The Argentine dairy industry is grappling with significant challenges this year brought about by the country’s economic crisis, according to the most recent United States Department of Agriculture Foreign Agricultural Service global dairy report. The combination of inflation in domestic inputs and government instituted foreign exchange controls (restrictions on capital outflows, controls on foreign debt payments, etc.) have wide-ranging impacts on milk production, export competitiveness, and domestic consumption, and is reshaping the industry’s landscape in the short run.

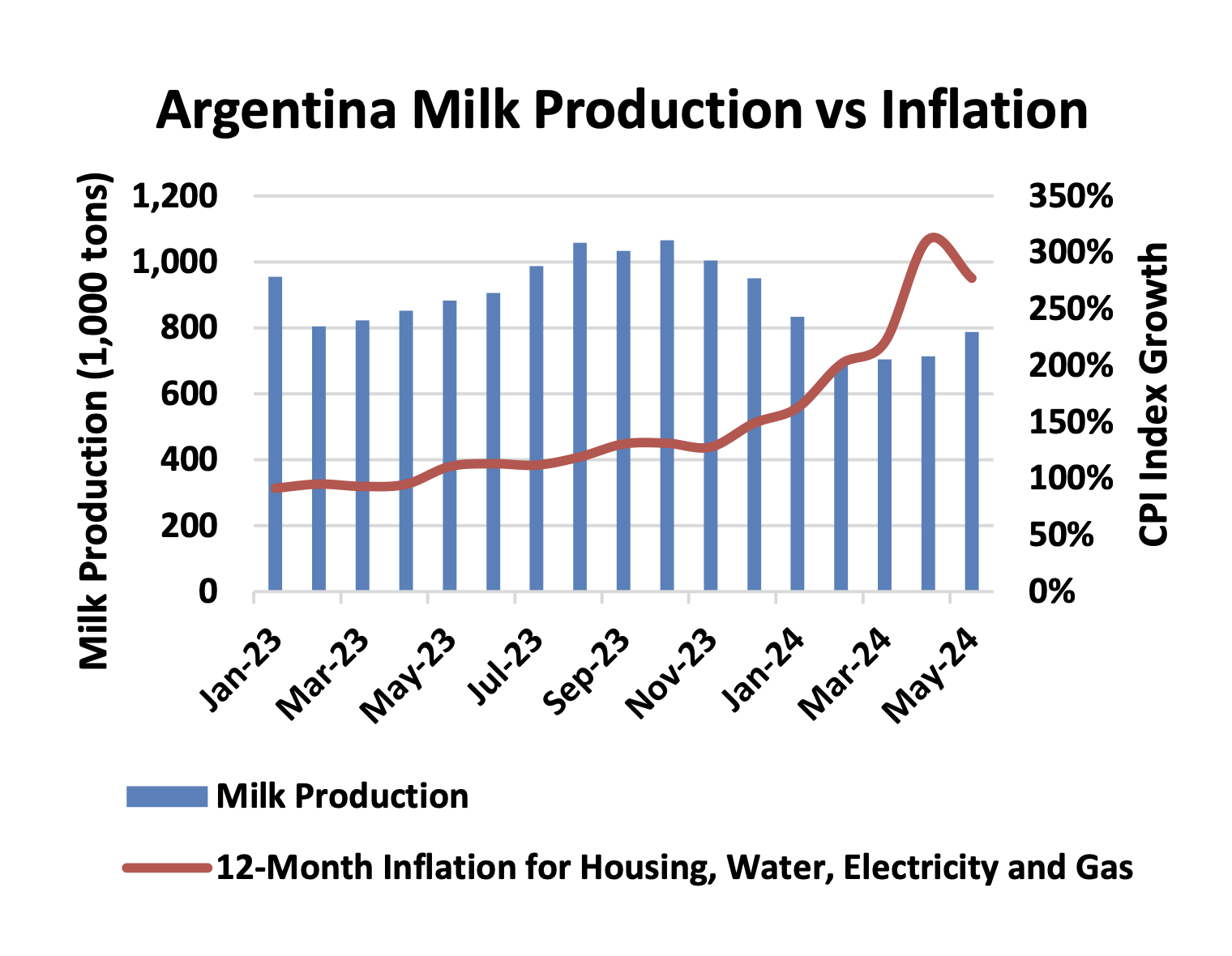

Argentine dairy farmers depend heavily on largely domestically produced inputs, including feed, machinery, and fuel. The increased financial burden has forced many to cut production or seek additional capital, with many operating at a loss. As a result, year-to-date milk production in Argentina has declined precipitously.

From January through June 2024, Argentina milk production fell 13% from the same period in 2023. In 2023, milk production totalled 11.7 million tons, but this figure is forecast to fall 7% to 10.8 million tons. The abrupt drop in production in early 2024 led to a rapid recovery in milk prices, which supports expansion in production during the second half of the year. The consistent decrease in production over the past 5 years highlights the sector’s struggle to maintain output levels amidst rising costs and economic instability.

Conversely, the currency devaluation has made Argentine dairy products more competitive in the global market. A weaker peso translates to lower prices for foreign buyers. Exchange rates and inflation were so disadvantageous to domestic producers that it raised significant uncertainty as to whether traders would sit on inventories or if there would be a rush to secure foreign currency, notably in US dollars. Dairy export volumes increased 10% in the first 5 months of 2024 compared to the same period in 2023. Notably, cheese exports are forecast to rise from 85,000 tons in 2023 to 100,000 tons in 2024.

