Commodity Overview

- Milk production in coming months is anticipated to be flat to lower year-on-year as lower farmgate prices and dry conditions in some areas weigh on producer sentiment.

- Processors are unlikely to lift farmgate prices significantly as current values are more aligned with global export competitors.

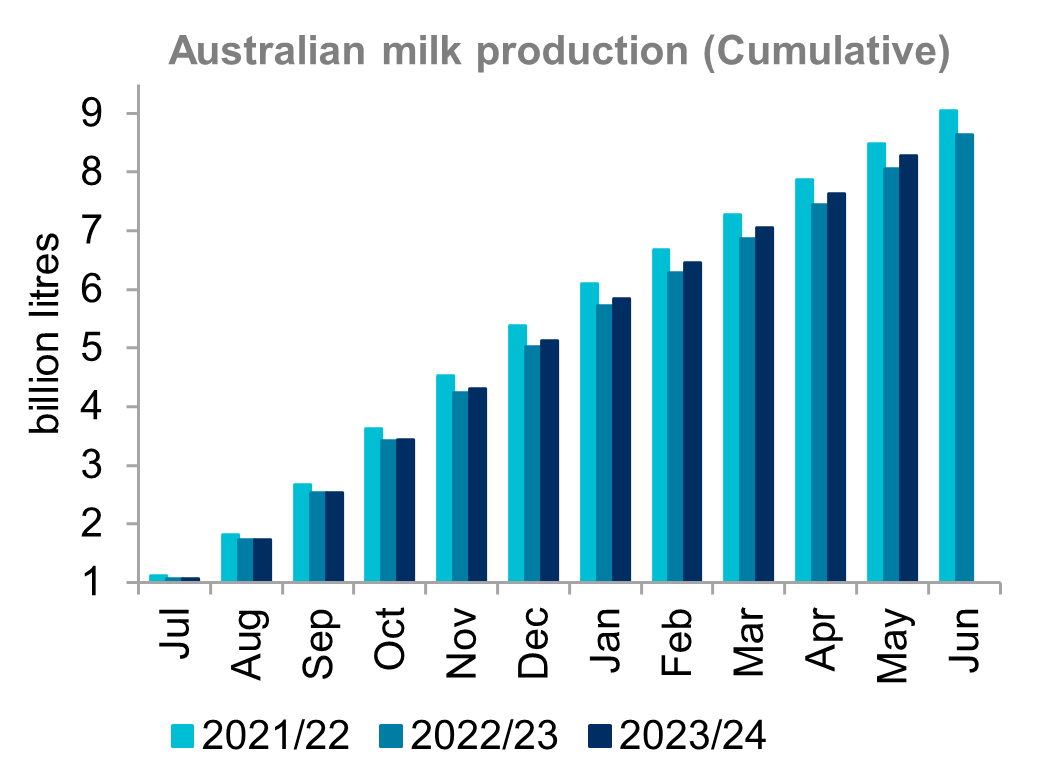

Dairy Australia is yet to release official June milk production figures. But favourable seasonal conditions should see June milk production close to the average of 600 thousand litres. This would put 2023/24 season milk production at around 8.3 to 8.4 million litres which is in line with expectations. While this puts 2023/24 season production around three per cent higher year-on-year, it is still around five per cent below average.

Seasonal conditions vary across the states which may affect milk production going forward. Dry parts of Victoria and South Australia received some rainfall in July. This has helped pasture growth but supplies of both hay and grain are tight. Increased freight costs to source feed from further afield places more pressure on margins. A wetter outlook for spring is anticipated to improve pasture growth for much of eastern Australia. But this may come too late for the peak production period of September through to January. Based on current conditions, we expect to see milk production similar to or slightly lower than last season.

