ASB economists estimate higher interest rates have added an average of 60 cents per kilogram of milk solids to debt servicing costs for dairy farmers over the past year.

ASB economists are estimating that higher interest rates have added an average of 60 cents per kilogram of milk solids to the debt servicing costs of the country’s dairy farmers.

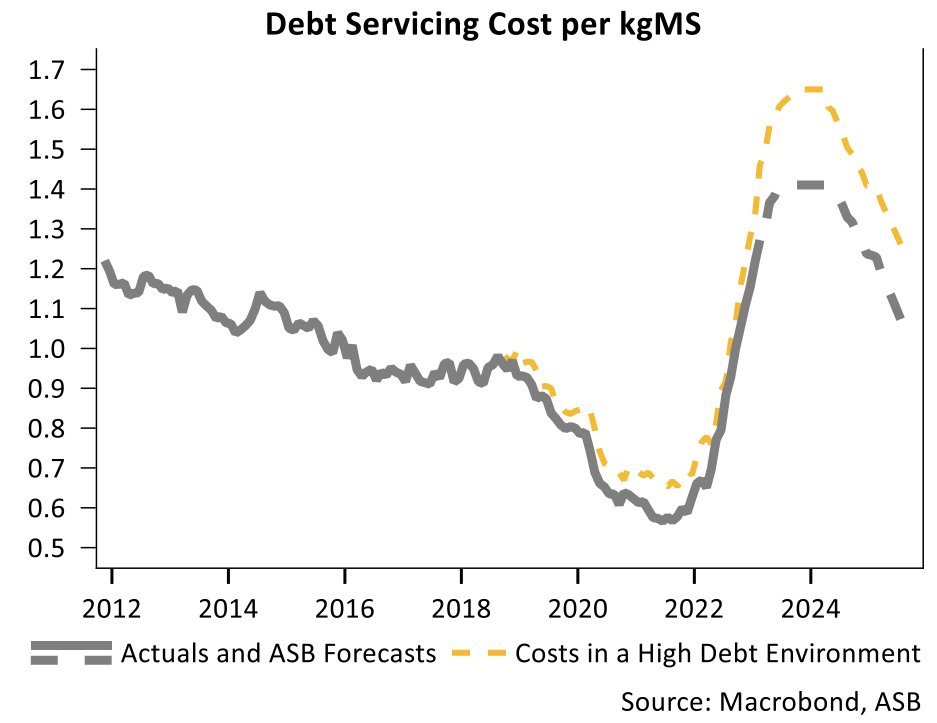

In a Rural Economic Note, ASB economist Nat Keall estimates debt servicing per kgMS is currently running around $1.35- 1.40 per kgMS.

“That represents a lift of more than 75% over the last twelve months – i.e., about 50-60c. Unsurprisingly, almost the entirety of the increase comes from higher interest rates given overall debt levels have remained relatively stable as a proportion of output.”

Keall’s current forecast for the farmgate milk price in the season that’s just started is $7.25 per KgMS, while the first official forecast for the season from Fonterra is for a price of between $7.25 and $8.75.

The increased debt servicing costs have come as the Reserve Bank (RBNZ) has cranked the Official Cash Rate (OCR), up to 5.5% – although it is indicating that it may now at least take a pause at that level as it has forecast the OCR to remain at 5.5% till the middle of next year.

Keall says with the RBNZ “potentially at the end of the hiking cycle”, he estimates farmers’ debt servicing costs will lift “only a little” further from now, by around another 5c or so to take average debt servicing costs into a $1.40-1.45 per kgMS range.

“But given we don’t expect any OCR cuts from the RBNZ any time soon, the risk is that debt servicing costs remain around these levels – circa twelve-year highs – until the end of the 2023/24 season.”

While debt-servicing costs have undergone “a very lofty increase”, however, the cost for farmers could have been a lot larger had they not used recent high payouts to reduce debt levels, Keall says.

“Our analysis suggests that if debt levels had remained at their 2018 highs, debt servicing costs would likely be set to peak at levels 20-25c higher than they currently are, in a $1.60-1.65 per kgMS range. That would have been a painful increase given how stretched margins already are, illustrating the degree of resilience farmers have delivered through those repayments.”

Keall says that lately, reductions in dairy debt levels have stalled.

“After reaching $36.3 billion in early 2022, total NZ dairy lending has actually ticked up moderately. Sharp lifts in various working expenses (like feed, fuel and fertiliser) over 2021 and 2022 have left less room for debt repayment, and the regulatory burden has only continued to escalate.

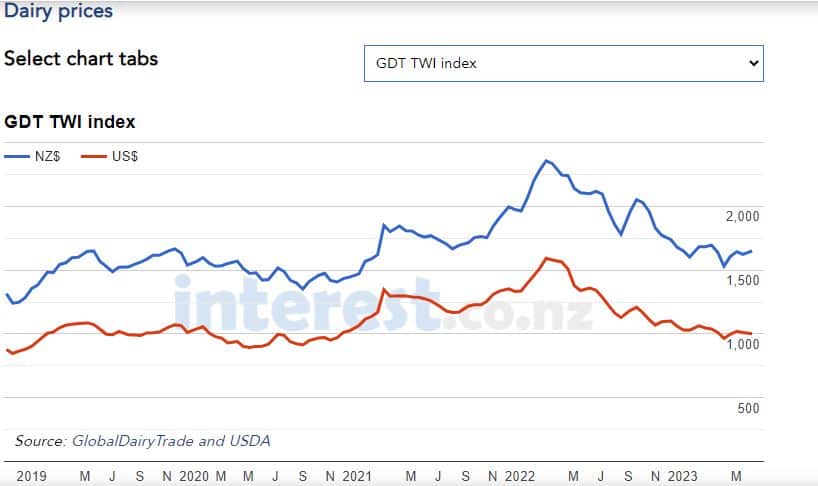

“What’s more, the long-feared scenario of higher lending rates coinciding with a weaker milk price looks to be coming into focus. Dairy prices have fallen about 25% in NZD terms over the past twelve months…”

Keall suggests farmers should budget on lending rates “remaining elevated for some time”.

“From the latter half of 2024, we expect debt servicing costs to ease progressively in line with lending rates, getting closer to the $1 mark by the end of our forecast track in mid-2025.”

He says, however, the risk is that if this season’s milk price is lower – “as we expect” – some farmers may need to take on additional debt to ride out the downturn – in which case debt servicing costs can “start to move a bit closer to the high-debt scenario” plotted in the below graph.