UW-Madison dairy experts Bob Cropp and Mark Stephenson found glimmers of good news among the impacts on production and dairy stocks during their June “Dairy Situation and Outlook” podcast this week, including rising cheese, butter and milk prices.

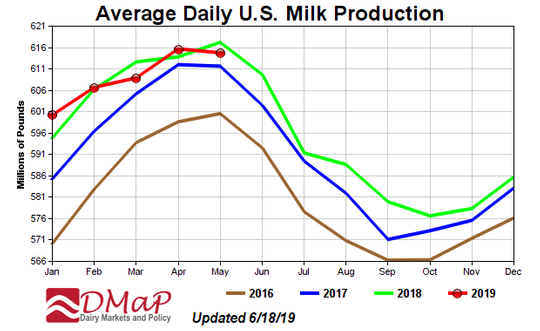

Cow numbers in May were 9.333 million head, down 89,000 since January or 0.9% lower than a year ago. The continued exiting of dairy producers and the slaughter of cows running 5.0% higher than a year ago is reducing the size of the dairy herd. Milk per cow was also well below trend being up just 0.6%. Of the 24 reporting states 14 had fewer cows and 11 had lower total milk production.

Lower milk production levels have resulted in better milk prices forecasted for this fall. (Photo: Courtesy UW Madison)

“While cow numbers went up around 5000 head due to some large herd expansions in Texas and Colorado, the nation’s farmers are milking 1 percent fewer cows than they were a year ago and production per cow is below trend at around 0.6 percent,” Cropp said. “With less milk, we’re forecasting better milk prices down the road.”

Less milk on the market is also impacting butter and cheese stocks, according to the May Cold Storage Report. Compared to a year earlier April butter production was 4.8% lower, American cheese production 2.8% lower with cheddar 3.3% lower, total cheese production just 0.2% higher, nonfat dry milk production 2.6% lower and dry whey production 13.7% lower.

“When you look at dairy product production, we’re producing 4.8 percent less butter and less American cheese, so there’s less milk and decreased production which help improve stocks,” Cropp said, adding that the cheese market is on the rebound. “As of last Friday, barrels were $1.72 per pound and blocks almost $1.83.”

Cheese demand remained somewhat modest said Stephenson, adding that “I’m not hearing any panicking from buyers yet. But you know they’re keeping a close eye on this (tightening market).”

Cropp said that butter remained around $2.39 per pound with powder and whey increasing to $1.05 and $0.34 respectively.

While butter and cheese sales continue to show moderate growth, Cropp says fluid milk sales continue the downward trend with April sales 3.1% lower than a year ago and year-to-date sales 2.5% lower.

The Class III price which was as low as $13.89 in February will improve about $2.40 in June to around $16.30. The Class IV price which was as low as $15.48 in January will improve about $1.30 to around $16.80 in June.

“Milk prices according to the futures market are also recovering, starting in July at $17/cwt for the rest of the year, which is as it should be with things tightening up,” Cropp said. “We started below $14 in January and February and prices have come up a lot since then. I hope we see some prices above $18 as farmers need it.”

Fewer dairy products on the market have been felt in the export market. However, overall exports for the first four months of the year were the third highest in volume with 2018 being the highest and 2014 the second highest.

“The point is, we’re producing a lot less milk so we don’t need as high of exports to support milk prices…because domestic demand can absorb a greater share,” Cropp said.

Exports to China in April were 64 percent lower than a year ago, with Cropp pointing to retaliatory tariffs and the impact African swine fever has had on the country.

While April cheese exports were one percent lower than a year ago, Cropp says year-to-date exports are 7% higher. April exports were down 25% for nonfat dry milk/skim milk power, 71% for butterfat and 31% for total whey products. Yet on a total solids basis exports were equivalent to 14.4% of milk production.

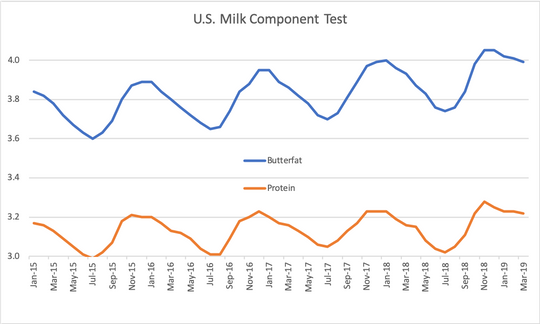

Stephenson pointed out that the strength of milk components has largely flown under the radar.

“Our milk production is actually down below year earlier levels, but one the the things we forget is that our milk components like butterfat and protein have actually been up,” he said. “For example, if you look at yield in a cheese vat, that milk production on the basis of components is not actually down.”

While milk production is down below year earlier levels, milk components such as butterfat and protein have increased. (Photo: Courtesy UW Madison)

Stephenson who recently attended the International Farm Comparison Network Dairy Conference is Germany, met with other experts from research institutions and dairy boards and associations from 45 countries to discuss latest analysis results and exchange international perspectives.

“Countries (liked the EU and New Zealand) are off to a better start on their season, but milk production is not really strong in most places,” Stephenson said. “Stocks have been pulled down quite a bit, but some countries are actually feeling pretty good about their milk prices, finding them ‘reasonable'”.

Stephenson cited a report from Rabobank that forecast a season of strong milk pricing that could reach $7.15/kg payout price for New Zealand milk solids.

“That’s roughly equivalent to a $18/cwt. milk price here,” Stephenson said. “I think that is possible this year (in the U.S.) and we look forward to that.”

Milk prices should improve further as the year progresses. Cropp said the USDA now forecasts milk production for the year to be just 0.3% higher than 2018, the result of cow numbers averaging 0.7% lower and milk per cow 1.0% higher.

“As of now we could see the Class III price in the low $17’s by August and in the mid to high $17’s by fourth quarter. Some are predicting Class III even in the $18’s. Class IV could be in the low $17’s by July and in the mid $17’s fourth quarter,” Cropp said. “If this holds true, Class III would average about $16.30 for the year compared to $14.61 in 2018 and the Class IV price would average about $17.00 compared to $15.09 in 2018.”

Stephenson believes that forage harvesting and planting challenges in the U.S. may factor into future milk production this fall. Cropp agrees, particularly in the Upper Midwest and Northeast where farmers have contended with an abnormally wet and cold planting season this year.

“Hay stocks are low to start with and there’s been some real challenges in trying to harvest good, quality first crop hay (due to the weather and winterkill),” he said. “Lower quality forages will have an impact on production for cows.”

Delayed corn planting and unplanted acres means higher corn prices. Futures markets are also pushing the price of corn up, with the latest price standing at $4.50 per bushel.

“So farmers are also looking at higher feed costs as well,” said Cropp, adding that tighter feed supplies, lower quality forages along with higher feed prices will likely continue to reduce cow numbers and dampen milk per cow this fall and winter. “We’ll have to see how those second, third and fourth crops of hay and corn silage harvest play out.”