High raw milk prices in China and elevated selling & distribution expenses are a potential drag on China Mengniu’s profitability.

China Mengniu trades at 24.2 times consensus forward FY2020 P/E representing a slight premium to its historical five-year average forward P/E of approximately 22 times.

Hong Kong-listed Chinese dairy company China Mengniu Dairy Co., Ltd. (OTCPK:CIADF) (OTCPK:CIADY) [2319:HK] is the second largest player in the China drinking milk products market with a 19.4% market share behind market leader Inner Mongolia Yili Industrial [600887:CH] which has a 21.7% market share, according to a Euromonitor research report published in September 2019.

China Mengniu trades at 24.2 times consensus forward FY2020 P/E representing a slight premium to its historical five-year average forward P/E of approximately 22 times. The stock also offers a consensus forward FY2020 dividend yield of 1.1%.

Please refer to my initiation article published on China Mengniu on March 2, 2018, and my prior update on the company published on September 23, 2019 for more details on China Mengniu. China Mengniu’s share price has increased by +6% from HK$29.95 as of September 20, 2019 to HK$31.65 as of December 19, 2019.

I maintain my “Neutral” rating on China Mengniu. I like the fact that the recent proposed acquisition Australian branded dairy and beverage company Lion-Dairy & Drinks is done at a reasonable low-teens P/E acquisition multiple and will help the company secure high quality raw milk and expand overseas. With China Mengniu’s share price up close to +30% year-to-date and currently trading at 24 times forward P/E, I think that there could be downside risks, if the company’s future profitability disappoints due to higher-than-expected raw milk price and elevated selling & distribution expenses.

Readers are advised to trade in China Mengniu shares listed on the Hong Kong Stock Exchange with the ticker 2319:HK where average daily trading value for the past three months exceeds $35 million and market capitalization is above $15 billion. Investors can invest in key Asian stock markets either using U.S. brokers with international coverage such as Interactive Brokers, Fidelity, Charles Schwab or local brokers operating in their respective domestic markets.

Second Acquisition In Australia

On November 24, 2019, China Mengniu announced that it was proposing to acquire 100% of the shares of Lion-Dairy & Drinks Pty Ltd, an Australia-based branded dairy and beverage company, for a consideration of AUD600 million or approximately HK$3.19 billion.

This is China Mengniu’s second acquisition in Australia in a span of less than three months. Earlier, the company had disclosed on September 15, 2019 that it was proposing to acquire a 100% stake in Bellamy’s Australia, Australian’s largest organic infant formula company, Limited, for a consideration of AUD1.46 billion or approximately HK$7.86 billion. The proposed acquisition of Bellamy’s Australia was approved by Australian regulators in mid-November, and expected to close before the end of the year.

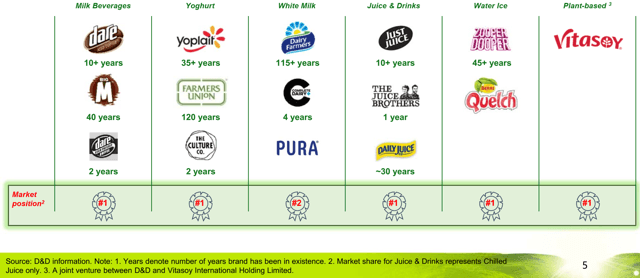

Lion-Dairy & Drinks is a producer and seller of branded dairy and beverage products such as milk based beverages, yogurt, white milk, chilled juice and drinks, ambient juice and drinks, water ice, culinary and plant-based products. The target company has 13 manufacturing facilities across Australia, and a cold chain distribution network serving over 35,000 customers across multiple distribution channels such as grocers, independent retailers and convenience stores. Lion-Dairy & Drinks also distributes its products outside its home market Australia, to foreign markets like Southeast Asia and China (mainly yogurt products).

Lion-Dairy & Drinks’ Brand Portfolio

Source: China Mengniu’s November 2019 Investor Presentation

The proposed acquisition price for Lion-Dairy & Drinks is more reasonable compared with the prior acquisition of Bellamy’s Australia. China Mengniu’s’s proposed acquisition price of AUD12.65 per share for Bellamy’s Australia represented a consensus forward P/E of 45.2 times.

The AUD600 million price tag for Lion-Dairy & Drinks is equivalent to approximately 13.2 times FY2018 P/E and 1.0 times P/B, based on the company’s FY2018 net profit of AUD45.3 million and net assets of AUD596 million as of August 30, 2019. In comparison, China Mengniu is valued by the market at 31 times trailing twelve months P/E and 4 times P/B based on its share price of HK$31.65 as of December 19, 2019.

