After setting a three-decade high in March, April U.S. dairy cull cow marketing returned to a more normal pace.

The number of dairy cull cows marketed through U.S. slaughter plants was estimated at 243,600 in April 2023, up 5,800 from April 2022 but 62,500 fewer than March 2023.

April 2023 had 25 non-holiday weekdays and Saturdays, two less than March 2023 and one less than April 2022. Slaughter averaged 9,700 head per day, a six-month low.

The USDA estimated there were 9.43 million dairy cows in U.S. herds in April 2023, down 16,000 from March and putting the April culling rate at about 2.6%. Year-to-date (January-April) dairy cull cow slaughter now stands at 1.114 million head, up 51,800 from the same period a year earlier.

Heaviest dairy culling during April occurred in the Southwest (Arizona, California, Hawaii and Nevada), at 60,900 head, and Upper Midwest (Illinois, Indiana, Michigan, Minnesota, Ohio and Wisconsin), at 55,400 head.

Other monthly regional totals were estimated at 32,200 head in Delaware, Maryland, Pennsylvania, West Virginia and Virginia; 32,300 head in Arkansas, Louisiana, New Mexico, Oklahoma and Texas; and 34,600 head in Alaska, Idaho, Oregon and Washington.

Primary data for the USDA’s Livestock Slaughter report is obtained from reports from about 900 federally inspected plants and nearly 1,900 state-inspected or custom-exempt slaughter plants.

U.S. farm wages up another 5%

April 2023 U.S. gross farm wages were up 5% compared to a year earlier, according to the USDA’s latest Farm Labor report. Farm operators paid their hired workers an average of $18.08 per hour during the reference week (April 9-15, 2023). Among individual worker categories:

- Field workers received an average of $17.26 per hour, an increase of 5%. Workers in California and Lake and Northern Plains (North Dakota South Dakota, Nebraska and Kansas) states earned an average of more than $19 per hour.

- Livestock workers earned $16.48 per hour, up 4%. Highest averages were in California and Pacific states, but average wages also topped $17 per hour in Corn Belt II (Iowa and Missouri) and Mountain I (Montana, Idaho and Wyoming) states.

- The field and livestock worker combined wage rate, at $16.99 per hour, was up 4%. Outside of highest averages in California and Pacific states, wages averaged more than $17 per hour in Lake, Corn Belt I (Illinois, Indiana and Ohio) and Corn Belt II and Northern Plains states.

The quarterly USDA survey analyzes workers numbers and wages in January, April, July and October.

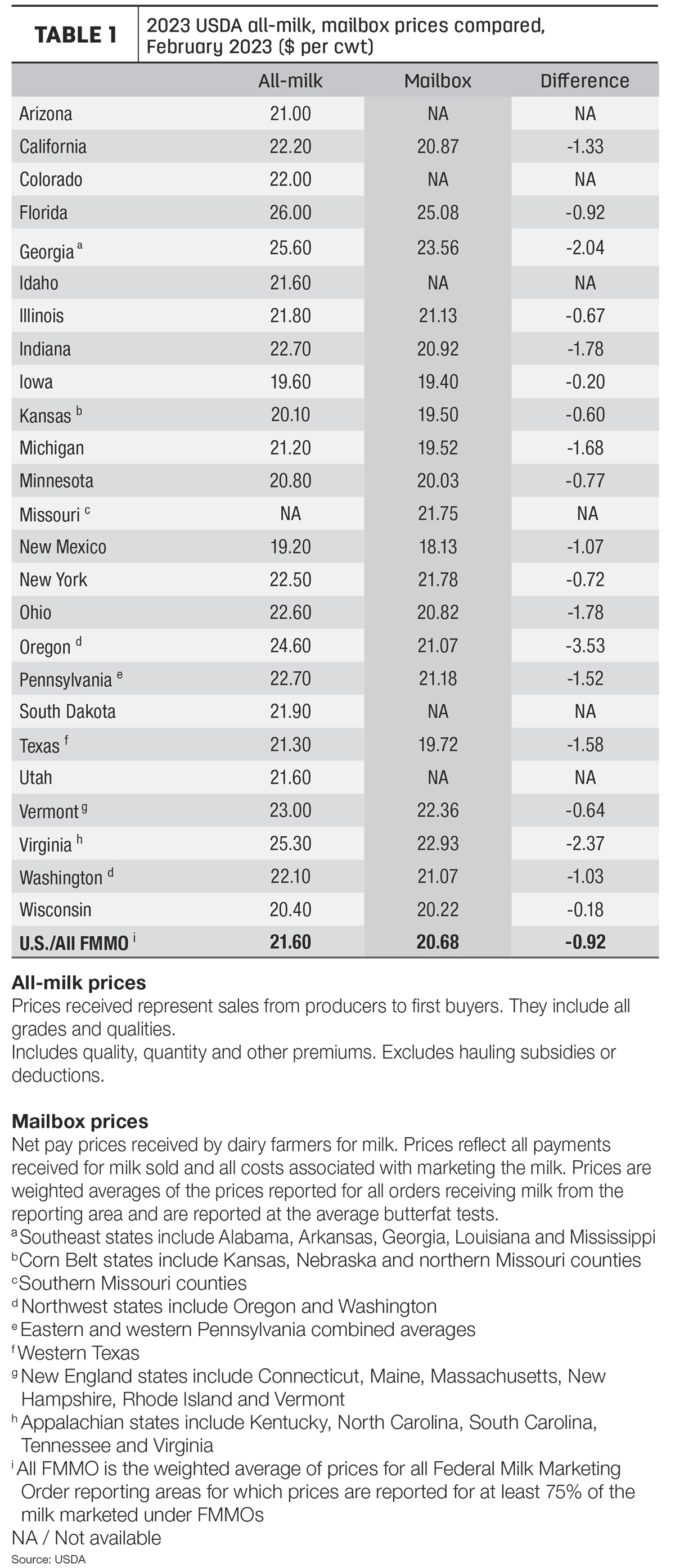

All-milk, mailbox price spread widened in February 2023

The gap between February 2023 average “mailbox” prices and the comparable “all-milk” prices widened to about 92 cents per hundredweight (cwt), up from 82 cents in January. Based on a preliminary look at two USDA milk price announcements (Table 1):

- During February 2023, U.S. all-milk prices averaged $21.60 per cwt, down $1.50 per cwt from January.

- The February 2023 mailbox prices for selected Federal Milk Marketing Orders (FMMOs) averaged $20.68 per cwt, down $1.60 per cwt from the month before.

All-milk prices are reported monthly by the USDA National Ag Statistics Service (NASS). The all-milk price is the estimated gross milk price received by dairy producers for all grades and qualities of milk sold to first buyers, before marketing costs and other deductions. The price includes quality, quantity and other premiums, but hauling subsidies are excluded.

The mailbox price is the estimated net price received by producers for milk, including all payments received for milk sold and deducting costs associated with marketing. Mailbox prices are reported monthly by the USDA’s Agricultural Marketing Service (AMS) and generally lag all-milk price announcements by a month or more.

The price announcements reflect similar – but not exactly the same – geographic areas.

The difference in the two announced prices can affect dairy risk management, since indemnity payments under the Dairy Margin Coverage (DMC) are based on the all-milk price, while Dairy Revenue Protection (Dairy-RP) and Livestock Gross Margin for Dairy (LGM-Dairy) programs are based on FMMO class and component prices.