From a possible trade war to brewing discontent within the country, there are five significant trends poised to shape China in the coming year.

China was plagued with challenges in 2024. From economic headwinds and an erosion of trust to a deteriorating political environment, those struggles in 2024 aren’t expected to be resolved anytime soon.

James Palmer’s analysis in Foreign Policy’s China Brief described 2024 as a “relatively quiet if depressing year for China.” But Palmer pointed out 2025 could be a lot stormier, especially when it comes to clashes with the U.S.

Palmer outlined five significant trends shaping China in the coming year:

- A harsh trade war: With Donald Trump’s second term, his tariff-heavy policy could escalate economic tensions, intensifying China’s manufacturing struggles while leveraging its global supply chain strength.

- Brooding public discontent: Amid record youth unemployment and lingering effects of the pandemic, social disillusionment is growing. U.S.-imposed tariffs could become a scapegoat for economic grievances.

- Grassroots government crisis: Local governments face crippling debt and revenue shortfalls, leading to withheld wages and corruption. This financial strain could spark unpredictable public protests.

- Global opportunities: As the U.S. withdraws from international organizations under Trump, China positions itself as a stable global leader, particularly in U.N. forums.

- The PLA on a leash: Military reforms and anti-corruption drives are curbing the PLA’s capacity for adventurism, with a focus on resolving internal issues rather than engaging in conflict.

Bottom line:

Palmer’s insights underscore both the challenges and opportunities facing China in 2025, painting a complex picture of its domestic and international dynamics.

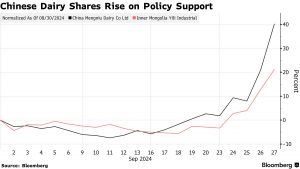

China’s Manufacturing Slowdown in December

China’s manufacturing sector shows slower expansion in December. China’s private Caixin manufacturing purchasing managers index (PMI) indicated continued expansion for the third consecutive month in December, standing at 50.5, down from 51.5 in November. The slower pace highlights the stabilizing effect of Beijing’s recent economic stimulus measures.

While supply and demand improved, the pace of growth in output and new orders decelerated, and export demand remained weak amid global uncertainties. Employment contracted for the fourth straight month, and business optimism waned due to concerns over economic recovery and U.S./China trade tensions.

Experts suggest policies should focus on boosting household income and supporting disadvantaged groups to enhance economic resilience.

Xi Jinping Acknowledges Economic Challenges in New Year’s Address

In a rare deviation from his usual celebratory tone, Chinese President Xi Jinping acknowledged the challenges facing China’s faltering economy during his New Year’s address. Speaking on state broadcaster CCTV, Xi noted uncertainties in the external environment and the difficulty of transitioning economic drivers but urged confidence, asserting, “These can be overcome through hard work.”

The acknowledgment comes as China grapples with a sluggish post-pandemic recovery, marred by a struggling real estate sector and deflationary pressures. Recent government efforts include increased public borrowing, spending, and interest rate cuts aimed at stimulating weak consumer demand.

Xi confirmed that China’s economy grew “about 5%” in 2024, meeting the government’s target, though analysts question the validity of the figures. The Rhodium Group estimated growth closer to 2.4–2.8%, citing the government’s aggressive economic measures as inconsistent with moderate growth claims. The group projects 3–4.5% growth for 2025, contingent on favorable conditions.

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K