The USDA released its latest Ag Prices report on April 30, including factors used to calculate monthly DMC margins and payments. The actual March margin had not yet been posted by the USDA, but based on preliminary estimates by Progressive Dairy, the March DMC milk income over feed cost margin is just $6.46 per hundredweight (cwt), a slim 24-cent improvement over February 2021 and the fourth time the monthly margin has been below $7 per cwt in the past 12 months, when the onset of the COVID-19 pandemic sent milk prices plummeting.

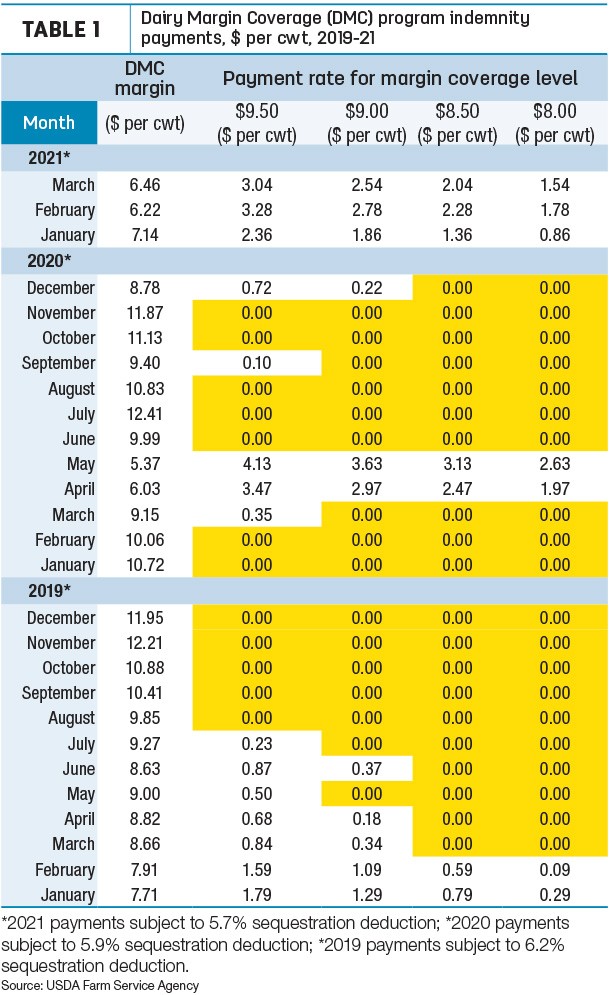

At that level, the March margin triggers indemnity payments on Tier I and Tier II milk insured at all levels above $6.50 per cwt. Those with Tier I (5 million pounds or less of covered production history) who are insured at the top level of $9.50 per cwt will see a payment of $3.04 per cwt, following payments of $3.28 and $2.36 per cwt on February and January milk marketings, respectively (Table 1).

For those insured under Tier I and at $9.50 per cwt, the March DMC payment would equal about $2,400 for each 1 million pounds milk covered, or about $2,270 after the sequestration deduction, according to Zach Myers, risk education manager with Pennsylvania’s Center for Dairy Excellence. The payments are on one-twelfth of a dairy operation’s covered annual production history, and DMC payments are subject to a 5.7% sequestration deduction in 2021.

Milk price improves only slightly

The low income margin in March resulted from U.S. average milk prices that struggled to improve, along with increased overall feed costs.

The March 2021 announced U.S. average milk price rose 30 cents from February to $17.40 per cwt.

Among major dairy states, March milk prices were slightly higher than February in every state except California (Table 2). The biggest increases were in Kansas, New Mexico and Texas. Even with the increase, however, the lowest announced price in March was again in New Mexico. In contrast, March prices hit $20 per cwt or higher in Florida and Oregon.

Not included in the all-milk price calculations is the impact of negative producer price differentials (PPDs) on producer milk checks. March PPDs were again negative in six of seven applicable Federal Milk Marketing Orders (FMMOs).

PPDs have zone differentials, so they’ll vary slightly within each FMMO. In addition, PPD impacts on individual milk checks are based on individual milk handlers.

Feed prices higher

On the cost side of the ledger, U.S. average feed costs to produce milk in March continued to rise to seven-year highs, even though the average cost of soybean meal softened somewhat.

The average price for a blend of Premium and all alfalfa hay used in DMC calculations was $195.50 per ton, up $7 per ton from January.

Compared to a month earlier, the average price for corn jumped another 14 cents to $4.89 per bushel, the highest in the history of DMC and its predecessor, the old Margin Protection Program for Dairy (MPP-Dairy).

Helping offset some of the increased prices for alfalfa hay and corn, the average cost of soybean meal dipped another $17 in March. At $410.02 per ton, the March average was down more than $29 from January, but still the third-highest monthly average since December 2014.

Those feedstuff prices yielded an average DMC total feed cost of $10.94 per cwt of milk sold (Table 3), up 6 cents from February and the highest since June 2014, under MPP-Dairy.

Indemnity payments likely to continue

The April 2021 margin and any indemnity payments will be announced May 28. Based on current market conditions, DMC could pay monthly indemnity payments throughout 2021. Using the DMC Decision Tool, monthly average feed costs are expected to top $11 per cwt in April-May and September-December and be above $12 per cwt in June-August. That would require all-milk prices to surpass $21 per cwt to halt DMC payments.

Production history adjustments still pending

There’s still been no word from the USDA regarding when adjustments to annual milk production histories for smaller producers will be applied. Approved in last December’s COVID-19 relief bill, the provision allows smaller dairy producers to update their milk production history baselines and receive a supplemental DMC payment on a portion of any increased milk production.

The adjusted milk production baseline, capped at 5 million pounds per year, is effective January 2021 through the life of the current farm bill and DMC program, ending in 2023.

Not all of the increase in the production history will be eligible for a supplemental payment. The bill limits that payment to cover 75% of the difference between an eligible dairy operation’s actual 2019 milk production and its previous DMC milk production history.

Once the USDA Farm Service Agency (FSA) determines a sign-up period, eligible producers must contact their FSA office with 2019 actual milk production records if they wish to adjust production history on an existing operation. Those eligible to cover additional milk under the DMC production history adjustment must already be enrolled in DMC for 2021.

Any increase in milk production history covered under DMC also means the producer will have to pay the additional margin insurance premiums on that milk.