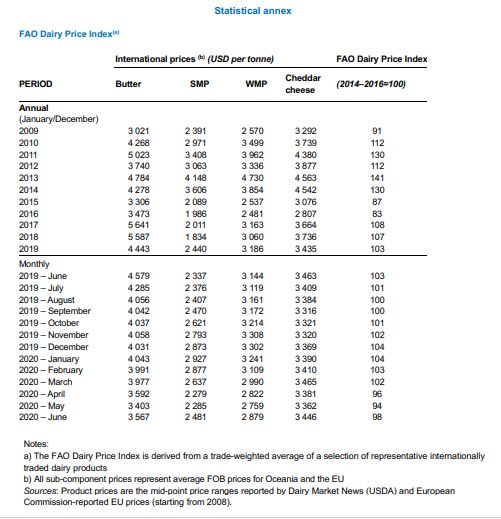

Dairy prices rebounded in June after four months of consecutive declines

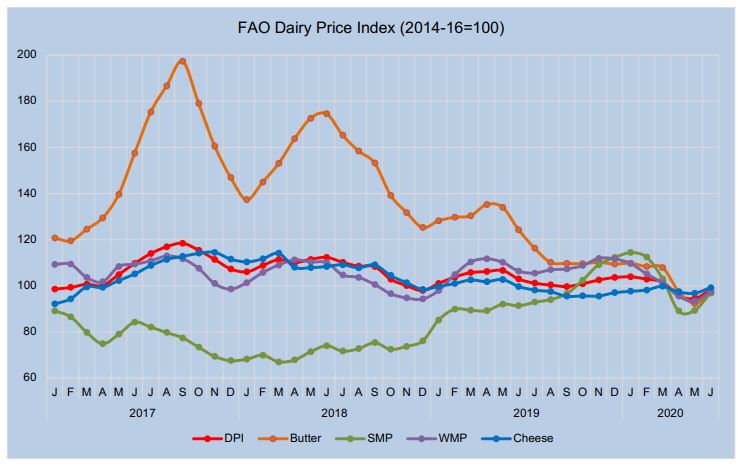

The FAO Dairy Price Index (2014-16)1 averaged 98.2 points in June, gaining 3.8 points (4.0 percent) from May after four months of consecutive declines, but remained 4.6 percent below the corresponding month last year. June’s increase in the index was principally caused by a renewed import demand for spot supplies, especially from the Middle East and East Asia, following the easing of COVID-19 related lockdowns and transport bottlenecks. Relatively limited export availabilities from major exporting regions also provided support to prices. In Europe, milk production began seasonally declining while internal demand saw an increase in view of improved prospects for the resumption of food services sales with the easing of COVID-19 related social distancing and travel restrictions. In Oceania, milk production has reached its seasonal lows with most dairy cows dried off, while available supplies are already committed leaving little for spot supplies.

In June, skim milk powder (SMP) quotations rose the most, principally driven by a rebound in import demand from the Middle East for spot supplies. Relatively competitive prices and proximity to European supplies appear to have been principally behind an 11.6 percent increase in European SMP prices to USD 2 424 per tonne compared to a 3 percent increase in Oceania prices to USD 2 600 per tonne. Import demand for whole milk powder (WMP) too saw a rebound, especially from East Asia for supplies from Oceania amid WMP production remains seasonally low, notwithstanding the fact that much of the available milk is moving to WMP production. Butter prices saw a revival amid an increase in internal demand with the easing of COVID-19 travel restrictions and importers seeking the relatively lower priced European supplies. After two months of declines, cheese prices slightly increased in June, reflecting high import demand coupled with somewhat limited export availabilities.

