Bongards Creameries has just approved another $125 million expansion that will allow for more intake of milk and higher production of cheese and whey.

It’s soon expected that the average American will devour 40 pounds of cheese each year.

To put that into perspective, that’s about 960 slices of American cheese annually — or more than 2.5 slices a day.

Bongards Creameries is one of the cheese producing companies in the region that has a handsome slice of that growing cheese market. In the past decade they’ve grown their sales and production capabilities. Expansions at their milk intake location in Perham, as well as their Humboldt, Tennessee, processing plant continue to help support consumers’ need for cheese.

“We’ve been on a huge growth trajectory,” Bongards Chief Revenue Officer Scott Tomes said. He’s coming up on 10 years with Bongards and 35 years in the food industry. “When I took over running the company 10 years ago, you know, we were doing about 108 million pounds of value-added sales, and now we’re up over close to 250 million pounds, so it’s significant.”

While cheese demand rises, sales of liquid milk keep falling.

“But cheese is still a very high growing category, especially natural cheese,” Tomes said.

U.S. Department of Agriculture reports back that up with data showing an almost constant increase in cheese consumption since 1975. Average consumption of cheese in 1975 was 14.2 pounds per person. In 2021, consumption was 38.4 pounds. The growth has been shown in both American-type (cheddar, colby, Monterey, Jack and washed or stirred curd) and others. Cottage cheese is the one outlier that has seen a steady decline.

“The U.S. consumer continues to eat more cheese,” Tomes said. “A lot of that is driven by natural because it’s perceived better, but even processed has got growth with it as well.”

To keep up with demand, Bongards has beefed up their production and squeezed everything they can out of the product.

Cheese demand

What is helping the growth in cheese demand is that businesses like Bongards provide an increasing variety of cheeses that can be eaten for breakfast, lunch, dinner and snacks. They continue to find ways to add value to this coagulation of proteins and fats.

“At the end of the day it’s a very wholesome, nutritious product,” Tomes said.

Processed cheese has been around a long time, but what must change is the offering that cheese processors can provide to their customers, Tomes explained. As a brewery must constantly entice patrons with new concoctions, the cheese business must make a cheese for each specific use a customer can come up with. If they want ghost pepper, or a certain smoke flavor, maybe it needs to have a high or low melting point, they research and develop their way into a cheese that matches the needs.

Since their rebranding of Bongards about 10 years ago, they put the emphasis on cheese and started building relationships in the service industry.

Bongards has a retail presence in Minnesota, Wisconsin and Iowa, but it’s the service foods sales that make up 99% of their sales. Large franchises like McDonalds, Panera, Burger King, Sonic and Chipotle may not promote that it’s Bongards cheese in their meals, but it is, according to Tomes.

Perham processing plant

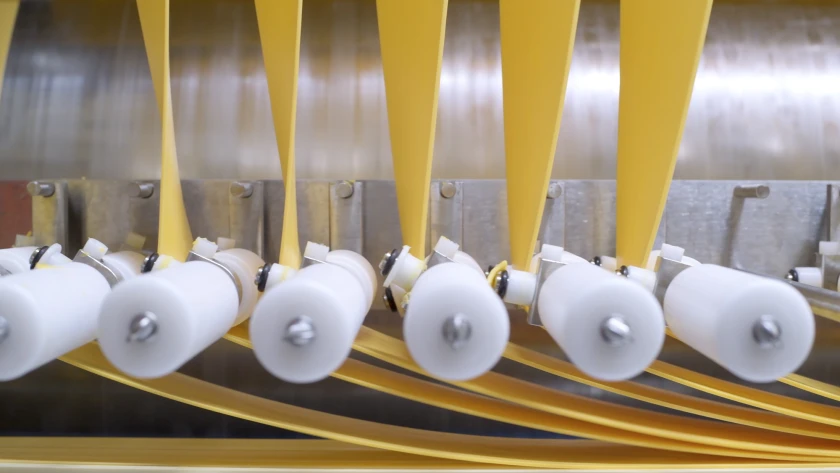

In Perham, where all Bongards milk is delivered, liquid milk becomes either 500-pound natural barrels that are processed at the other Bongards processing locations in Humboldt, Tennessee, and Bongards, Minnesota, or 40-pound natural blocks that are sold to various customers.