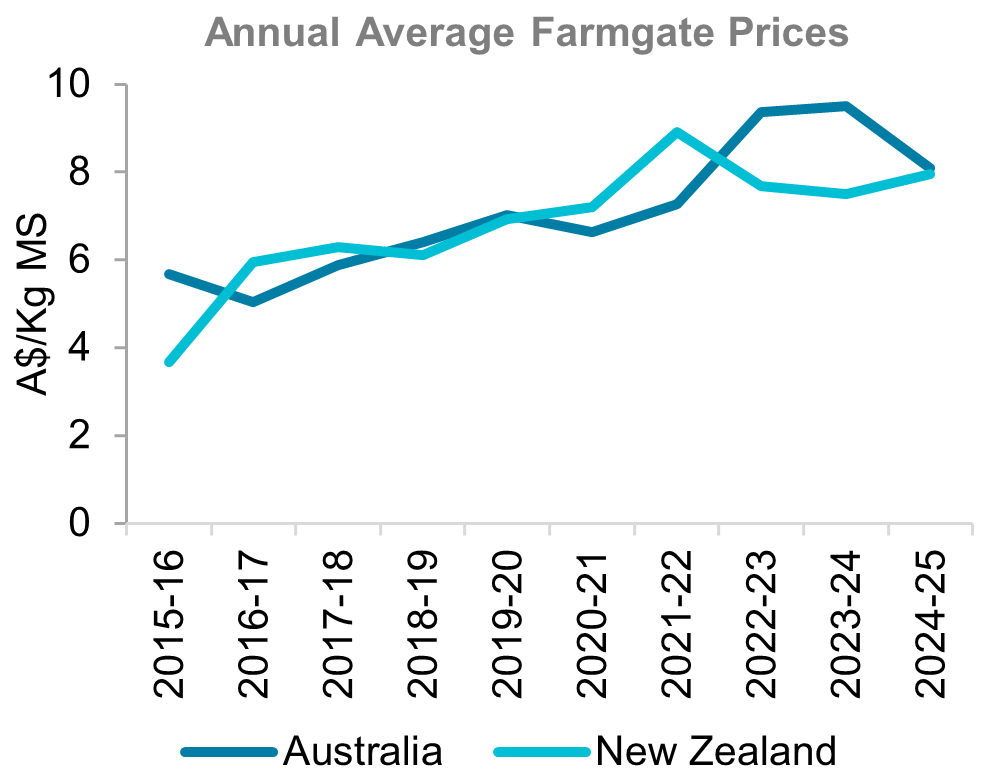

New Zealand milk production continues to face challenges presented by an El Nino weather pattern. June milk production was down 1.1 per cent year-on-year. Earlier forecasts anticipated milk production to increase slightly. But recent downturn in milk deliveries has seen forecasts revised and production is likely to see a year-on-year decline. Tight supply in New Zealand is also supporting prices. The New Zealand Stock Exchange recently revised their milk price forecast to NZ$8.66/kg MS. At current AUD/NZ exchange rates, that puts New Zealand farmgate prices at around AUD$7.95. This puts Australian farmgate prices only 1.9 per cent higher than New Zealand, compared to around 33 per cent higher in 2023/24.

Export demand for dairy products remains volatile which is reflected in global pricing. Global Dairy Trade prices for dairy products are higher year-on-year. Skim Milk Powder and Whole Milk Powder are up 3.5 and 13.8 per cent respectively. But sporadic demand has seen prices unable to hold a sustained run of increases. It’s a bit two steps forward one step back.

Demand for butterfat and cheese products are finding more support. Global butter prices are up 38.7 per cent year-on-year, and cheese is up 9.3 per cent year-on-year. Australia has cashed in on increased demand for cheese, with export value in 2023/24 reaching a record high $1.12 billion. This is despite volume of 150 thousand tonnes being the ninth highest total in the past 10 years. Lower Australian farmgate prices and improved competitiveness with New Zealand should see Australian cheese continue to capture export demand.

Processors have held firm with farmgate prices largely unchanged from opening bid announcements. The average 2024/25 weighted farmgate milk price sits around $8.10/kg MS. This is around 9 per cent below last season’s opening prices, and 15 per cent below closing prices. The Australian Dairy Products Federation has defended price drops. Surging dairy imports are one reason for lower farmgate prices. As are uncompetitive farmgate prices compared to global competitors.

They also point out that current farmgate prices are around 13 per cent higher than 2019. Producer groups argue that while current prices are higher, so is the cost of production. Australian Dairy Farmers President Ben Bennet pointed out that fertiliser costs are up 42 per cent since 2019.

Labour is also more difficult to secure than pre-COVID times. Mr. Bennet claims “while processors may feel a 15 per cent price drop is modest, dairy farmers aren’t feeling quite as relaxed”. Adding weight to this argument is the fact global dairy prices are higher year-on-year. But significant step ups are not anticipated this season. Processors may announce minor step ups should supply tighten through to the new year. But farmgate prices are unlikely to lift significantly to maintain alignment with global markets.

Sources: Milk Value Portal, Dairy Australia

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K