Mexico’s president said on Tuesday the country will respond to U.S. tariffs with a 25% tariff on U.S. goods, but she will hold off announcing the targeted products until Sunday.

President Donald Trump followed through on his threats of imposing a 25% tariff on most imports from Canada and Mexico, along with an additional 10% on goods from China. While China and Canada released their list of retaliatory tariffs the same day, Mexico’s president, Claudia Sheinbaum, says they won’t release their list until the weekend.

Sheinbaum said the country will also respond with a 25% tariff on U.S. goods but will announce the products it will target on Sunday.

But can Mexico afford to retaliate? That was one of the questions asked by USDA chief economist Seth Meyer during Commodity Classic this week. The reason is Mexico’s economy is struggling, due to a number of factors, which includes a large informal sector, high budget deficit and unstable infrastructure.

According to the Federal Reserve Bank of Dallas, Mexico’s GDP grew only 0.9% year over year in fourth quarter 2024, after expanding 2.% in 2023 and 4.6% in 2022. Economic growth slowed, mainly due to lower investment, slowing consumption and a contracting energy sector.

The Dallas Fed says lower investment and consumption was the main driver behind the slow growth.

“Investment contributed three percentage points less to GDP growth in 2024 compared with 2023,” the Federal Reserve Bank of Dallas said in a recent report. “The major drop was in nonresidential construction investment, while purchases of imported machinery and equipment also slowed noticeably as the Mexican peso continued to weaken against the dollar. In addition, consumption was impacted by sluggish growth in remittances, high interest rates and flat employment. However, net exports boosted growth in 2024 after dragging it down the previous two years.”

Extremely Reliant Upon Exports

The other issue? Mexico is extremely reliant upon demand from the U.S., exporting $41.9 billion worth of agricultural products to the U.S.

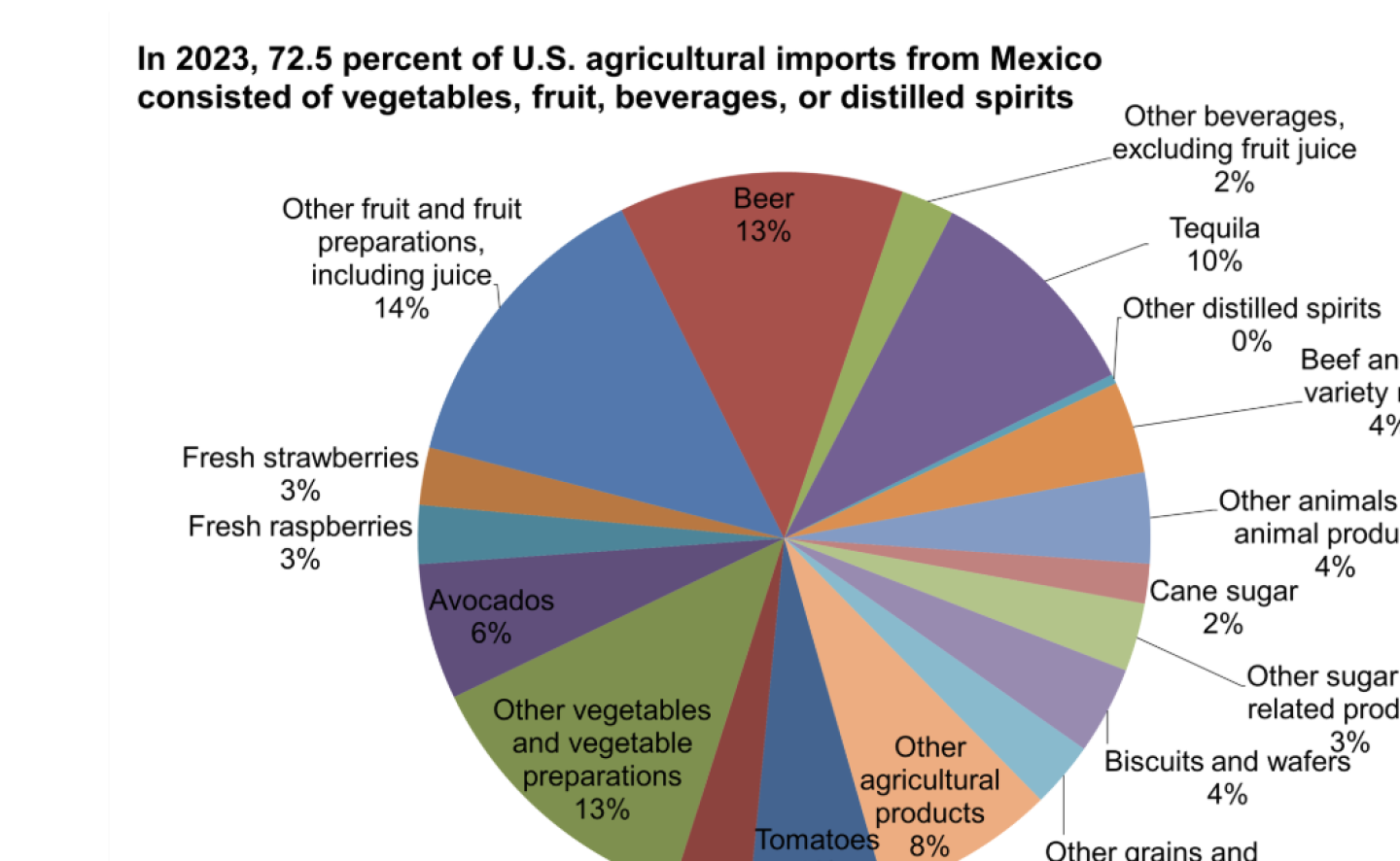

In 2023, Mexico accounted for 16.3% of U.S. agricultural exports and 23.3% of U.S. agricultural imports.

By the numbers:

- Mexico is the largest source of horticultural imports to the U.S., supplying 63% of vegetables and 47% of fruit and nuts in 2023.

- The top agricultural exports from Mexico to the U.S. in 2024 included beer, tomatoes, tequila, avocados, strawberries, raspberries and peppers.

Mexico is the Biggest Customer of U.S. Ag Exports

The other important piece is Mexico is now the U.S.’s top ag export destination.

According to Krista Swanson, chief economist for National Corn Growers Association (NCGA), Mexico is a huge destination for U.S. corn. More than 40% of U.S. corn exported last year went to Mexico. Not only does that mean the U.S. relies on Mexico, but Mexico is also reliant upon the U.S. do to the strong demand.

“That’s the other key piece here when we think about a Mexico situation, you know, will they retaliate on corn because it’s so important to the consumers in their country,” Swanson told Farm Journal during Commodity Classic this week. “And it’s such a big part of their diets and consumption. It’s a commodity that they consume way more of than what they produce. So they’re going to have to get it from somewhere.”

Bigger Picture

According to USDA’s Economic Research Service, between 1993 (the year before NAFTA’s implementation) and 2023, U.S. agricultural exports to Mexico expanded at a compound annual growth rate (CAGR) of 7%, while agricultural imports from Mexico grew at a rate of 9.7%.

“With the economic recovery in the United States and Mexico that followed the pandemic, U.S. agricultural exports to Mexico increased at a CAGR of 15.7% between 2020 and 2023, and U.S. agricultural imports from Mexico grew at a CAGR of 11.3%,” the USDA report said. “In 2023, however, U.S. agricultural exports to Mexico decreased by 0.3% compared with the previous year, as the prices of major agricultural exports (such as corn and soybeans) declined.”

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K