Notwithstanding the rebound in the index value in June, the FAO Dairy Price Index remained 5.7 points (5.4 percent) below its level in January, when the index registered its highest value during the last 12 months. Before June’s price revival, the overall dairy index fell consecutively for four months, shedding 9.4 points (9.1 percent) from January to May, reflecting the impact of COVID-19 on global dairy markets. Across dairy commodities, from January to May, SMP prices fell the most (-21.9 percent), followed by butter (-15.8 percent) and WMP (-14.9 percent). In dairy importing countries, COVID-19 related lockdowns and social distancing measures led to market disruptions; transport bottlenecks, especially port congestion and delays in port cargo handling, also made importing more difficult, contributing importers to delay their purchases. Economic uncertainty and loss of income are widely believed to have contributed households to reduce purchasing dairy products – a group of food commodities whose demand is known to fall disproportionately when household incomes fall. In exporting countries, reduced sales of milk and milk products, especially fresh milk, led producers to divert higher than usual volumes of milk into powder manufacturing, a process that is less labour-intensive, adding to already existing powder stocks, putting downward pressure on its export prices.

The situation was made more difficult in the producing countries in the Northern Hemisphere, as milk production was in its seasonal peak, especially from March to May. Cheese price quotations, however, only slightly (-0.8 percent) declined from January to May, as import demand remained relatively strong amid concerns over labour shortages having possible negative impact on cheese production and export availabilities.

Revision to the FAO Food Price Index

The FAO Food Price Index (FFPI) is a measure of the monthly change in international prices of a basket of food commodities.

It consists of the average of five commodity group price indices weighted by the average export shares of each of the groups.

The base period for the calculation of the index has been revised to 2014-16 from 2002-2004 along with changes to price coverage revisions to food commodities represented in the index, which are explained in a feature article published in the June 2020 edition of the Food Outlook. A November 2013 article contains technical background on the previous construction of the FFPI.

Following this revision, the FAO Dairy Price Index (FDPI), a measure of the monthly change in international prices of four dairy commodities – butter, cheese, skim milk powder (SMP) and whole milk powder (WMP) – has been rebased to 2014-16.

In addition, the cheese sub-component has been revised to include the European Union (EU) cheddar cheese prices, starting from 2008, given the large share of the EU in global cheese exports. Butter, SMP and WMP subcomponents were redefined to include European Commission-reported EU prices, starting from 2008. Review of the dairy price index found EU export prices before 2008 were found to be heavily influenced by the intervention regime for butter and SMP; therefore, it was decided to remove EU dairy prices prior to 2008 from the index. Comparing the revised index with that of the previous index, it was found that the revised index has an Ordinary Least Squares (OLS) error of 3.7 percent in almost 12 percent of the observations and turning points do not correspond. However, the revised index is considered to be more representative of market and trade conditions than the previous index.

Policy update

This review provides an update to policy measures related to domestic production and international trade of milk and milk products, covering the period from December 2019 to end of June 2020.2 Measures-related to production

Argentina: measures related to COVID-19

In April 2020, the Government of Argentina introduced a decree, numbered 418/2020, aiming to compensate retailers for part of the cost of freezing the price of certain dairy products to contain inflation and sustain consumption during the COVID-19 lockdown.

Canada: increases to farm gate milk prices, butter storage fees and support prices

On 1 February 2020, the Canadian Dairy Commission (CDC) raised: 1) farm gate milk prices by 1.93 percent; 2) butter storage fees, leading to a 2.2 cents increase per kilograms of butter at the retail level; and 3) butter support price by 2.54 percent from CAD 8.3901 (USD 6.32) per kilogram to CAD 8.6034 (USD 6.48) per kilogram. These changes were introduced on the basis of a survey conducted in October 2019, identifying changes in costs of milk production and dairy product processing for the 12-month period ending October 2019. According to the survey, within that year, milk processing costs have increased by 4.0 percent, while the consumer price index for dairy products has risen only by 1.6 percent since 2014, putting producers in a disadvantaged position. Moreover, the Commission noted that there is a need to increase butter stocks to satisfy an expected rise in demand. Increased butter storage fees and the rise in the price of raw milk is estimated to results in an average increase of 1.97 percent in the price charged to processors. The Commission noted that the impact of the price adjustments on retail prices will depend, among others, on costs of manufacturing, transportation, distribution and packaging throughout the supply chain.