Approximately 70% of the acquisition consideration is expected to funded by China Mengniu’s internally generated cash, with bank loans financing the remaining 30%. On a pro-forma basis, Lion-Dairy & Drinks will account for 10% and 8% of China Mengniu’s revenue and EBITDA respectively post-acquisition.

Lion-Dairy & Drinks’ FY2018 EBITDA margin was 6.6%, versus an EBITDA margin of 7.8% for China Mengniu Dairy in FY2018. But China Mengniu has plans in place to improve the operating efficiency of the Lion-Dairy & Drinks’ white milk segment (which is the main culprit dragging down Lion-Dairy & Drinks’ overall profitability) to increase the company’s future EBITDA margin, so that the acquisition of Lion-Dairy & Drinks does not dilute China Mengniu’s profitability.

China Mengniu expects to complete the acquisition of Lion-Dairy & Drinks in 1H2020, pending regulatory approvals from the Foreign Investment Review Board of Australia and the Australian Competition and Consumer Commission .

Access To High Quality Australian Raw Milk

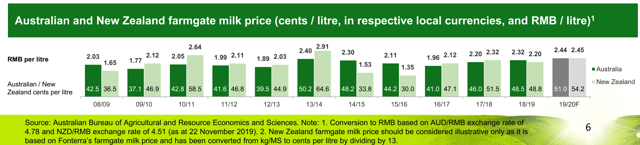

One of the most important strategic considerations for China Mengniu in acquiring Lion-Dairy & Drinks is the access to high quality Australian raw milk.

Australian is known for the quality of its milk, with approximately a third of its dairy production exported to overseas markets. Lion-Dairy & Drink procures approximately 825 million of milk equivalent liters from approximately 280 farmers every year. The prices of raw milk in Australia are at least 30% lower than raw milk prices in China, as per the charts below. In other words, China Mengniu secures a new source of high-quality, cost competitive raw milk with the acquisition of Lion-Dairy & Drinks.

Prices Of Raw Milk In Australia

Source: China Mengniu’s November 2019 Investor Presentation

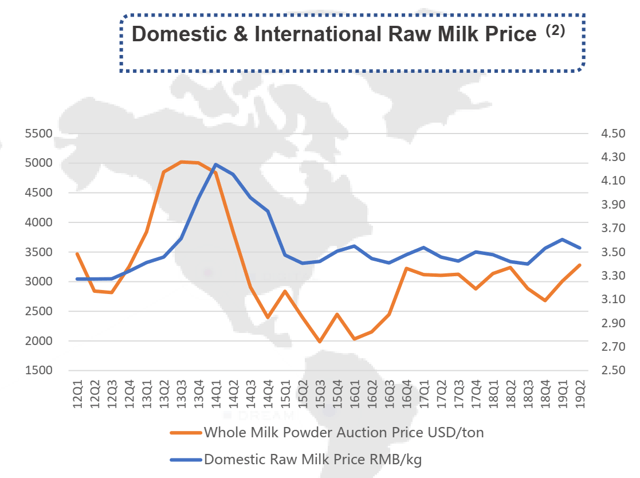

Prices Of Raw Milk In China

Source: China Modern Dairy’s (OTC:CMDKF) [1117:HK] 1H2019 Results Presentation

Having access to raw milk is a top priority for China Mengniu and other dairy companies in China. China Mengniu has a 58.2% stake in China Modern Dairy, the largest dairy farming operator and fresh raw milk producer in China, which operates 26 dairy farms with approximately 230,000 dairy cows in China. China Mengniu also has a 23.1% equity interest in China Shengnmu Organic Milk [1432:HK] which owns 34 dairy farms (including 11 organic farms) and 109,610 dairy cows (of which 47,054 produce organic milk) in China. China Mengniu’s competitor and peer, Inner Mongolia Yili, completed the acquisition of Westland Co-operative Dairy Company Limited, New Zealand’s second-largest dairy co-operative, for approximately NZD244 million to secure access to New Zealand raw milk in August 2019.

International Expansion Opportunities And RMB100 Billion Revenue Target

Another key strategic reason for China Mengniu’s acquisition of Lion-Dairy & Drinks is international expansion opportunities.

Lion-Dairy & Drinks has leading market positions in the yogurt markets in Southeast Asia and China with its Yoplait, Dairy Farmers and Farmers Union brands. Notably, Lion-Dairy & Drinks is the market leader in Singapore’s yogurt market with an overall market share of 35% and a 55% share of the premium yogurt segment in the country. The company is also among the top five players in Indonesia and the Philippines; while it is No.1 in the imported yogurt sub-segment in Malaysia and Thailand. Furthermore, China Mengniu can cross-sell its dairy products to Lion-Dairy & Drinks’ 35,000 customers in Australia.

