The coronavirus outbreak has spurred a new demand in China for protein milk powder from Australia and New Zealand, but experts are concerned there is new danger in its use as a supplement for infants.

Chinese demand for lactoferrin and whey products has increased dramatically since the outbreak began, with consumers hoping the immunity boosting qualities can help both adults and children fight off the deadly virus.

Exploding demand and the claims of the “powers” of lactoferrin and whey protein on social media led to a fact-check by news agency Reuters in late March, which showed there was no evidence the products can prevent coronavirus infections.

Exports of Australian whey protein milk powder to China tripled in March from February to more than 1,000 tonnes, according to data from the Australian Bureau of Statistics collected by industry group Dairy Australia. The export volume remained high in April, with more than 700 tonnes shipped.

How Feihe survived the 2008 tainted milk scandal and became China's largest baby formula company

Before the coronavirus outbreak, Chinese imports of whey protein generally stood at around 200 tonnes to 400 tonnes a month. A breakdown of lactoferrin milk powder exports is not available.

China customs data also showed a 25 per cent growth in annual protein powder exports from Australia between 2018 and 2019.

In New Zealand, export volumes are expected to grow by 40 per cent this year to 7 million cans from 5 million cans last year, according to China infant formula market consultant Jane Li.

One New Zealand milk powder manufacturer told Li in February that it had received three times as many orders in the first two months of the year than it did for the whole of 2019.

The booming trade is lucrative, with more than 100 brands in China partnering with Australian and New Zealand manufacturers to produce batches of whey protein and lactoferrin products primarily for the Chinese market, Li said.

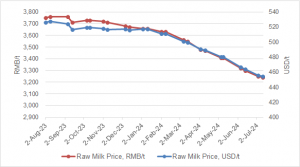

A 60 gram tub of lactoferrin powder costs just under 30 yuan (US$4.20) to make and send to China, but are being sold for between 400 yuan (US$56.40) to 600 yuan (US$84.70), representing a mark-up of over 1,500 per cent, she said.

Last year, Australian-listed Beston Global Food Company upgraded its dairy protein processing plant in South Australia, saying the “dairy protein market is one of the most valuable markets in the dairy industry” and high-grade lactoferrin products were selling at eight to 10 times more than 2015 prices.

The boom has been fuelled by general consumers, but also new mothers who, swayed by retailers, buy up cans of whey protein and lactoferrin powder mostly on e-commerce platforms such as JD.com, Taobao and Tmall to use as a supplement to their babies’ daily consumption of standard infant formula.

To be clear: you shouldn’t take a scoop of whey protein you bought online or at a supplement store, mix it in liquid, and feed it to an infant

Whey Protein Institute

This situation is potentially risky as the stand-alone powder products, while widely researched as having health benefits, have not been properly produced or tested to infant food standards, which are stricter than general food standards, Li added.

Lactoferrin added commercially to infant formula brands during the manufacturing process, though, has been properly tested to the higher standards for consumption by babies and infants.

The US-based Whey Protein Institute advises consumers, “to be clear: you shouldn’t take a scoop of whey protein you bought online or at a supplement store, mix it in liquid, and feed it to an infant” because of possible protein toxicity.

While there are some questions around the use of the product for babies, both the Australian Department of Agriculture, Water and the Environment, and the New Zealand Ministry for Primary Industries say their infant formulas and stand-alone lactoferrin milk powders aimed at adults are manufactured to strict food standards and that there have been no contraventions of local laws or Chinese import rules.

It’s all about the sales. The people selling don’t know the implications of their actions

Dr George Marano

Ministry for Primary Industries deputy director general, Bryan Wilson, added that products could still be further processed and labelled on arrival in China.

“In China, when a product is on-trend [like lactoferrin] … the store owner can be quite mischievous and put adult proteins in mum and baby stores, and by sheer osmosis, they think it must be good for children,” said Australia-based China dairy trade researcher and expert, Dr George Marano.

“It’s all about the sales. The people selling don’t know the implications of their actions. They have a simple arithmetic where infant formula is made up of dairy, and since protein is part of dairy, it could therefore be given to children with no understanding that adult protein could be digested differently in babies.”

Many manufacturers in Australia and New Zealand leave it to their retail partners to drive sales, including how they market the products, added China infant formula market consultant Li.

“The trend of these dairy based supplements being marketed to infants started a few years ago, but the marketing really took off in the wake of Covid-19 … most of these products are imported through legal channels, which is why they are able to be pushed through mum and baby stores,” Li said.

“These contract manufacturers are taking advantage of a regulation loophole that allows them to classify and export these products as regular milk powder or formulated milk powder or beverage drink intended for general consumption. It is a very deliberate way of avoiding strict testing and labelling requirements for infant foods.”

Marano suggested China’s Certification and Accreditation Administration could force retailers and manufacturers to agree on marketing or issue a warning on the use of lactoferrin and whey protein as several advertising inconsistencies already exist.

Labels on cans of Homart’s Autili lactoferrin with probiotics marketed on its Australian website say it should not be consumed by infants under one year old, but online retailers advertising the product claim it as being suitable for children under three. Homart did not respond to a request for comment.

Retailers selling IBC and Sunplus products on JD.com promoted the use of lactoferrin powder as a supplement for newborns. When contacted about the safety of the products when consumed by children, several retailers said they were “absolutely” safe, while also repeatedly saying that it was “not infant milk formula”.

Neurio-maker Jatenergy, which posted record monthly revenues in February and March due to a surge in lactoferrin sales, said Chinese authorities did not limit the ages of people who can consume lactoferrin if they are processed in infant milk formula.

Other stand-alone formulated milk powder with lactoferrin was deemed suitable for “general consumers”, said Jatenergy chief executive Wilton Yao.

Regulators in Australia and New Zealand take food safety very seriously, but sometimes they fail to appreciate the speed at which the China market evolves

Jane Li

In 2008, six babies died and 300,000 were poisoned in China after drinking toxic milk powder.

And while there has not yet been any serious widespread problems, last month in Hunan province in southern China, local authorities cracked down on a new protein-based milk powder drink, Bei An Min, which was being sold in stores, hospitals and pharmacies, as it was found to contain harmful chemicals.

China infant formula market consultant Li said that the Hunan incident was an example of how manufacturers and retailers could hide behind the defence “that the products were safe and legal in New Zealand and Australia”.

“Regulators in Australia and New Zealand take food safety very seriously, but sometimes they fail to appreciate the speed at which the China market evolves,” she said.