However, recently, futures prices for Class III milk and cheese have risen significantly.

There is good news is this mix and that will be the major content of this post. Diary prices are really about cheese prices and cheese prices are influenced primarily by the wholesale inventory of cheddar cheese. (See these prior posts, October 13, 2019 and March 22, 2020, for detail on the relationship between the price of cheddar cheese and the Class III price.) Cheddar cheese inventories are not publicly available, so much of this post will rely on “American Cheese” inventories, which are primarily but not wholly made up of cheddar cheese.

The newly released data covers cheese inventories, cheese disappearance, and exports/imports through March 2020. April data will not be available for another month.

The COVID-19 program of USDA dairy purchases could be very impactful. It is briefly reviewed at the end of this post.

CHEESE INVENTORIES

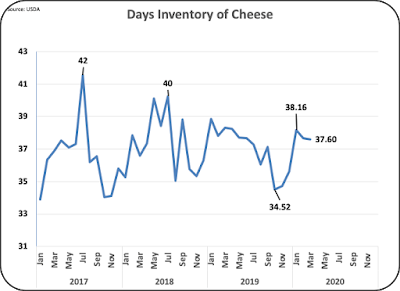

Chart I shows the newly released data on total cheese inventories. At the current inventory level of 37.6 days, overall cheese inventories are about average, not unusually high or low. That is a little surprising and is good news, because when milk is low priced and plentiful, typically the excess milk goes into cheese inventories and lowers cheese prices. To date, this is not happening. This is good news for future dairy prices.

|

| Chart I – Days Inventory of Total Cheese |

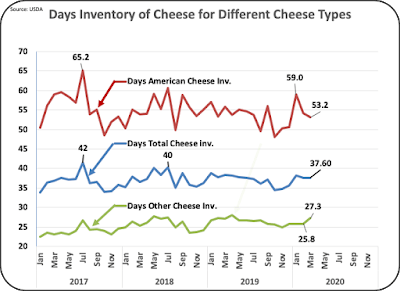

Chart II shows a more detailed picture of cheese cold storage inventories. The total cheese inventory levels from Chart I are repeated in blue Chart II, but the breakdown between “American Cheese” (primarily cheddar cheese) and “Other Cheese” are also displayed with “American Cheese” in red and “Other Cheeses” in green.

The first notable difference is that “American Cheese” is held in storage much longer than other cheeses. The good news for cheese and milk prices is that the days of inventory of “American Cheese” are decreasing while the inventory of “Other Cheese” is increasing. Lower inventories result in higher cheese and milk prices. Class III milk prices are based primarily on the cheese price and the cheese price used for this is the cheddar cheese price. In turn, cheddar cheese prices are influenced largely on cheddar cheese inventories which make up the bulk of “American Cheese.”

The recent drop in “American Cheese” inventory adds to the good news from Chart I. The inventory for “America Cheese” is more positive than for the total cheese inventory.

|

| Chart II – Day Inventory of Cheese by Type |

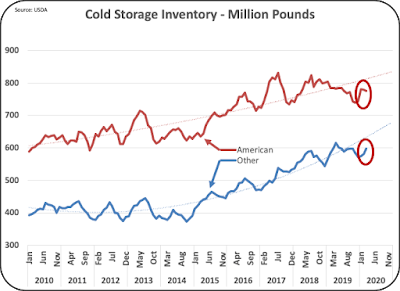

Chart III reinforces the current good news in cheese inventories with 20 years of data. “American Cheese” inventories are down, “Other Cheese” inventories are up in 2020.

|

| Chart III – Long-term Cheese Inventory Levels. |

The elements that influence cheese inventories are disappearance of cheese and production of new cheese. Domestic disappearance and export/import disappearance will be covered next.

CHEESE DISAPPEARANCE

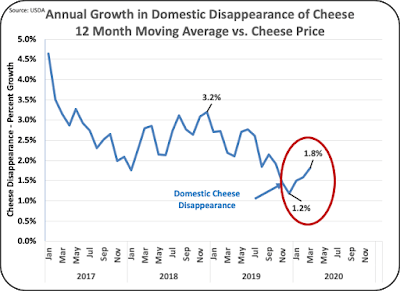

Chart IV shows the domestic disappearance of cheese from cold storage and Chart V shows the domestic disappearance compared to the wholesale price of cheese. Domestic disappearance in March was up to 1.8 percent from the 12-month average of the prior year. That is near the long-term growth in domestic cheese consumption.

|

| Chart IV – Growth of Domestic Disappearance of Cheese |

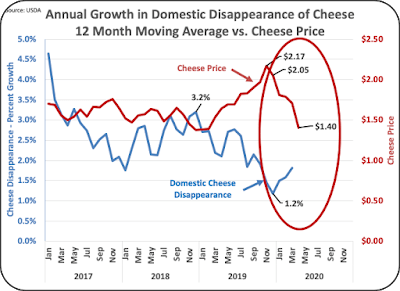

Chart V compares the growth in domestic cheese disappearance compared to the wholesale price of cheese. There is clearly price elasticity of demand. As the wholesale price of cheese rises, the purchase and disappearance of cold storage cheese is reduced. When the prices decrease, the purchases accelerate.

