The raw milk sector is now in a cyclical period of oversupply and prices, which have been falling since the middle of last year, are expected to decline further in 2023, Song Liang, an independent dairy industry analyst, told Yicai Global. Things will only get better once demand improves, he added.

“The situation is bleak,” a person working at a large farm in northern Hebei province, which is near Beijing, told Yicai Global. The market continues to cool, even in the run up to the week-long Lunar New Year holiday at the end of the month when many dairy product makers usually stock up on their milk supplies.

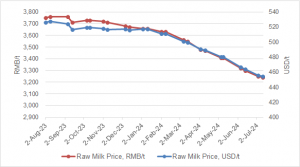

The price of unpasteurized milk in 10 major milk-producing regions, including the Inner Mongolia Autonomous Region, dropped 4.2 percent in the last week of December from the same period a year ago to CNY4.12 (USD0.59) per kilogram, according to the Ministry of Agriculture and Rural Affairs.

The price was between CNY4.20 and CNY4.30 per kg at large farms in the middle of last year, but this dropped to between CNY3.90 and CNY4 per kg by the end of the year, Yicai Global learned. In fact, prices in northwestern Ningxia Hui Autonomous Region have fallen to CNY3.80 per kg.

If that was not bad enough, the price of animal feed, such as soybean meal, corn and alfalfa, has gone up considerably in the past year, eating away at the profit margins of milk producers. Fodder accounts for about 70 percent of milk production costs.

Fresh milk prices should average at least CNY4.30 per kg to ensure a basic profit margin of 8 percent for producers, Li Shengli, chief scientist at the National Dairy Industry and Technology System, said previously.

Yet producers of cheese, yoghurt and other dairy products are unable to increase their milk orders, the person at the Hebei farm said. A big farm can get through the hard times, but smaller operations need to sell their cows, raise cattle for beef or even close down to make ends meet.

And the situation is so dire that some customers have chosen not to renew their purchase contracts for 2023.

Vicious Cycle

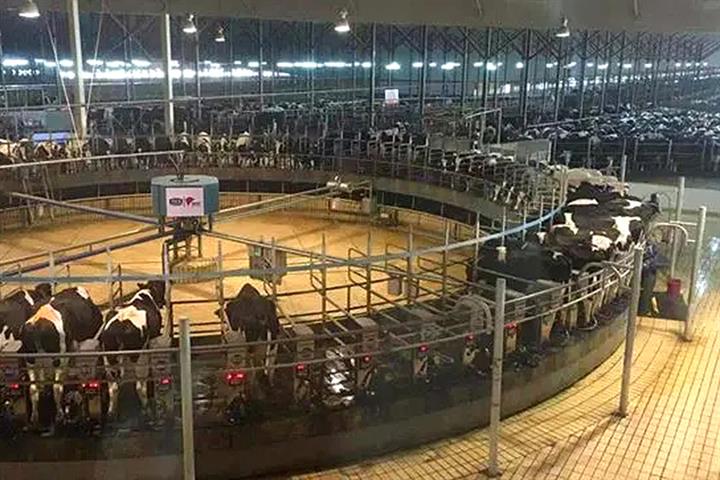

The current imbalance between supply and demand also has to do with the size of dairy herds increasing too much in the past three years, said Song Huiting, chairperson of Jiangsu Jiahui Biotechnology. Estimates have it that the number of dairy cows jumped 37 percent last year from 2019 to 6.3 million.

The unpasteurized milk market has fallen into a vicious cycle of ‘milk shortage – price markup – cattle breeding – oversupply – cattle culling – milk shortage,’ Song Liang said. It needs to explore conglomeration and linking upstream-downstream capacity to solve the problem.

If the market does not bounce back during the Spring Festival holiday, the raw milk sector will be under even greater pressure, several insiders told Yicai Global.

Editors: Tang Shihua, Kim Taylor