The Perham plant produces 3 million pounds of cheddar, Monterrey Jack, Colby Jack, reduced fat and mozzarella per week.

On top of making cheese, the Perham plant also makes whey protein powder, the stuff body builders use to bulk up. Another byproduct of the milk is a deproteinized whey powder that can be used in bakery products, dry mixes and snack foods. A large amount of this powder is shipped to China to help grow piglets.

Daryl Larson, president and CEO of Bongards, is the former vice president of natural cheese and manager of the Perham plant. He said Bongards’ ability to grow efficiently is key to their success. His many years with Land ‘O Lakes, Leprino Foods, DFA and Agropur, along with Bongards for the last 11 years, give him quite a perspective on the dairy industry.

“I knew the Perham plant had a lot more capabilities than it had ever been utilized for,” Larson said of the growth they have seen in the last decade.

He recalls that the Perham plant was taking in about 1.7 million pounds of milk a day prior to an expansion that was completed in 2015. After that, they were able to take 4.2 million pounds of milk a day.

“There was minimal staff added,” Larson said. They only had to add about 10 hourly positions to bring the total to about 130 employees, while more than doubling intake. The technologies they brought in helped to automate part of the process and increased cheese yield, according to Larson.

The main addition at that time was a new cheese belt, 40-pound block towers, a whey packaging facility, a whey warehouse, as well as expansion of the entire cheese/whey plant to handle the additional volume.

Less than 10 years later, the company is ready for another expansion, this time a $125 million project that will take the throughput up to 5.5 million pounds of milk per day.

“So that’s another 33% increase in throughput,” Larson said.

Justin Larson, Perham plant manager and son of Daryl, said the expansion includes a deproteinized whey drier that has more capacity than the plant can currently handle.

“It’s kind of setting us up for in case, in the future, we want to proceed with another expansion,” Justin said.

This work has already begun as it’s a multi-year project. It has an expected completion of June 2025. The new whey drier equipment alone is a two-year build. Another major change will be a new milk intake to streamline the milk unloading process, adding three additional truck unloading bays.

“And then really touching every piece of the plant to increase the capacity all through the plant to be able to handle 5.5 million pounds of milk instead of the 4.2 (million) that we are maxed out at now,” Larson said.

This expansion adds roughly 53,000 square feet to the facility. That’s enjoyable for Justin, who considers himself lucky to be able to work with the latest in technologies.

“For me it’s pretty amazing to see what this plant’s done,” Justin said. “It’s pretty exciting to be a part of that growth. And then ultimately it’s for member owners. They are going to get to come back and see the plant and have something that they can be very proud of.”

Other recent builds include an expanded refrigerated warehouse capacity in 2022 and a replacement of existing cheese vats and evaporator in 2023.

“The investments that we are making are made to insure we remain competitive in the marketplace and continue to be the best milk market possible for our member owners,” Daryl Larson said.

Growing milk intake

Bongards Creameries started out in 1908 in Bongards, Minnesota. Bongards Cooperative is made up of 181 direct members of Bongards, and 93 members of cooperatives that are members of Bongards. All but one of the total 274 members that ship their milk are Minnesota farms, with one farm in North Dakota. Larson said there is a waiting list of producers interested in selling their milk to the cooperative. The expansion will allow more farms to join the cooperative.

“There’s a lot of people that would love to sell their milk to us and, frankly, there is a lot of our current members that want to expand,” Larson said. “So those two things, along with the knowledge that the current expansion will drive increased efficiencies in the Perham plant that will benefit our member owners drove a decision to increase our capacity. We will be able bring on some new members and allow some current members to expand, where if we didn’t bring on the capacity we wouldn’t be able to take anymore milk. We’re full.”

Tomes said Bongard’s goal is to pay their milk producers the highest price they can. Larson said this area is a great place to produce milk, so it remains a great place to make and process cheese. It’s up to them to continue to find ways to add value to the abundant resource.

“We just need to continue to stay as efficient as the best processors out there so we can compete,” Larson said.

As long as they can keep the cheese coming, it won’t take much to keep Americans from piling it on higher.