser, feed and fuel.

Amid the gloomy forecast there is one silver lining – there is plenty of green grass around the country.