As relations continue to deteriorate between Australia and China, an export industry worth $1.1 billion a year may be in jeopardy.

But Graham Forbes, president of the Dairy Connect farmers’ committee, told 7NEWS.com.au while the growing conflict in Canberra is concerning, the industry is pinning its hopes on China’s enduring love affair with Australian powdered gold; baby formula.

“Of course farmers are concerned about the situation but we’re trying not to jump to any conclusions,” he said.

“We have to establish whether (these threats) are fair dinkum or just speculation.”

Forbes said the industry was hoping China’s consistent enthusiasm for high-quality milk powder and ready-to-use baby formula will insulate dairy farmers from the growing war of words between Prime Minister Scott Morrison and the Chinese ambassador to Australia, Cheng Jingye.

On Tuesday, China announced a suspension of beef imports from four major Australian abattoirs in an escalation of trade tensions between the two nations.

While the temporary ban was attributed to “labelling issues” by the Australian Meat Industry Council, it came on top of a threat to lob an 80 per cent tariff on Australian barley, ostensibly over allegations of systematic dumping.

But the string of threats and actual suspensions are being viewed in some diplomatic and political circles as retribution for Morrison’s ongoing lobbying on the international stage for an independent inquiry into the origins of the COVID-19 pandemic.

“We’ve had no official confirmation of action against the industry yet,” Forbes told 7NEWS.

“But given the barley and beef, well, it has implications.

“We’re just hoping it all doesn’t run off the rails.”

Largest market

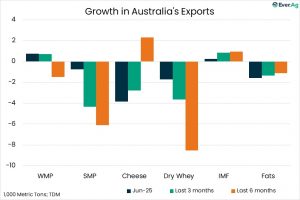

Australia exports more than 30 per cent of the dairy it produces, including cheese, butter and milk as well as milk powder and formula.

One third of all of it goes to China, our biggest trading partner.

The figures are strikingly similar to another export industry now perceived to be under threat because of the diplomatic stoush with China.

Tony Battaglene, the chief executive of the wine industry’s peak body, Australian Grape and Wine, said product to China made up more than one-third of its total exports, worth $1.1 billion a year.

“We’re always nervous when there is potential for disruptions, and the coronvirus has made the market even more nervous,” he said.

“But we’ve been trading with China for a long time, so I’m hoping we’ll stay in a reasonably good place.”

Battaglene said he was inclined to agree with recent comments made by past and present Labor figures, including Kevin Rudd, Gareth Evans and Joel Fitzgibbon.

‘We would prefer political and diplomatic issues remain behind closed doors.’

They have accused the Morrison government of jeopardising relations with our largest trading partner by engaging in “chest beating” and “sabre rattling” over the issue of an independent inquiry into the initial outbreak of COVID-19 in the Hubei province of central China, and an alleged cover-up by the Chinese government concealing the true extent of the outbreak in the early months.

“Business is business and politics should be kept out of it,” he said.

“The wine industry would prefer political and diplomatic issues remain behind closed doors.”

Chinese business management academic Professor Hans Hendrischke from the University of Sydney Business School said talk of trade sanctions between China and Australia based on political grievances were premature.

“China is careful to insist the current trade restrictions are linked to technical issues,” he said.

“This leaves the door open for a solution through government to government dialogue.”