Canada: measures related to COVID-19

In March 2020, in view of the impact of COVID-19, Canada authorized Farm Credit Canada (FCC) to extend up to CAD 5 billion (USD 3.6 billion) additional loans to agricultural and food businesses. These funds can be used to defer principal and interest payments up to six months for existing loans, or defer principal payments up to 12 months, or provide access to a 24-month credit line of up to CAD 500 000 (USD 359 000). This credit extension was intended to provide flexibility to manage cash flow issues faced by Canadian farmers, food processors and agribusiness during the COVID-19 pandemic.

On 5 May 2020, Canada announced the allocation of CAD 252 million (USD 179.5 million) to assist Canadian farmers and food processors to cover losses from reduced demand due to COVID-19 lockdowns. The funds were earmarked for: 1) purchasing equipment and supplies, for example, masks to keep workers safe in meat processing plants or those harvesting food; 2) providing assistance to those in the food supply value chain, for example, to collect crops in the field or bring animals to slaughter; and 3) buying surplus food that processors and producers are unable to sell due to the closure of restaurants and disruptions to the value chains and distributing them to food banks.

In May 2020, Canada increased the borrowing limit of the Canadian Dairy Commission (CDC) to CAD 500 million, (USD 358 million) from CAD 300 million (USD 215 million), to take effect from 31 July 2020, to fund the purchase and storage of surplus butter and cheese from farmers and processors during the pandemic. The measure aimed to mitigate unpredictable shifts in domestic milk supply and demand due to the impact of COVID19. The CDC deploys part of its borrowing limit for bulk purchases of surplus butter stocks and the balance to pool farmers’ revenue. The use of funds is subject to Treasury Board approval. In a typical year, CDC purchases butter in the spring when milk production exceeds demand and sells back to dairy processors in the fall when consumption rises. CDC purchases have been rising in recent years, but COVID-19 Pandemic led to reduced sales, requiring increased purchases, including cheese.

The European Union: measures related to COVID-19

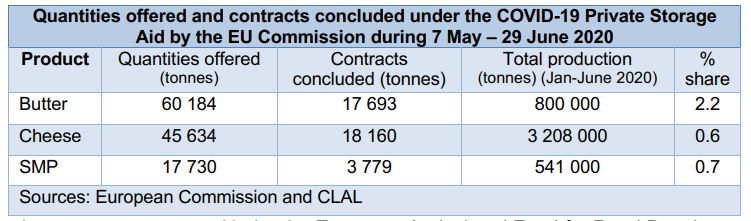

On 30 April, 2020, the EU Commission unveiled a series of measures to support agricultural and food markets affected by the coronavirus outbreak. The measures included: a) private storage aid (PSA) for the dairy and meat sectors; b) the authorisation of self-organisation market measures by operators in hard hit sectors and flexibility in fruits and vegetables and wine.

a) Private storage aid. The Commission opened private storage aid (PSA) for butter and SMP, allowing the temporary withdrawal of products from the market for a minimum of 2 to 3 months and a maximum period of 5 to 6 months.

The program was expected to decrease available supply on the market and rebalance the market on the long-term.

Stakeholders were eligible to apply through June 30, 2020 and receive subsidies to help pay for 60 to 180 days of private storage through December 26, 2020. The EU Commission established a total limit of 100 000 metric tons (MT) for cheese under the PSA scheme. By 30 June 2020, contracts under the scheme had been concluded for 17 693 tonnes of butter and 3 779 tonnes of SMP, equivalent to 2.2 percent and 0.7 percent, respectively, out of total estimated production from January to June 2020.

b) Flexibility for market support programs. Under the European Agricultural Fund for Rural Development (EAFRD), the Commission offered increased flexibility, including for: a) the use of financial instruments such as loans and guarantees to farmers and other rural development beneficiaries to cover operational costs of up to EUR 200 000 (USD 226 000) at favourable conditions; b) re-allocation of funds still available under their rural development programs (RDP) to finance relevant actions to face the crises; c) postponement for the submission of annual reports on the implementation of their RDPs; and d) elimination of the requirement to amend partnership agreements when modifying RDPs and lifting some administrative procedures.

c) In addition, the Commission offered flexibility and simplification of instruments under the EU common agricultural policy (CAP), which included: a) extension of deadline for CAP payment applications from 15 May to 15 June 2020;

b) increased advances of direct payments from 50 to 70 percent, and rural development payments from 75 to 85 percent; and c) reduction of physical on-the-spot checks and leeway for timing requirements with a view to minimize physical contact between farmers and the inspectors carrying out the checks during the pandemic period.

