In the 2004 film “Napoleon Dynamite,” quirky teen Napoleon (played by Jon Heder) embarks on a mission to help his new friend win the class presidency. Set in a small, Idahoan town, scenes depicting dairy farms and milk are strong throughout the film, especially because Napoleon is a member of the Future Farmers of America (FFA). In one scene at school, Napoleon approaches fellow classmate, Deb, and comments on her drink of choice: 1% milk. He suggests she “could totally be drinking whole” if she wanted to.

Although we don’t know whether Deb ever made the switch to whole milk, recent data shows us what kinds of dairy drinks and alternatives consumers are opting for — and which kinds they aren’t favoring.

Anne Scott Livingston, research analyst at Chicago-based Euromonitor International, notes that producers were forced to increase their milk prices due to a jump in input costs, which “have significantly strained category margins.”

“Price hikes in a category already struggling with lowered demand put a strain on sales in both 2021 and 2022,” she says. “After a year of strong retail sales in 2020, consumer behavior normalized somewhat in 2021, and retail sales of milk declined. The category also continues to face competition from dairy alternatives, which have become increasingly available in recent years.”

Sydney Olson, consumer insights analyst of food and drink at Mintel, Chicago, suggests that dairy milk sales will grow 2.3% by the end of 2022. The increase would put dairy milk sales at $16.7 billion, which Olson says is “just 1% shy” of the high in 2020 during the pandemic.

“While growth this year is in part due to elevated price points and inflation-driven shopping behavior, improving perceptions of health are also contributing,” she notes.

Euromonitor’s Livingston notes that flavored dairy milk is a driving growth for the dairy beverage category, with “strong retail sales growth in 2021.” She expects flavored dairy milk to maintain that growth through this year.

“This growth is partly attributable to high levels of innovation in the category, with established milk brands rolling out new varieties and new brands entering the market,” she says. “Much of this innovation is focused on health and wellness, with consumers seeking out attributes such as organic, clean label or ultra-filtered.”

An array of dairy alternatives

The non-dairy options at the grocery store, has become home to variety of milk alternatives. There’s soy milk, almond milk, cashew milk, oat milk and many, many more.

John Rodwan, editor of New York-based Beverage Marketing Corporation’s (BMC) biweekly enewsletter The Beverage Strategist, explains that “unlike dairy milk, plant milks (or dairy alternatives) did grow in 2021,” but not drastically.

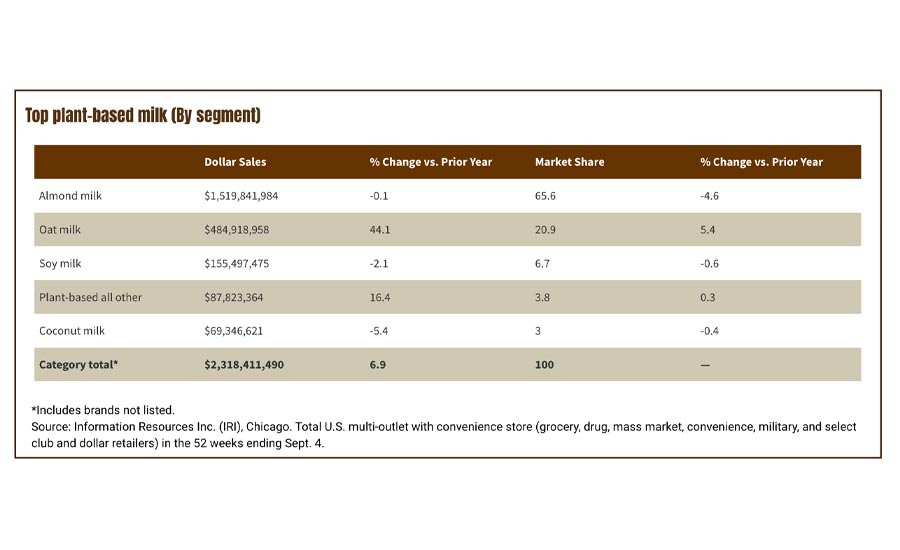

“The various plant milks tend to perform rather differently, and a pattern has emerged where a newer-style plant milk emerges and grows rapidly and others start to fade,” Rodwan explains. “As a result, the segment-of-the-moment may chart remarkable growth, but the alternative milk category as a whole does not.”

