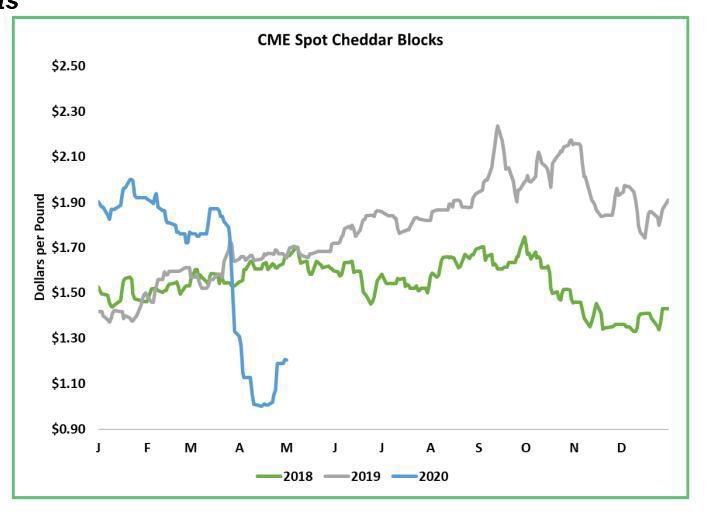

Cheese led the comeback. Chicago Mercantile Exchange spot Cheddar blocks increased 13.5 cents this past week to $1.205 per pound. Barrels increased 14 cents to $1.19. Spot whey added a penny and reached a year-to-date best price at 39.5 cents. Spot butter rallied 4.25 cents to $1.1875.

But the nonfat-dry-milk market continued to slip. Spot nonfat-dry milk closed at 79.25 cents, a decrease of 1.75 cents to its worst value since July 2018. That’s less than the European Union’s Intervention purchase price for skim-milk powder, which suggests that further downside may be limited.

There’s still more milk than the market needs. But for myriad reasons the excess has become a little less burdensome. The markets are working. Bargain pricing has enlivened U.S. cheese exports. Inordinately cheap milk has given some dairy processors the courage to increase output even before would-be buyers commit, reducing the volume of dumped milk. Ice cream season has arrived, which is helping to use some of the glut in the cream market.

Processors are adapting some supply lines to direct more product through retail channels. Grocers are restocking. As consumers grow weary of staying home, some restaurants are ordering food in anticipation of better demand. Restaurant sales are still terrible, but traffic is not quite as abysmal as it was in early April. Indeed some fast-food chains report that business is booming. But many restaurants remain dark. Meanwhile the temperature, the milk price and steep over-production penalties are all working to slow milk output.

