To name just a few of those changes, the Transportation Security Administration and more strict airport check-in procedures were put into place, the Department of Homeland Security with our own Tom Ridge as the first secretary was formed, and there were changes in how states reviewed applications for things such as driver’s licenses.

I believe that most of us reflected on “where I was” that day as the planes hit their targets and what we did to navigate the insecurity of the following days.

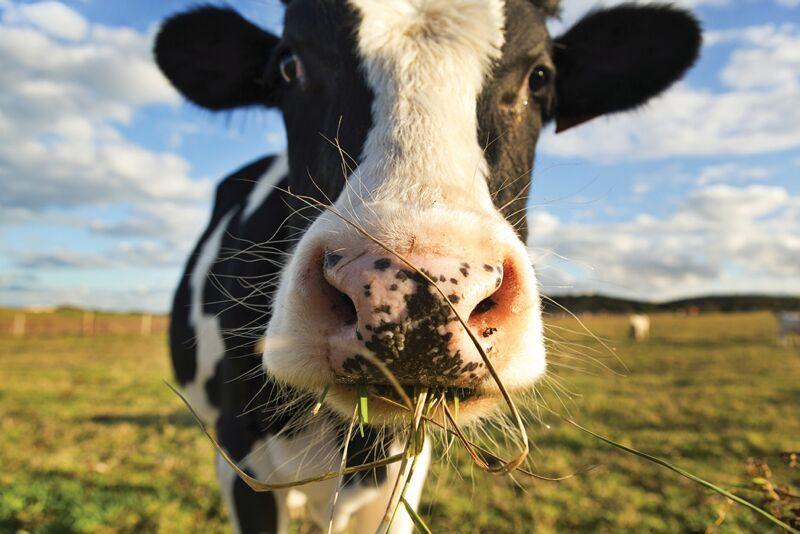

Part of our recollections could be to examine conditions for the dairy industry as we entered and passed the dawn of a new millennium. I think that, in retrospect, we will see that the seemingly constant changes we see today were beginning to take shape many years ago.

In 2001, USDA reported there were 97,460 milk cow operations in the United States. By 2009, that number had declined to 65,000, a decrease of 33%.

Despite this decrease in farm numbers, both milk production and the number of cows increased. Between 2001 and 2009, production increased by 15% with an accompanying increase in the number of dairy cows of 1%. Obviously, the production per cow was increasing dramatically over this period.

This should not surprise any long-term dairy farmer, as milk production had increased by over 45% during the 25 years prior to 2001.

It was also during this time that several states not normally identified with dairy production began to experience growth — Idaho, Kansas, Washington and New Mexico. In today’s dairy discussions, Idaho and New Mexico are definite players in terms of production.

Marked differences in production, especially production per cow, were emerging between the traditional dairy regions (northeast and lake states) and the nontraditional areas of the western mountain and Pacific states. Overall structural changes in the dairy industry were beginning to evolve with weather issues in some areas, environmental concerns in others, and the impact of topography and geography on an ability to consolidate and industrialize.

A 2002 report by Don Blayney for USDA noted that three broadly defined structural changes had been taking place to create the industry evolution we are living with today — innovations in technology, changes in the milk production system, and specialization. Add to these the changing markets, globalization and facilitation of transport, and barriers imposed by our geography and you can start to see how Pennsylvania agriculture has been shaped by factors much out of our control.

Comparatively, the rapid production growth in the nontraditional areas occurred for a variety of reasons — mainly economic — with considerations to availability of resources and market access. Increases in herd sizes in these areas have often led to situations in which a few or possibly only one operation affects regional production and markets. Dairy farms are often near one another, which then leads to a high concentration of production in one area.

Newly formed and clustered operations with high growth might be confronted with environmental challenges, especially in our region, which has many smaller and older farms. The operations that are emerging in the nontraditional dairy areas most likely have the advantage of state-of-the art technology to counter these challenges. The expense required to obtain many of these technology improvements is beyond what most of our small farms can absorb.

Often, stabilization of a situation leads to the types of positive changes that create growth.

How do we look at our current situation and use our knowledge of the past — including those structural changes which have allowed other states to grow their industry — to stabilize the dairy industry in Pennsylvania? What barriers exist that we can never overcome, and what are the barriers we can realistically mitigate?

These are the questions I pose to the agricultural leaders in Pennsylvania.