Milk futures on the Chicago stock exchange were at US$14.38/cwt (£11.63/cwt) at the beginning of the week, which is 30.1 per cent higher than the lows seen on April 22, although about a fifth lower than pre-coronavirus levels.

Meanwhile, the latest Global Dairy Trade Auction on May 5 achieved an average price of US$2,866/tonne ($2,319/tonnes), which was 0.8 per cent lower than the April 21 event.

Milk powder prices were up fractionally, with higher lactose values too.

The index was dragged down by a 6.8 per cent fall in Cheddar prices and a 5.8 per cent drop in butter values.

The auction index is at the lowest it has been since November 2018, but it is nearly 75 per cent higher than it was in August 2015.

There is an expectation across the world that dairy output will be curtailed by the coronavirus crisis.

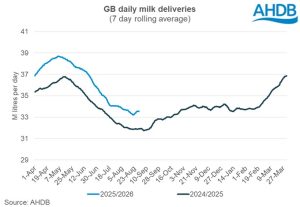

UK milk deliveries to dairies in March were down 2.4 per cent on March 2019 at 1.297 million litres.

AHDB said pressure from processors to cut milk production saw April milk deliveries shrink by a further 23m litres to 1.094m litres, with analysts predicting production had now peaked for the year.

Strain

Chris Gooderham, AHDB head of market specialists, said: “If volumes had reached 1,117m litres it would have put considerably more strain on the processing capability of the country and likely would have led to significantly higher volumes of milk needing disposal on farm.

“Thanks to the reaction of those farmers who have cut back on volumes, the disposal of milk has been kept relatively in-check so far.

“Whether we continue to have sufficient capacity over the remainder of the spring will now be determined by retail sales continuing to remain high and processors continuing to run at, or near, capacity without breakdown or serious levels of staff absenteeism.”