China is driving WMP demand, but a bearish outlook persists. NZ milk output is up 2.8% year over year in October, slowing after earlier gains. German milk fat and herd declines are notable for the butter pricing outlook.

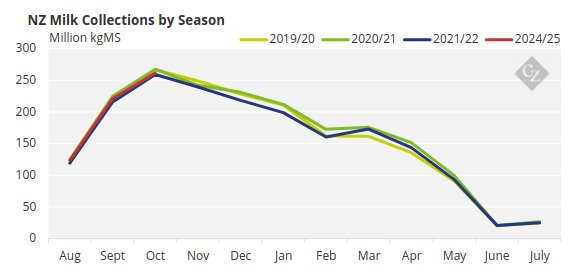

NZ October Milk Collections on Track

There was a 2.8% year over year increase in October milk collections from all NZ processors, slowed by cold snaps and heavy rain in the South. This is right on average for October collections and far off the record pace set in August and September.

We compare this season to the three seasons which had the most similar starts below — Fonterra’s 2020/21 Financial Year went on to be the record.

Fonterra itself was up 2.5% year over year in October, with its North Island collections making up for slowing in the South. The non-Fonterra group was up 3.8%. Given its relative tilt to South Island market share and the North Island strength, this likely shows farms who have moved from Fonterra to supplying others this season.

The non-Fonterra group continued its solid growth, with the market share for Fonterra FYTD sitting at 21.3%. This is 0.2% above trend.

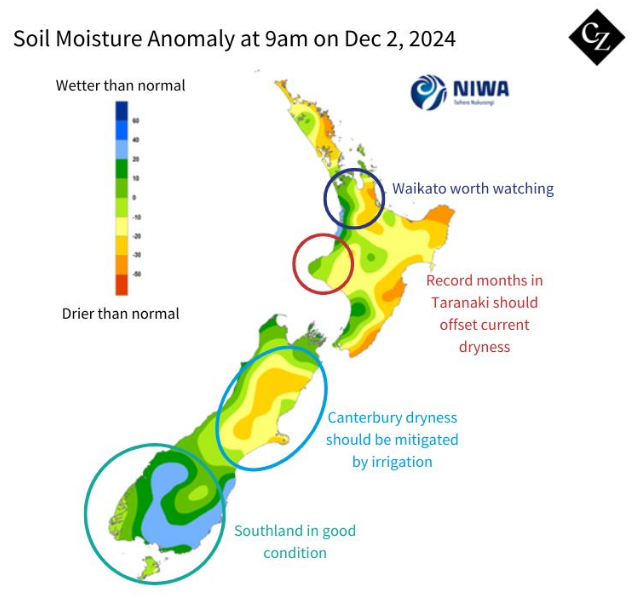

Soil moisture is about average across New Zealand. Only the Central North Island (especially Waikato) is worth watching. Otherwise, various mitigating factors mean that soil moisture is less important to watch for than usual at this time of year.

Map courtesy of Niwa

Contacts in the feed industry have reported record months in Taranaki, which will offset any dryness appearing there in the immediate term. The wet spells in the South earlier in the season mean that Southland is in good condition. Meanwhile, irrigation schemes in Canterbury are full so the dryness appearing there is unlikely to be impactful to dairying.

Putting all of this together, my expectation is that we should see the November 2024 milk production print nearer to +1.5% year over year for a total of approximately 242 million kgMS.

GDT WMP Event Surprises

I found GDT Event 369 WMP result surprising, as well as the magnitude of the decline in butter.

We are seeing strong and consistent demand from China as it restocks WMP ahead of its own peak in February. During GDT 368, North Asia purchased the highest volume of WMP since January 2022.

There has been a lot of talk about Chinese domestic milk prices being low and the possible negative impact this has on the coming Chinese peak. Given that the push to grow domestic milk production is part of a Central Government Policy, my thesis is that growth will continue relatively unabated.

Last week the Algerian Government purchased 25,000 tonnes of WMP for deliveries from February to May 2025. Based on anecdotal CFR prices reported, we believe this was concluded at around USD 4,125/tonne FOB New Zealand equivalent (including labels and pallets).

This is a decent premium to Fonterra’s base price. It was likely a meaningful sale in terms of relative payout impact for whichever NZ processor won the lions share. It will therefore have market share implications for this season. Sales targeting February arrivals are risky and will need to be dispatched immediately to avoid incurring any penalties.

