Yili Group, China’s largest dairy company, has been aggressively expanding abroad and at home as economic growth boosts global demand for dairy products.

The company acquired a New Zealand producer in October, and recently opened a new factory in its home region. Sales and net profits for the January-September period were both record figures, and it is now the fifth-largest dairy company in the world.

Westland Milk Products, which is New Zealand’s second-largest dairy company and is wholly owned by Yili, announced in October that it had acquired butter and cheese producer Canary Foods, with an aim on expanding its product lineup.

Westland just opened a butter creamery in July. “Yili’s investment has helped us turn our performance across the entire company around and we’re now in a very strong position to capitalize on that,” said Westland CEO Richard Wyeth.

Yili has steadily expanded its foothold overseas since acquiring New Zealand dairy giant Oceania Dairy in 2013. In 2019, it acquired Westland for about 1.1 billion yuan ($156.59 million).

In December 2021, Yili started operation of a site for ice cream and other products in Indonesia. It is said to be the first production facility the company has built in Southeast Asia. In March, the company completed a deal to acquire an approximately 59% stake in Ausnutria Dairy, a Chinese company that has production and sales bases for infant formula and powdered milk in the Netherlands and China.

In July, Yili started operations at a milk and formula factory in Hohhot, Inner Mongolia, where the company is headquartered.

The company’s annual production capacity for 2021 was 14.13 million tonnes, an increase of about 8% from the previous year. The company plans to invest 14.8 billion yuan in facilities and equipment for the fiscal year ending in December, expanding factories and warehouses domestically as well as overseas.

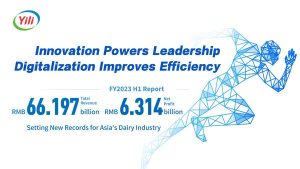

Sales for the January-September period of 2022 were 93.4 billion yuan, up 10% year-on-year. In addition to growth in overseas businesses, the company saw the successful domestic launches of multiple new products.

Net profit was 8 billion yuan, up 1.5%. The growth rate slowed compared with the previous three years when it increased by around 7% to 32%. Citywide lockdowns resulting from the Beijing’s zero-COVID policy to combat the coronavirus, and resulting sluggish demand for seasonal gifts such as premium infant formula, contributed to the drop in growth.

Currently, soaring feed prices are hurting the global dairy industry. Going forward, cost control is likely to be a key to increasing earnings.

Worldwide demand for dairy products is increasing along with economic growth. According to estimates by the Organization for Economic Cooperation and Development and others, global consumption of fresh dairy products is expected to grow by 22% from 2021 to 2030. Consumption of butter is expected to increase by 19% for the same period, and cheese 12%.

According to the China Commercial Industry Research Institute, sales of dairy products in China were 468.7 billion yuan in 2021, up 38% from 2018. Yili’s market share was 23%.

According to Dutch financial institution Rabobank, Yili ranks fifth in the world in sales among dairy manufacturers as of 2021. The top four spots are dominated by Western companies, comprising France’s Lactalis, Switzerland’s Nestle, Dairy Farmers of America, and France’s Danone in descending order.