The report said while some regional disruptions would continue to occur as a result of COVID-19 and uncertainty remained, the potential for major global demand shocks was limited, with downside risk to the global dairy market more likely to stem from the anticipated slowdown in Chinese import demand.

With supply expected to outpace demand in China, as domestic production and inventories increase, the country’s imports were expected to start to decline in the second half of this year, the report said.

And with prices heavily dependent on import demand, the “near-term peak in global dairy commodity prices is likely behind us”.

Meanwhile, global milk supply has been on an “extended run of interrupted growth” which was set to continue, the report said, albeit at a slower pace.

“The growth rate has been sustainable without becoming overly burdensome on markets so far, but any slowdown in global demand would quickly lead to inventory build,” it said.

Australia’s outlook

For Australian dairy farmers, farm margins are positive with most experiencing healthy on-farm profitability, Rabobank senior dairy analyst Michael Harvey said.

“Near-record milk prices, affordable purchased feed prices and supportive seasonal conditions have set many up for positive trading conditions ahead,” he said.

While the cost of fertiliser had jumped, Mr Harvey said it had only had a “slight negative hit on farm gate margins”, with the majority of Australian dairy farmers locking in near-record milk pricing for the current season.

“We have revised up Rabobank’s farm gate milk price to $7.05/kg MS for 2021-22,” he said.

“While this is broadly in line with the official farm gate milk prices range, it also takes into account the limited upside in global dairy markets for the remainder of this season.”

Mr Harvey said Australian dairy farmers were also heading towards a “favourable spring peak” with the bank forecasting milk production growth to be up 1.5 per cent in 2021-22, to 8.9 billion litres — a level not reached since 2017-18.

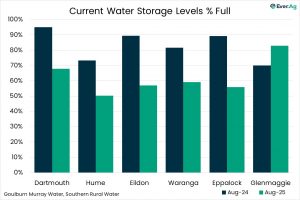

“With the spring peak just around the corner, conditions on the farm remain very favourable with the latest seasonal outlooks pointing to average winter-spring rainfall in key production regions.”

This was also boding well for irrigators, he said, with lower water prices and increased allocations as demand from competing crops had subsided.

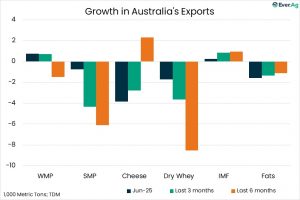

Mr Harvey said dairy export volumes were also up, with liquid milk and milk powders leading the way.

In the domestic market, he warned current lockdowns were leading to “ongoing channel distortion in dairy markets”.

“With a large proportion of consumers in lockdown due to the Delta variant, the Australian consumer market is on a rollercoaster.

“That said, pantry-loading seems to be less pronounced this time round and dairy consumption seems to be holding firm in the face of all this uncertainty.”