The SGX-NZX futures essentially predicted the WMP GDT result well. C2 WMP Regular printed USD 3,940/tonne, which is still at a discount to ONIL (the Algerian purchasing agency).

With very strong production from New Zealand and the WMP stream return finally worth consideration over SMP/fat, my view remains relatively bearish for WMP in the coming months.

It is worth noting that New Zealand exports a lot of AMF into Mexico. In fact, Mexico is New Zealand’s second-largest destination with (about 20,000 tonnes per year or 10% of all New Zealand AMF production. This AMF then is largely processed and then exported onward into the US.

If Trump does enact the 25% tariff on Mexican imports to the US, then this flow is likely to be severely impacted. New Zealand AMF, already discounted compared with butter, may stay undervalued in global cream markets if US tariffs on Mexican imports proceed.

Fonterra added 2,675 tonnes of AMF to its GDT offer volumes last week – is this AMF’s canary in the coal mine? Any further cracks in the SMP/AMF stream could see milk swiftly redirected to WMP if current WMP prices persist. EU fat dynamics could also interplay, and we discuss these in detail shortly.

All Eyes on German Collections

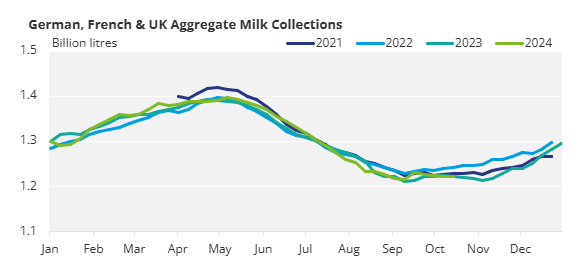

Milk collections in the major producing countries Germany, UK and France are now up by a cumulative 0.13% in 2024 YTD according to our calculations. Week 44 aggregate collections are down just 0.03% across the group. In both cases UK gains are making up for German losses .

French collections have made the largest gains compared with prior seasons, however it is important to note that France’s 2023 autumn was terrible for milk flows, so the comparison is with a very low base. Comparing to 2021 and 2022 the milk flows in France this year are still relatively weak.

Germany is the crucial country to watch for EU collections. After a strong start to the year, the past 15 weeks straight have shown YoY declines. The seasonal low point is now expected to have passed, and we will be watching the rate which collections increase going forward very closely.

The number of dairy cattle in Germany decreased by 100,000 animals last year, according to the Federal Agricultural Information Center (BZL). Around a third of German milk ends up in the food retail trade. The rest goes to industrial customers or flows into the world market as dairy commodities. If we assume that the one third for the food retail trade remains constant in notional terms moving forward, then a shrinking milk pool will result in lower export of German dairy commodities.

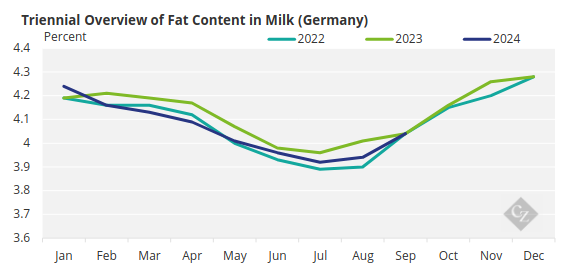

Fat content of German milk has been consistently below normal since February, according to the Bavarian Milk Producers’ Association, which it says is unusual. According to the association, there has been a nationwide reduction in fat content of between 0.01% to 0.04% which is corroborated by the chart below.

Source: CLAL

This equates to approximately a 0.9% drop in total fat collections. Lower fat milk means that more milk is needed for the same amount of butter or cheese. Butter and cheese combine to use about 70% of all fat from milk produced and butter is impacted first when milk fat falls (then cheese, then fluid milk and cream).

Even without a drop in total milk, if the full 0.9% fat loss comes from butter then this could equate to a decline of 13,500 tonnes of German butter production this year. According to Eurostat, through September of this year we have already lost 6,000 tonnes of butter from Germany. It is unclear as yet whether this is due to Bluetongue or feed.

More butter is always needed in the run-up to Christmas. This is due to the seasonal consumer demands for baked Christmas goods. Meanwhile, consumer prices in Germany hit new all-time highs in October and the number of promotional campaigns in retail declined 29% compared with last year according to AMI.

The broad market is expecting a collapse in EU cream pricing soon. If this plays out, then expect the butter pricing in Europe to do most of the work converging to New Zealand prices. EEX January butter futures are already EUR 500/tonne down from their highs, but still hold a significant premium to SGX-NZX.

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K