The current low prices of wholesale cheddar cheese are influencing accelerated purchases of wholesale cheese, helping to keep inventories low. The red line of wholesale cheddar cheese prices is shown through April while disappearance is available only through March. The April drop in cheddar cheese prices suggests that domestic disappearance will continue to grow in April.

|

| Chart V – Growth of Domestic Disappearance of Cheese Compared to the Wholesale price. |

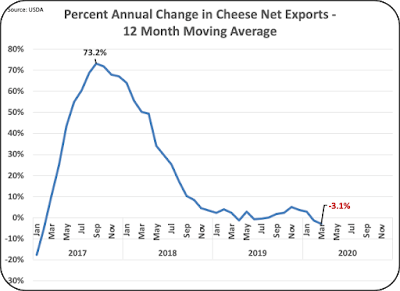

Net exports (exports minus imports) of cheese have not seen significant growth in the last year and a half. Chart VI is based on 12-month moving averages, which slow down and smooths the volatility. The most recent month of 12-month averages shows negative growth from the prior year. Net export disappearance of cheese from cold storage is not helping to reduce cheese inventories.

|

| Chart VI – Growth in Cheese Net Exports |

CHEESE PRODUCTION

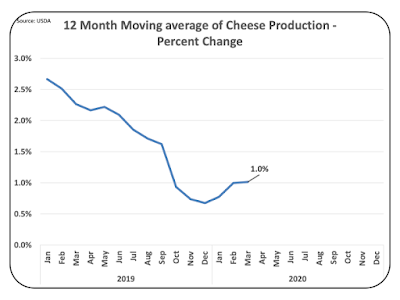

Cheese production slowed through 2019, helping to reduce cheese inventories. Since then, annual growth has increased from one-half percent to one percent based on 12-month averages.

|

| Chart VII – Annual Growth of Cheese Production |

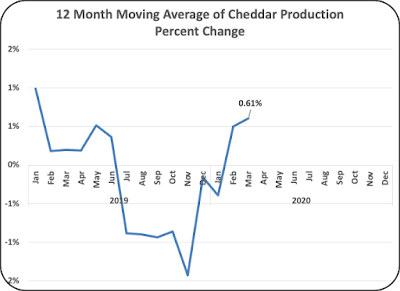

The production of cheddar cheese specifically is always a very volatile measure as shown in Chart VIII. Considering that Chart VIII is based on 12-month smoothed averages, the volatility is significant. The good news is that the production growth is near zero percent on the average. Cheddar cheese consumption is not a growth area.

|

| Chart VIII – Annual Growth of Cheddar Cheese Production |

USDA DAIRY PURCHASE PROGRAM

On May 8, 2020 the USDA issued the formal “COVID-19, U.S. Agriculture, and USDA’s Coronavirus Food Assistance Program (CFAP).” Included is funding for dairy products in the amount of $100 million per month for purchases of dairy products. For the full funded amount of the program to be utilized, that would allow purchases for 10 months. In addition to that, CFAP will buy $120 million of dairy products in the third quarter of 2020. Bids are being taken.

The current wholesale cheese price is $1.40/lb. If half of the $100 million per month was used for cheese, it would amount to increased disappearance of 35 million pounds of cheese per month. The reason for using half of the available funding for cheese purchases is based on the current milk usage for cheese which is about half of the total milk supply.

The March 30 inventory of cheese was 1373 million pounds. The purchase amount for cheese would reduce the inventory by 2.5 percent monthly or about one day of inventory per month. The additional program for $120 million purchases in the third quarter would further reduce the inventory by an additional 1 day of inventory.

Combined, the full extent of the program could reduce inventories by 11 days of supply. This potential impact has been noted by the futures milk market and has sent future prices skyrocketing,

SUMMARY

The data above paints a rosy picture for dairy demand and prices. The data for current cheese inventories is available only through the end of March 2020. The drop in food service purchases for restaurants will put pressure on cheese inventories in April. However, the low cheese price for April may keep disappearance robust and keep inventories in line. The month of May should bring new demand from the COVID-19 stimulus.

The COVID-19 purchase program discussed above is a very rich program of purchases. It will have a significant influence on producer milk pricing.

This provides optimism for the future of the dairy industry. As with everything about COVID-19, the future has uncertainties.