Much to the benefit of New Zealand, whole milk powder is faring better than other global commodities like crude oil at the moment, despite ongoing geopolitical uncertainty.

The global dairy trade auction late last week was the second since “Liberation Day”, when US President Donald Trump slapped baseline 10% tariffs on all its trade partners and more still on selected countries, a move that caused markets to veer wildly.

But the fortnightly auction saw dairy prices buck seasonal trends and lift 4.6% over the same time in mid-April, when they had gained 1.6% over two weeks prior to that. Average dairy prices this time were at US$4516/MT, while whole milk powder, the most important to New Zealand, gained 6.2% on the last auction, at US$4,374/MT.

One analyst called the leap in prices an anomaly, powered in part by supply constraints. But it led ANZ to lift its farmgate milk forecast for the 2024-25 and 2025-26 seasons to $10.00/kgms for each season, up from $9.85 and $9.00 respectively.

That in turn was a big increase on Dairy NZ’s estimated breakeven milk price of $7.51/kgms this season and $8.57/kgms next season.

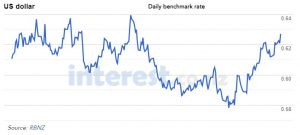

“This season has certainly been one to remember, with a rare trifecta of strong global dairy prices, strong domestic production, and a fairly weak [New Zealand dollar],” ANZ chief economist Sharon Zollner said.

Genuine demand

At the auction, prices were up across all products except mozzarella, which dropped 0.3%. Lactose saw the biggest lift with prices up 16.8%, followed by cheddar cheese up 12%.

Skim milk powder was flat on last month, up just 0.5%, while buttermilk powder, anhydrous milk fat and butter prices rose 6.2%, 5.4% and 3.8% respectively.

BakerAg dairy analyst Chris Lewis said a lift in commodities prices was expected in times of global uncertainty. But whole milk powder was faring better than other commodities, like crude oil, which has seen its average spot price forecast drop to US$59.24 per barrel next year from US$61.48 per barrel forecast in April.

“With the overlay of tariffs and genuine uncertainty, there is a changing demand for whole milk powder at the moment, which explains why the auction went up,” Lewis said.

That meant the current spike in dairy demand was “an anomaly rather than a trend”, Lewis said, as US dairy inventory in the first quarter of the year was down 0.3% on the same period last year and European production had slowed.

Zollner’s opinion concurred. She said “dark clouds over global growth mean it’s reasonable to assume some of this price strength will recede over the year ahead”.

Herd numbers

Cow numbers across China and the European Union have been dropping in recent years as milk producers faced reduced prices and high input costs, moving out of the sector.

Zollner said environmental constraints in Europe and profitability challenges for China’s dairy farmers meant New Zealand was likely to see high demand and high prices for now. But milk prices were forecast to start dropping next year in time for the 2026-2027 season.

Although the market was likely to see modest demand and prices as the season continued, she said current prices were “a useful shock absorber”.

“It is certainly good to be going into what could be more turbulent times from a position of strength.”

Red meat exports

Despite tariff turmoil, the US was still the biggest market for New Zealand sheepmeat and beef in the first quarter of the year, according to the Meat Industry Association (MIA).

Red meat export revenue came in at $3.28 billion in the first quarter of the year, up 28% on the same period last year, a “very positive” result, chief executive Sirma Karapeeva said.

The US remained Aotearoa’s biggest customer, snapping up $1.4b in red meat exports, followed by China which spent $832.5m on red meat between January and March.

Karapeeva said the full impact of US tariffs was still unclear for exports into the US or into any other markets. In the first two months of the year, there was a lift in sheepmeat out of the EU, recovery in sheepmeat prices in China and high demand for beef in North America.

“With the new US tariffs introduced in early April, we are yet to see what impact these are having on exports to the US,” she said.

Chinese beef demand remained subdued, with export volume in March down 35% on last March as the nation continued to import from South America.

“The one area where exports continued to be weak was beef to China, which was down 35% by volume and value compared to last March. This was largely due to China continuing to import large volumes of beef from South America.”

Tariffs not likely to shift sheep and beef demand

According to market analysis from Rabobank, sheepmeat exports into the US were likely to stay high as New Zealand and Australia supplied 98% of the country’s demand.

However, an existing US-Mexico-Canada Agreement (USMCA) meant all food and agricultural products were tariff-free between the three states, which was likely to keep Canada and Mexico at the top of America’s list of beef importers.

New Zealand supplied 12% of all US beef imports in 2024, while Canada and Mexico supplied 24% and 13% respectively, giving the latter a trade advantage over beef suppliers like New Zealand, Australia, Brazil and Uruguay, report authors Stefan Vogel and Angus Gidley-Baird said.

But the US was seeing its smallest beef cattle herd in more than 70 years, beef production was forecast to contract further in the next two years and “tariffs are not expected to accelerate the struggling US cattle herd’s rebuilding process”, Vogel and Gidley-Baird said.

It meant there would be strong demand in the US for beef in the next two years, and furthermore, retaliatory tariffs by Trump on key trade partners like South Korea, Japan and China meant those markets were likely to be looking at transacting more with the likes of New Zealand and Australia.

Sheepmeat exports to the US were forecast to remain unchanged. Aotearoa provided 23%-25% of American sheepmeat imports. Meanwhile Australia supplied around 75%, with Chile, Canada and Mexico supplying 1-2%.

“As long as US consumption of sheepmeat continues at current levels, Australia and New Zealand are expected to maintain export volumes into this market,” Vogel and Gidley-Baird said.

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K