Global dairy prices have retreated and reached usual averages, but farmers shouldn’t expect a repeat of milk payouts of the past two seasons.

That’s the view of ASB economist Nathaniel Keall, who notes that prices for both whole milk powder (WMP) and the Global Dairy Trade (GDT) index as a whole are now roughly at or even slightly above their usual averages.

“That said, because of the timings of Fonterra’s shipment profile and the period prices are typically struck, about 60% of product has already been priced and farmers won’t see all of the benefit,” says Keall.

“Hence why both ASB’s own forecast ($7.35/kgMS) and the midpoint of Fonterra’s guidance range ($7.50/kgMS)) remain substantially below the prices farmers received during the last two seasons.”

Fonterra farmers received a milk price of $9.30/kgMS in 2021-22 and $8.22/kgMS in 2022-23 respectively.

Having managed to claw back-ground at six of the last eight auctions, the GDT index is now about 20% above its low during August, notes Keall.

Fonterra’s biggest market, China is still struggling to recover from Covid lockdowns and their impact on the economy.

Keall says interestingly, China is also still proving relatively absent from the GDTs. The ‘North Asia’ region took 46% of the product on offer, still well below typical levels.

“While Chinese WMP inventories have eased and the domestic economic outlook is looking brighter, it’s worth remembering that the Chinese economy is still expected to grow at a below-trend rate next year – not a particularly conducive environment for dairy prices.

While there may be a limit to how far prices will rise without a more sustained increase in Chinese demand, interest from other regions – namely Southeast Asia and the Middle East – is still clearly proving strong enough to support prices, particularly in an environment where supply is looking mixed (decelerating in Europe; strong for now in NZ, but with El Nino conditions anticipated over summer).

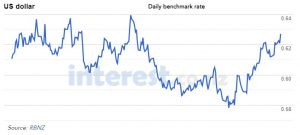

While the NZD has ground back up towards six-month highs lately, Fonterra is likely to be already close to 90% hedged for the season, limiting the impact on its effective exchange rate for the season.

Keall says ASB is sticking to its forecast and will re-examine “the lay of the land in the new year when we know how conditions over the summer are shaping up”.

“In general, a price at – or slightly above – Fonterra’s guidance midpoint of $7.50 per kgMS certainly looks achievable at this stage, without prices needing to build on their present gains by all that much.”