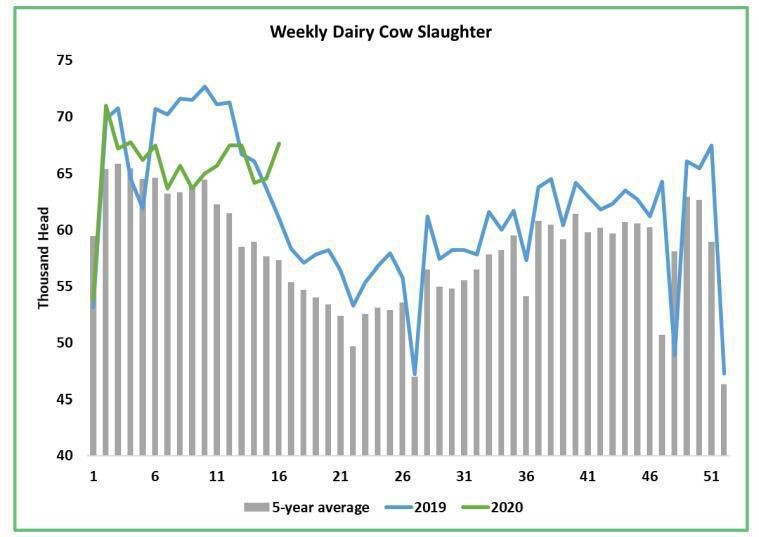

With nearby milk at $10 or $11 per hundredweight, dairy producers have every incentive to trim their herds. Despite crippling issues at the nation’s slaughter facilities, dairy-cow culling has remained inflated for now. Based on data through April 18, dairy-cow slaughter has increased to 34-year-greatest numbers in three of the past four weeks. The tidal wave of COVID-19 infections in the meat-packing industry has swamped the larger facilities, which generally focus on beef cattle. Smaller facilities that kill dairy cows are also swimming against a tide of infection, absenteeism and slower throughput – but the current is not as strong. Some dairy producers have not been able to cull all the cows they would like, but the national herd is likely shrinking.

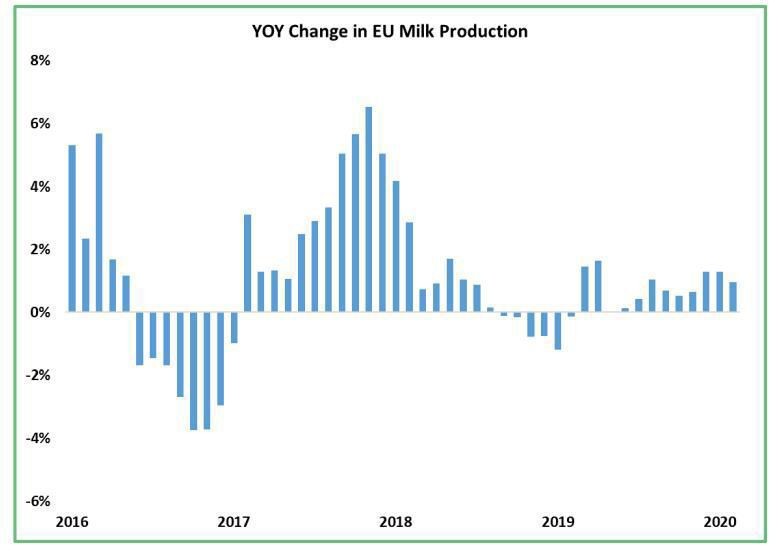

Around the world milk production is growing slowly. On a milk-solids basis, milk collections in March increased just 0.1 percent in New Zealand. Dry weather is likely to weigh on output as the season draws to a close. Milk collections in Australia increased 7 percent from a year ago, but they are still historically depressed. Australia’s dairy industry has been crippled by years of drought. A recovery from this past year’s paltry milk output still doesn’t mean a lot of new milk. Daily average milk output in February increased 1 percent from a year ago in the European Union-28. Growth is likely to remain tepid. Europe’s dairy industry is facing the same struggles as ours. The European Commission may grant nations and co-operatives permission to implement schemes to reduce milk production.

