Challenging times

Inflation has hit all food sectors hard. According to the ONS, food and non-alcoholic beverage prices rose by 14.6% in the 12 months to September 2022. This presents consumers with a challenge to look at some of their purchasing decisions to save money. Dairy products have long been seen as a staple item and used as a loss-leader to tempt shoppers into supermarkets meaning the price of milk has historically been at artificially low levels, with prices barely moving at all. The average price of a litre of own label cow’s milk was £0.54 in the 12 weeks to 7 Oct 2018 and £0.55 on 12 weeks to 2 Oct 2021 according to Kantar. Milk has been cast as a low-margin, high volume heavily commoditised category.

Cow’s milk remains a favourite in Britain’s households and alternatives are very different markets. Looking back over 12 weeks (to 4 Sept 2022) 95% households bought cow’s milk. This compares to only 13% households buying a private label alternative and 22% buying ANY alternative. Indeed, alternatives only make up less than 6% of volume of the total milk plus alternative market.

Also, cow’s milk is one of the cheapest ways to ensure good nutrition, as a naturally good source of protein, calcium, iodine and vitamin B12. During a cost-of-living crisis it makes sense that consumers would look for the most “bang for their buck” and cow’s milk is unrivalled. At 23% cheaper than the alternatives (Kantar 12we 2 Oct 2021,) it is likely that consumers, excepting those with food allergies or specific dietary requirements, will continue to choose cow’s milk as a part of their diet. There is a likelihood that consumers will try to waste less and plan their milk consumption better so there may be some volume loss as a result.

Private label cow’s milk has increased in price

The price of private label cow’s milk has risen from £0.55pl last year to £0.74pl this year, a rise of 35%.

Have milk alternatives also risen in price?

The price of private label alternatives is now, on average, £0.91pl, having also increased in price by 15%. This is still 23% more expensive than private label cow’s milk. Of course, branded alternatives, (that represents 2/3 of the value of the alternative market) have increased in price by much less – only 8% but as it already retailed at £1.59pl alternative buyers have been switching to cheaper private label alternatives. The branded alternative sector has seen losses of 10% of volume, year on year, whilst private label alternative volumes have grown by 10%

The alternative milk sector is going through the same commodification process (including a shift from brand to private label) that cow’s milk went through many years ago as supermarkets began selling milk and bread cheaply as a loss-leader to attract customers. It is likely that the cost-of-living crisis will continue the pressure on the alternative sector putting pressure on margins going forwards.

What is driving the uplift in cow’s milk prices?

Part of the story with rising milk prices on supermarket shelves is the rising cost of producing the milk. Dairy farms have been facing large hikes in prices for their key costs – things like animal feed, fuel and electricity as well as fertiliser.

On average, the costs of farm inputs have risen by 31% in the 12 months to August according to Defra’s agricultural price index. The three key categories for dairy farms of feed, fuels (energy) and fertiliser have seen inflation rates of 31%, 58% and 118% respectively.

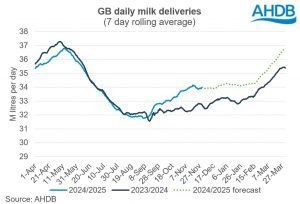

The rising production costs, combined with chronic labour shortages and stretched farm margins, saw production levels start to decline in the autumn of 2021. In the second half of 2021, milk deliveries were 138 million litres lower than in the previous year, a drop of 2.3%.

Dairy processors increased the prices paid to farmers for their milk to help offset the rising costs in the hope of prompting higher production, deliveries remained low. However, given the strength and persistence of input price increases, particularly for energy-related inputs such as fertiliser and fuels, the price increases did not generate the desired increase in milk production.

At the processing level, the higher cost of procuring necessary milk supplies, combined with inflation in inputs at this stage in supply chain (energy, packaging, labour and transport), has meant manufacturers have had to renegotiate selling prices. For fresh milk, these increases have followed a long period of stable pricing. Up until last autumn (Sep21), fresh milk prices had been declining in real terms, as general inflation (as measured by the RPI for all goods) outpaced inflation in fresh milk prices by almost 2 to 1.

Conclusion

As long as input costs such as energy and feed continue to rise then it is likely that the cost of products such as milk will follow suit and these costs will have to be passed onto the consumer. However, inflationary pressure is not confined to dairy milk and alternatives are also seeing costs increase. As long as cow’s milk remains better value for money it is likely that market share will be retained but there could well be volume pressures as consumers need to cut back across the board.

[1] The RPI increased by 16.2% between Jan17 and Sep21 while fresh milk prices increased by only 8.4%.