The majority of the subsectors included in the Brand Finance Food & Drink 2021 report recorded cumulative brand value losses this year, as the sector negotiates the fallout from the Covid-19 pandemic.

Soft drink brands were the most severely impacted, with the total value of the world’s top 25 most valuable soft drinks brands declining by 6%. The only subsector in the report to protect itself from a brand value loss is the dairy sector, which maintained its total brand value year-on-year.

Savio D’Souza, valuation director, Brand Finance, said, “The Covid-19 pandemic has put a huge amount of pressure on the food & drink industry globally, from disrupted supply chains and panic buying, to a complete change in consumer habits. The result of this has led to the majority of brand values suffering this year across the sector. The future is not bleak, however, brands with high levels of familiarity and reputation are likely to bounce back successfully as we begin the return to normality.”

Nestlé dominates food sector

Nestlé (brand value $19.4bn; BSI score 86.4 out of 100) once again leads the pack as the world’s most valuable and strongest brand in the Brand Finance Food ranking, which for the first time has been extended to 100 brands.

Despite the pandemic, the food giant posted its third consecutive year of organic growth, profitability, and return on investment capital.

According to Brand Finance’s Global Brand Equity Monitor, Nestlé increased its scores in the consideration metric, as well as improving its score for the community and environment metrics under the CSR measurement.

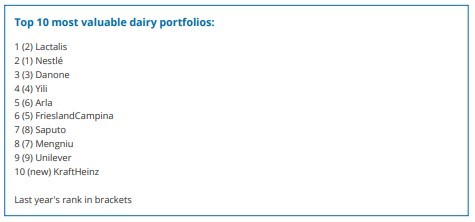

The Nestlé portfolio is also the most valuable food & drink portfolio, with a total brand value of $65.6bn. Despite the parent company underperforming compared with the previous year, it has been offset by the overperformance of some of its sub brands, particularly in the pet care and non-alcoholic drinks segments.

Yili posts healthy growth

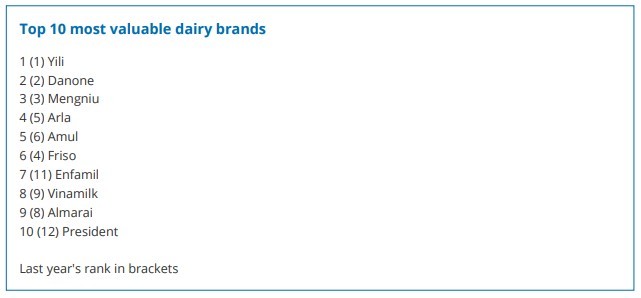

Yili tood the second spot overall, and repeated its top ranking as the world’s most valuable dairy brand, posting an 11% increase in brand value this year to $9.6bn and pulling even further ahead of previous sector leader Danone (up 5% to $8.2bn) in second place.

Despite the pandemic turmoil of the previous year, Yili has boasted strong sales growth, up 13% year-onyear, and the long-term forecast for the brand looks positive. The dairy giant has once again been striving towards new products and optimization, bolstered by innovation and long-standing R&D investment. This, paired with further expansion into new territories across Asia and overseas, has supported the brand’s strong growth.

According to Brand Finance’s Global Brand Equity Monitor, Yili scores very high for consideration compared to its peers. These solid results could be due to the brand’s focus on raising brand awareness, most notably through the sponsorship of the 2008 Beijing Olympics. Fellow Chinese dairy brand, Mengniu (down 10% to $4.8bn), has been implementing a similar strategy, previously sponsoring the 2018 FIFA World Cup, and more recently, signing the first-ever joint worldwide ‘TOP’ Partner agreement with the international Olympic Committee together with The Coca-Cola Company, that will continue until the 2032 Olympics.

Yili has the fourth most valuable dairy portfolio, with a total brand value of $9.6bn, an impressive performance given that Asian dairy brands have traditionally been outperformed by their international counterparts. Lactalis has overtaken last year’s leader, Nestlé, with a combined brand value of $11.4bn.

Every year, Brand Finance evaluates 5,000 of the biggest brands and quantifying their value, and publishes nearly 100 reports, ranking brands across all sectors and countries. The 25 most valuable soft drink brands, the 100 most valuable food brands, 10 most valuable dairy brands, and 5 most valuable chocolate brands are included in the report.

Brand value is understood as the net economic benefit that a brand owner would achieve by licensing the brand in the open market. Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Please see below for a full explanation of our methodology.