China Mengniu generated over 90% of its revenue in FY2018 from Mainland China, and has ambitions to expand overseas in a significant way. The company has been expanding its sales network in Southeast Asia, and its first factory in Indonesia was established in November 2018. Furthermore, China Mengniu most recently acquired company, Bellamy’s Australia, also distributes its products to Southeast Asia with exports contributing approximately a quarter of its revenue. China’s largest dairy player, Inner Mongolia Yili, also has similar international expansion ambitions, particularly in Southeast Asia. In December 2018, Inner Mongolia Yili acquired a 96.46% stake in Chomthana Co Ltd, Thailand’s largest ice-cream maker.

More importantly, China Mengniu has set a target of achieving RMB100 billion in revenue by 2020, which can only be accomplished via international expansion and acquisitions. In contrast, market consensus is expecting China Mengniu to record a revenue of approximately RMB83 billion for FY2020. China Mengniu delivered revenue of RMB39.9 billion in 1H2019, and Euromonitor expects retail sales for China drinking milk products market to grow by a decent albeit unexciting 4% CAGR from RMB259.4 billion in 2019 to RMB307.9 billion in 2024. A RMB100 billion sales target for 2020 implies a +20% YoY revenue growth for FY2020, which is impossible to be achieved via organic growth and domestic sales.

The proposed acquisition of Lion-Dairy & Drinks will help China Mengniu to move closer to its RMB100 billion revenue target, as Lion-Dairy & Drinks accounts for 10% China Mengniu’s revenue post-acquisition on a pro-forma basis.

Rising Raw Milk Prices And Elevated Selling & Distribution Expenses Are A Drag On Profitability

Putting the proposed acquisition aside, rising raw milk prices and elevated selling & distribution expenses could pose downside risks to China Mengniu’s future profitability in the near term.

China Modern Dairy, which is 58.2% owned by China Mengniu, typically allocates 80% of its annual raw production to China Mengniu. China Modern Dairy’s average selling price or ASP of raw milk increased by +3.2% from RMB3.73 per kg to RMB3.85 per kg over the same period. Going forward, China Modern Dairy is guiding for a +4% YoY increase in raw milk ASP for this year and next year.

In the near-term, there is further upward pressure on raw milk cost for China Mengniu due to two key factors. Firstly, the typical inventory stock-up of dairy products in 4Q2019 ahead of Chinese New Year in January 2020 should push up raw milk prices. Secondly, China Mengniu has been increasing the proportion of organic milk in its overall sales mix, and organic raw milk is typically 10%-15% more expensive than normal raw milk.

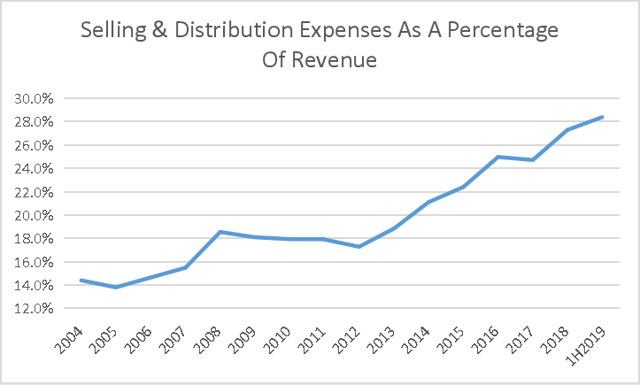

The second factor which could potentially impact China Mengniu’s profit margins is elevated selling & distribution expenses. Selling & distribution expenses as a percentage of revenue have been increasing over the years, due to both competition and the need to promote new products. With the Tokyo Olympics in 2020, selling & distribution expenses, particularly in the area of advertising & promotions, should remain high.

China Mengniu’s Selling & Distribution Expenses As A Percentage Of Total Revenue

Source: Author

Valuation

China Mengniu trades at 24.2 times consensus forward FY2020 P/E and 20.4 times consensus forward FY2021 P/E based on its share price of HK$31.65 as of December 19, 2019. The stock’s forward FY2020 P/E represents a slight premium to its historical five-year average forward P/E of approximately 22 times.

China Mengniu offers consensus forward FY2020 and FY2021 dividend yields of 1.1% and 1.3% respectively.

Variant View

The key risk factors for China Mengniu include a failure to obtain regulatory approval for recent acquisitions, actual synergies from recent acquisitions turning out to be lower than expected, stiffer-than-expected competition in the Chinese dairy market, and higher-than-expected raw milk prices depressing profit margins.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.