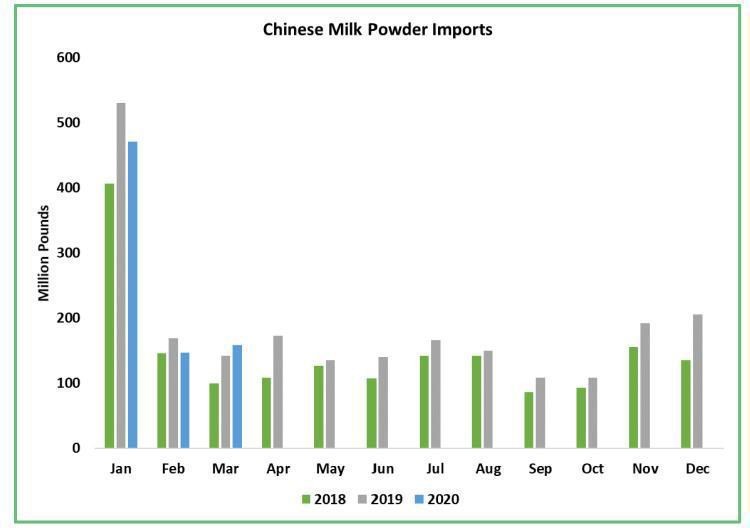

Chinese milk-powder imports had a slow start this year but improved in March. Combined imports of skim-milk powder and whole-milk powder increased to 158.1 million pounds, an increase of 11.3 percent from March 2019. That helped to narrow China’s year-to-date import deficit from 11.7 percent at the end of February to 7.8 percent at the end of March after adjusting for Leap Day. Going forward China may need less foreign milk powder. COVID-19 lockdowns severely disrupted dairy supply chains, forcing a greater share of China’s milk into storable powder. Conversely China may need to increase imports of relatively fresh dairy products from already inflated volumes. Chinese imports of butter, cheese, whey powder and extended shelf-life milks were more than year-ago levels throughout the first quarter.

Overall the dairy markets were a little less bleak this past week. The market is seeking balance; it’s not wobbling as precariously as it was 10 days ago. Painfully depressed prices have helped to stimulate some demand and reduce supplies. Unfortunately there’s more work to be done on the supply side. Dairy consumption is not likely to recover fully until consumers are confident to socialize and spend normally.

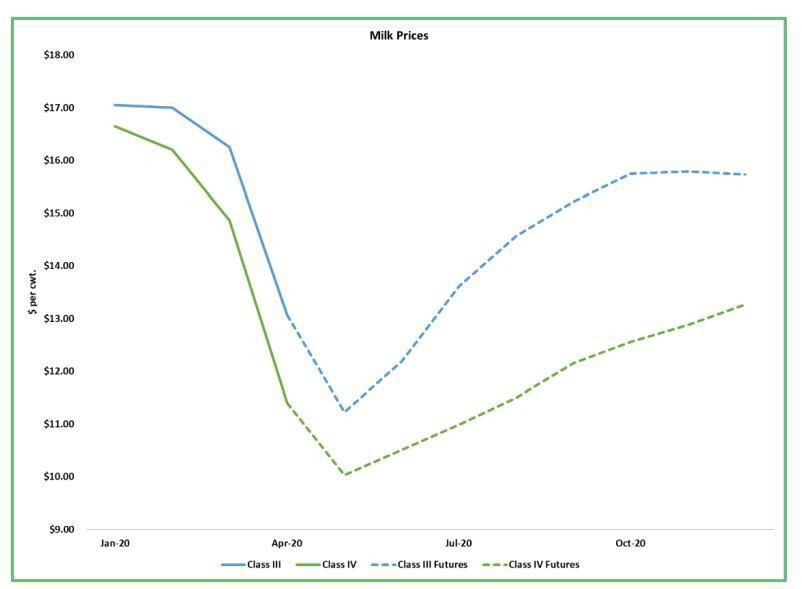

The U.S. Department of Agriculture announced the April Class III price at $13.07, with Class IV at $11.40 – a 10-year worst price. May will be worse but the futures promise better prices later this year.

Grain Markets

The soybean market was cheered by news that China is once again buying U.S. soybeans. The July contract rallied 2.75 cents this past week to $8.495. Soybean-meal values were basically steady. The corn market continued to lose ground. July corn settled May 1 at $3.185 per bushel, a decrease of 7.5 cents from the previous week.

Ethanol output has been cut in half. Projected demand for livestock feed is decreasing as growers do all they can to hold animals back. Beef producers are keeping cattle on pasture, while pork and poultry growers are slowing breeding as well as breaking eggs. Farmers are planting corn at a rapid pace, with soybean seedings to follow. Dry weather is becoming a concern in Europe, Russia and South America, which could trim global production from previously lofty projections. Still there will be more than enough.

Sarina Sharp is with the Milk Producers Council. Visit www.milkproducerscouncil.org for more information.