Driven by climate-related disruptions, America’s largest banks face financial risks of up to $9.3B from their investment in livestock agriculture.

By lending money to some of the world’s biggest meat and dairy companies, US banks aren’t just hurting the planet, but also their bottom lines.

Since 2023, 58 American banks have provided at least $134B in loans and underwriting to animal protein and feed producers, and 55% of this sum ($74B) has come from just three institutions. Bank of America, Citigroup, and JPMorgan Chase are the largest US-based lenders for livestock farming, but the climate crisis they’re exacerbating is putting their money at risk.

Nearly 90% of the outstanding financing provided by these ‘Big Three’ banks faces climate-related risks, while the 31 companies that benefit from this capital – including Nestlé, JBS, Tyson Foods, Fonterra, and Danone – themselves stand to lose up to $5.4T, according to a new report by Dutch research group Profundo.

It analysed financial data from 2016 to 2023 and used climate scenario modelling to calculate both near-term and long-term risks to both the banks and their beneficiaries, considering factors like deforestation impacts, greenhouse gas emissions, water scarcity, and supply chain risks due to weather volatility.

“The analysis and the numbers are a wake-up call: continued investment in this unsustainable industry creates very high externalized climate damage costs as well as potential high cash costs,” said Gerard Rijk, senior equity analyst at Profundo and a lead researcher for the study. “These hurt the planet as well as the portfolios of banks and asset managers.”

Big Three face up to $9.3B in long-term losses

The report suggests that in the near term (to 2030), the 31 corporations analysed could face $116B in losses, representing 44% of their gross debt. For the Big Three banks – whose outstanding financial exposure here is valued at $10.4B – this translates to a risk in the range of $430M to $1.1B.

In the long term, the numbers really rack up. The meat, dairy and feed producers face a risk in the range of $536B to $5.4T by 2050. These potential losses comprise 58% of their enterprise value at the lower end, and 581% at the higher end.

There are more factors that influence the long-term risks – in addition to higher feed costs and volume changes, livestock farming companies could also face carbon taxes, higher interest rates, declining consumer demand, and reputation loss.

Bank of America, Citigroup, and JPMorgan Chase, meanwhile, are confronted with financial risks between $2.3B and $9.3B in the long term. But by ending financing as soon as loans are redeemed, the Big Three can reduce these risks by 83-95%.

“Financial institutions must act swiftly to mitigate these risks by shifting capital toward more sustainable food systems,” said Kelly McNamara, senior research and policy analyst at climate non-profit Friends of the Earth US, which supported the report.

“The tools to redirect investments toward environmentally sustainable practices that benefit consumers, the climate and the global economy are already within our reach. The real question is: do major financial institutions have the will to use them?” she added.

How banks can halt climate risks and emissions

The study notes that Bank of America, Citigroup and JPMorgan Chase have joined the Net Zero Banking Alliance (NZBA) and committed to aligning their financed emissions with net-zero pathways. But while agriculture is among the high-emitting sectors for which NZBA signatories are required to set 2050 net-zero targets, no bank has taken this step.

“The data is clear: climate risk is financial risk. By significantly curtailing or ending financing to a small number of high-emitting companies in the agricultural sector, the Big Three and any other lenders or investors in the sector can limit exposure to climate-related losses and make significant progress on their net-zero commitments,” the report reads.

The Big Three’s lending to these companies represents just 0.25% of their total outstanding loans, but roughly 11% of their reported financed emissions – so taking action on a tiny portion of their portfolios will have an outside impact on their path to net zero.

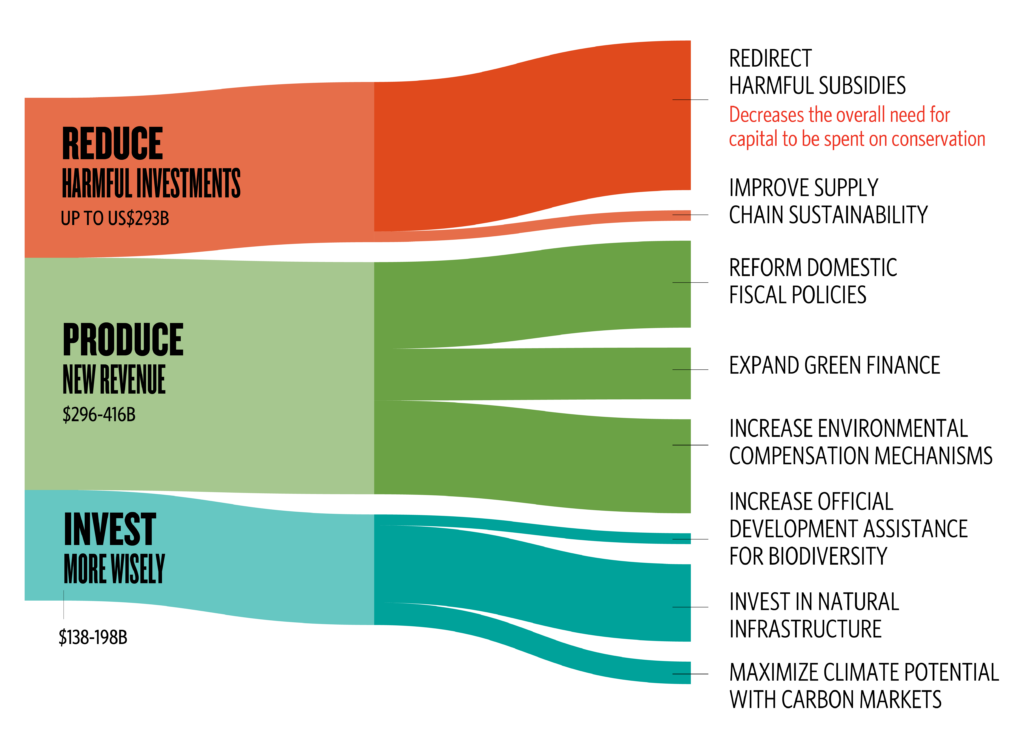

The report recommends these banks curtail and ultimately end financing that enables the expansion of livestock farming. To do so, they need to stop issuing new corporate or project-based financing or revolving credit facilities to meat, dairy or feed producers, and not renew existing loans or facilities either. The banks should also refrain from underwriting bonds or IPOs and halt new investments in their publicly traded securities.

According to Profundo, banks should require clients to disclose 100% of their emissions across scopes 1, 2 and 3, set near- and long-term absolute reduction targets, and prioritise methane cuts with a pledge to decrease emissions by at least 30% by 2030 (from 2020 levels). These companies should also lower emissions by reducing the number of animals in their supply chains, and without relying on carbon credits or offsets.

Bank of America, Citigroup and JPMorgan Chase were also among the banks that left the Equator Principles, a set of minimum standards and safeguards to identify and manage the potential ESG impacts of financing high-polluting projects, after political pressure last year.

That said, in November, JPMorgan Chase’s head of nature and biodiversity, Gwen Yu, highlighted the importance of filing the $700B nature funding gap: “We’ve seen a significant increase in client demand for products that incorporate nature, so we’re excited to be part of these global dialogues and share our expertise on how banks can help facilitate capital towards nature-related projects.”

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K