Rodwan cited almond milk as an example, noting that the beverage was “the hot segment” a few years ago. A more current example is oat milk, “but even its growth has cooled somewhat,” he adds.

“In 2019, oat milk’s volume grew at a quadruple-digit rate; in 2020 by a triple-digit rate; and in 2021, by a double-digit rate,” he explains. “But, even though that 2021 growth was quite fast, and oat milk has emerged as the No. 2 type (behind almond), overall category volume grew rather slowly as other segments declined.”

Mintel’s Olson notes that the diverse non-dairy options are what drive the market.

“Oat milk and other non-dairy drinks (comprising more recent non-dairy innovations such as plant-based blends, macadamia milk, hazelnut milk, etc.) are the only segments to see growth in 2022,” she says. “Even amid higher inflationary grocery spending and inherently higher prices of non-dairy milks, all other segments experienced their second consecutive year of decline following pandemic highs.”

John Crawford, vice president of client insights of dairy at Chicago-based Information Resources Inc. (IRI), says that oat milk is the leading alternative driving the market, while almond, soy and coconut milks “struggle.”

“Almond is up slightly in dollars (plus 0.6%), but down (minus 5.6%) in volume,” Crawford says. “Soy has been declining for many years, first getting cannibalized by almond, and now by oat.”

Euromonitor’s Livingston shares similar sentiments regarding the market-driver of alternative options.

“Although almond milk remains the most popular option among plant-based alternatives, oat milk has recorded impressive growth and quickly gained a large amount of share,” she says. “Soy milk has continued to decline, and alternatives such as rice milk and coconut milk have lost share, as well as many consumers’ shift toward almond and oat. Other alternatives have started to gain popularity as well, such as pea-based milks.”

Livingston notes that manufacturers have explored other non-dairy alternative options, like hemp and barley milks. In the future, she suspects such varieties “may grow in the market in coming years.” She credits health and wellness trends as the force that drives consumers toward non-dairy and plant-based options.

“Consumers have become aware of dairy’s environmental footprint and are opting for plant-based milks that tend to have lower levels of greenhouse gas emissions and use less water and land,” she explains. “Foodservice trends have also driven sales of milk alternatives, particularly as coffee chains are increasingly adding plant-based options to their menus. Continued innovation in the category has also been an important contributor to growth, with dairy alternatives having a much higher level of product development than liquid dairy products.”

Treading through the trends

With more and more consumers becoming health conscious, producers must work to keep up with demand and stay on top of trends, experts note. Further, factors like sustainability and healthiness are important to consumers and influence shopping habits.

Euromonitor’s Livingston notes that such trends impact which types of milk, whether it be dairy or an alternative, are most popular among consumers. As sustainability initiatives gain importance with consumers, many plant-based milk companies especially are looking at “increasing efficiency while reducing their carbon footprint,” she says.

“Companies that engage in sustainability initiatives such as these are more likely to attract consumer interest as many seek to reduce their environmental impact,” she explains. “As interest in sustainability continues to grow, milk alternatives will be better positioned to attract consumers than dairy milk.”

In The Beverage Strategist, BMC’s Rodwan noted that health trends have had “decisive impacts” on both dairy and dairy alternatives. Some of that impact has resulted in growth, while some of it has not, he added.

“Concerns about fat content, calories and digestive issues have contributed to milk’s volume loss, and have also caused some consumers to seek alternatives,” Rodwan explained. “And, while some consumers seek alternatives to conventional milk, perceptions of plant milks as superior in terms of health and wellness have not made them as major category, volume-wise.”

Further, Rodwan credits the common belief that plant-based diets and diets involving reduced intake of animal products being better for an individual’s health and the environment, as factors that contribute to the popularity of dairy alternatives.

Citing Mintel’s March 2022 Global Consumer report, Olson says almost half of adults in the United States think a healthy diet should consist of both plant and animal proteins, “proving there is room for both dairy and non-dairy milk brands to contribute to consumers’ current healthy intentions.”

“However, because of rising concerns and confusion surrounding non-dairy processing and ingredients, brands should consider leading with the inherent ingredients and benefit of plants and of specific base types, rather than attempting to artificially replicate the taste and nutritional profile of dairy milk,” she adds.