Agrivision: Automatic milking systems save labor but are expensive.

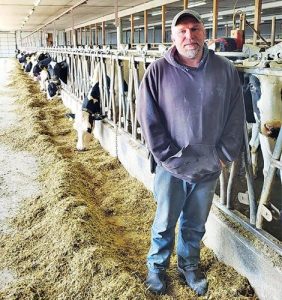

My son and I milk 150 cows in northeastern Wisconsin. He is 35 years old and I am 62. We have too much work for the two of us, but we have problems finding someone who can work six or seven hours a day, six days a week. We farm 275 acres and owe less than $50,000 on a tractor we bought in 2021. I’m wondering about robotic milkers. Our neighbor put two of them in, but I don’t know how much they cost or if they are a good idea or not. What are your thoughts?

Tom Kestell: Congratulations on your successful farm operation! It is always difficult to navigate the future when there are so many unknowns in dairy farming. You seem to be in a great financial position, but remember, with a large capital investment, the operation must be able to service the new debt.

In my experience, robots do not adapt very well to current facilities, so in most situations, new facilities are the best option. I would anticipate at least a $10,000-per-cow investment to realistically construct and equip a new robot dairy. So, if 180 cows are the goal, then expect an investment of at least $2 million. Talk to successful owners of robots to see what challenges and advantages they have found. Also be careful, because as you add bells and whistles, the price could quickly go to $3 million.

In my experience, the dairymen who enjoy and embrace the high-tech aspects of robotic milking are the most satisfied and most successful with them. The robots give back mountains of information that can be used to better manage and make profitable decisions for your herd. Again, I encourage you to do your homework — once, twice and then do the extra-credit work before making this huge management decision. But once you do make the decision, give it your all to make it a success.

Sam Miller: Fortunately, you are in a very strong financial position and can consider a large capital investment in a robotic milking system. Based on your question, this is a decision about trading capital for labor. Contact your local dairy supply company for an estimate of cost and how many units you would need. Also consider the changes required for management. With robotic milking systems, collecting, analyzing and acting on the data produced will provide you with the return on investment. You will achieve labor savings, but you must determine if the cost is worth the investment.

Some benefits of these systems include consistent milking, improved milk quality, higher milk production, early warning of herd health issues and, of course, lower milking labor. Drawbacks include the cost of buying and maintaining the system and parts availability, training cows on the system, and the learning curve to gather, manage and use the data. Work with a dairy business consultant or University of Wisconsin Extension agent to help you analyze the investment to guide you and your son on a decision.

Katie Wantoch: For many farmers, installing automatic milking systems may be simply an economic decision — purchase of the robot to minimize the cost and hiring of farm labor. However, this type of technology does come with its own challenges.

The change to AMS may be part of a generational transition plan if your son is onboard. Robot maintenance is key to keeping AMS running 24/7 and can be expensive. Will you or your son have the time and skill to repair the robots yourself? AMS collects lots of information on milk quality and cow health, which will help you better manage your herd. Are you or your son comfortable with reviewing the data on a computer and making changes or adjustments as needed?

Robotic milking may be a good choice, so I encourage you to consider your goals and management style before you invest in AMS.

Taking stock

My wife and I live in southwestern Wisconsin. We milk 110 cows, own 250 acres and rent 50 acres, and we owe $300,000 on our farm. We are in our mid-50s and have been farming for 30 years. We are treading water with low milk prices. We can pay our bills, but just barely. Our cows average 24,500 pounds of milk on twice-a-day milking. We grow all our feed. Our youngest son, who is 22 and still lives at home, helps us with chores on weekends and after work with the crops during the growing season.

We don’t take vacations, and we only go out to eat at a fast-food restaurant once or twice a month. Our pickup truck is 15 years old and our car is 11 years old. We’re wondering if we would be better off selling our cows, machinery and the farm, and looking for jobs in town. My wife points out that we have nothing saved for our retirement. None of our four children wants to farm, and they all have full-time jobs off the farm. We could try and hang on until milk prices are better, but who knows when that will be? We have some decisions to make. Please advise.

Tom Kestell: First, you must look at all your options. Sit back and evaluate where you are and where you want to go. The first thing is to realize you have made great progress over the last 30 years. Your assets are well in excess of $2 million. That means you have consistently increased your net worth $60,000 per year. Congratulations!

The next thing to address is where to go from here. Look at your options. Maybe selling the young stock and only milking cows is one of those options. You could breed your herd to Angus to increase the value of your young calves. This would aid in the purchase of fresh milking cows that can enter the herd and start making money immediately.

Selling your farm assets and getting jobs in town is also an option. Ask yourself: What do I like about farming? What do I not like about farming? How can I change my present situation to be more positive for myself and my wife?

On our farm brochures, we have written: “Attitude is everything!” The most important thing in life is to enjoy the journey. Not everything can be wine and roses, but appreciating and accepting your success can go a long way in putting a smile on your face and a glow in your heart. If you still find dairy farming unrewarding after making changes, don’t be afraid to make the ultimate change and move on to a lifestyle you maybe will enjoy more fully. Invest your life in things you enjoy, and your returns will be bountiful.

Sam Miller: Taking stock of your financial position is common at the beginning of a new year. To assist in your decision, gather some additional information. Start with a visit to your tax preparer and ask to understand the ordinary income or capital gains tax of selling your assets. Analyze them separately — the livestock, machinery and real estate. You may be able to sell the livestock and equipment, pay the tax, pay down your loans, and then rent out the farm to make the rest of the debt payments.

Next, explore options to get jobs off the farm. What type of job, benefits, retirement plans, etc., can you find? With this information in hand, have a conversation with your wife as to the best course of action. Maybe the answer is to continue the dairy. Maybe the answer is to sell all your assets and move to town and take new jobs, or maybe it’s something in between. After making a decision, get started on putting some funds away for retirement. Good luck with your decision.

Katie Wantoch: Unfortunately, you are not alone in your struggle to pay bills and have a positive cash flow on your dairy farm. Farming is a capital-intensive business, meaning you own many assets or capital that don’t always contribute to your sales and profits. As you adjust to lower commodity prices, many expenses will not adjust down. Thus, you may be experiencing squeezed profit margins in the past few years.

In the short term, you should review your costs to see if any can be reduced, such as changing feed sources, lowering rent, etc. You also want to make sure you are not decreasing your milk production. Your cows are producing at the state average, but you should consider opportunities to increase milk per cow, such as increased milk premiums or improved genetics through culling of low-producing cows and semen selection.

In the long run, you and your wife need to discuss your future for the farm business if there are no successors. Consult with trusted professionals to improve both your current and future farm business.

Agrivision panel: Tom Kestell, dairy farmer, Sheboygan County, Wis.; Sam Miller, retired managing director, group head of agricultural banking, BMO Harris Bank; and Katie Wantoch, statewide Extension farm management outreach specialist/professor of practice. If you have questions you would like the panel to answer, send them to: Wisconsin Agriculturist, P.O. Box 236, Brandon, WI 53919; or email fran.oleary@farmprogress.com.