Domestically, the economic situation remains challenging. The rise in production costs has led to higher prices for dairy products on the domestic market. With inflation eroding consumer purchasing power, many families are struggling to afford basic food products, leading to a decline in forecast domestic consumption. Domestic fluid milk consumption in Argentina is forecast to fall to 1.6 million tons in 2024, 7% below 2023. Falling consumption of all dairy products poses a significant challenge for the industry. Producers are faced with the choice of focusing on the more lucrative export markets or continue serving the increasingly price-sensitive domestic market.

In response to these challenges, the Argentine government has introduced several measures to support the dairy sector. In December 2023, the government reopened agricultural export registrations as part of a broader strategy to boost exports and generate foreign currency revenue. The same month, the government also introduced a “blended” exchange rate for agricultural exports, which combines the official exchange rate with an unofficial local exchange rate. This approach has provided a more favorable rate for exporters, enhancing their competitiveness in international markets.

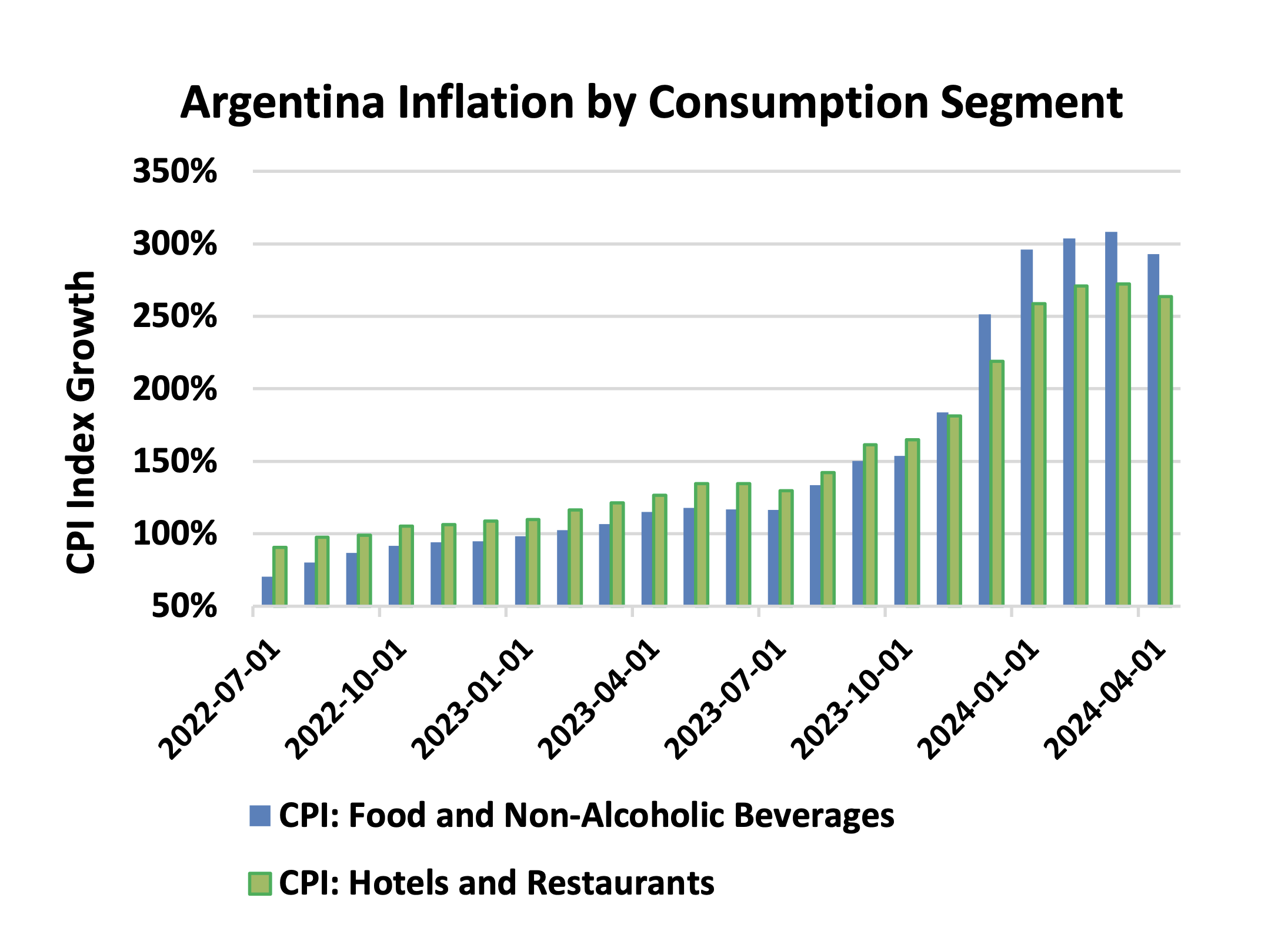

The effectiveness of these measures remains uncertain, as the broader economic environment continues to present significant challenges. While measures to support dairy exports have largely shown positive benefits, measures aimed at helping to address inflation have been mixed. Argentine consumers are still grappling with annualised inflation rates of nearly 300% for food and non-alcoholic beverages, including milk, and expected to continue to limit growth in domestic dairy demand.

You can now read the most important #news on #eDairyNews #Whatsapp channels!!!

🇺🇸 eDairy News INGLÊS: https://whatsapp.com/channel/0029VaKsjzGDTkJyIN6hcP1K