The complaint claims DFA is “an aspiring monopolist” that will compel cooperatives and independent dairy farmers to either join DFA or cease to exist. This harm will be particularly strong in the areas around milk processing plants in North Carolina and South Carolina. This is where Maryland and Virginia Milk Producers Cooperative Association is DFA’s only significant remaining competitor for the supply of raw milk and plaintiff Food Lion is one of the largest retailers selling milk, the lawsuit says.

“With capability to wield market power at two levels of the supply chain, DFA now has both the ability and the incentive to wipe out any remaining pockets of competition,” the suit said.

The antitrust concerns that have clouded DFA’s purchase of Dean Foods since before the sale was approved continue to surface.

The lawsuit said DFA’s ownership of Dean’s milk plants is the “coup de grâce for competition” in fluid milk markets. The plaintiffs argue this deal will lead to a DFA monopoly over the dairy supply chain, the death of the independent, family owned dairy farms and higher prices for consumers, especially during the current pandemic. The concerns in the suit echo issues farmers and shareholders have already expressed about the deal.

The plaintiffs are requesting the court grant a preliminary injunction to block the sale and want DFA to divest at least one of the legacy Dean facilities in the Carolinas to an unaffiliated independent purchaser.

It may be difficult for the plaintiffs to win this case because the U.S. Justice Department already approved the deal. After a highly criticized bankruptcy sale, the DOJ’s antitrust division approved the purchase of the majority of Dean Food’s assets by DFA just three weeks ago. A condition of the deal is that DFA will need to divest three dairy processing plants in Illinois, Wisconsin and Massachusetts because of antitrust concerns. It did not identify any facilities in the Carolinas.

Food Lion and the producers cooperative are not the only ones that have expressed concern about the future of the industry. As talks about a deal between DFA and Dean started back in November after it filed for bankruptcy, stakeholders were already raising red flags about potential competition issues. Before the sale was approved, Dean dropped DFA from serving as the lead bidder after complaints from creditors. But the bankruptcy court still approved DFA as the winning bidder to 44 of the company’s fluid and frozen facilities for $433 million. Soon after, more than 100 objections were filed opposing the sale, Hoard’s Dairyman reported.

Since Dean, which had 57 manufacturing facilities and a broad portfolio of milk and dairy brands before the sales, is DFA’s biggest customer, farmers and others are worried about what consolidation will do to an industry that has already been struggling with demand and debt. I

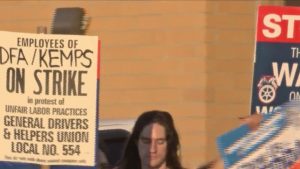

Farmers in the past have filed class action lawsuits against Dean, DFA and others for violating antitrust laws. Although the companies didn’t admit wrongdoing, Dean and DFA have settled for millions of dollars. This latest lawsuit isn’t the first and likely won’t be the last DFA faces.

The new suit argues that for the last two decades, DFA has rapidly consolidated and dominated the market for the supply of raw milk through “unlawful conduct and anti-competitive agreements,” gaining near-complete control over the purchasing of key milk processors across the country. If the plaintiffs can prove its case, then more lawsuits could be coming.

“This anti-competitive campaign has allowed DFA to transform itself from a modest regional dairy cooperative into the Standard Oil of the modern dairy industry,” the lawsuit said.