The EU Commission introduced flexibility in the implementation of market support programs for the EU’s school scheme (milk, fruits and vegetables) and agri-food sectors, aiming at reorienting funding priorities towards crisis management measures.

d) Exceptional derogation from EU competition rules. Under Article 222 of the Common Markets Organization Regulation, allowing farmers and farm organizations to collectively take measures to stabilize the market, including approval to collectively plan milk production, withdraw products from the market and maintain storage by private operators, for a maximum of six months. The measures were applicable to the milk, flowers and potatoes sectors.

e) On 30 June 2020, the EU Commission launched two calls for proposals for promotional programs to support the agri-food sector to recover from the COVID-19 crisis. This program targeted fruit and vegetables, wine, live plants, milk and milk products and potatoes, which are eligible for the promotion support of EUR 10 million (USD 11.3 million); they have to be implemented in the EU or any third country and for a duration of one year. The call recognized the significant impact of COVID-19 on specific agri-food sectors mainly due to rapid changes in demand and to the closure of restaurants, bars and cafés across the EU.

European Union: public intervention scheme

In March 2020, the European Commission opened its public intervention scheme for butter and non-fat dried milk (NFDM) for the period from March 1 to September 30, 2020. Under the programme, the European Commission would procure butter at EUR 2 217.50 (USD 2 400) per metric tonne and NFDM at EUR 1 698 (USD 1 850) per metric tonne.

The programme established limits of 50 000 metric tonnes for butter and 109 000 metric tonnes for NFDM. Beyond those limits, any additional procurements can take place under a tendering process. During the new window opened on 1 March 2020, 115 tonnes of SMP have been offered to public intervention.

European Union: the EU school fruit, vegetables and milk scheme

On 25 March 2020, the EU published the budget for the EU school scheme for the 2020/21 year, allocating EUR 105 million (USD 116 million) for the distribution of milk and dairy products with the balance for fruits and vegetables to schoolchildren from nursery to secondary school. The programme allows for flexibility in the choice of products, depending on dietary requirements, seasonality, variety, availability and environmental aspects. Generally, no added sugar, salt, fat and sweeteners or artificial flavours are allowed. The scheme also supports educational measures such as lessons, farm visits, school gardens, tasting and cooking workshops, theme days and games. The key objectives are to connect children to agriculture and teach them about healthy eating habits. Issues such as local food chains, organic farming, sustainable production or food waste are also covered. Educational activities may also involve teachers and parents. National funds may also be used to top up the EU budget.

India: measures related to COVID-19

In May 2020, India unveiled a COVID-19 economic package worth 1.7 trillion rupees (USD 22.5 billion), which includes measures to assist the agricultural and agri-food sector for strengthening infrastructure, logistics and capacity building.

The package includes funds to upgrade agricultural infrastructure such as cold chains, post-harvest storage, livestock sector programs and animal husbandry infrastructure development. The details on the types of organizations to be supported, support formats and the legal framework and amendments required for implementing the package are yet to be announced.

Japan: measures related to COVID-19

On 13 April 2020, Japan approved a 108 trillion yen (USD 990 billion) economic package to support the economy in response to COVID-19 pandemic, with USD 5 billion earmarked to support food and agricultural sectors, including USD 875 million to the Agriculture and Livestock Industries Corporation (ALIC), a state-trading enterprise. Out of funding for ALIC, 5 billion yen (USD 46 million) was earmarked to support the use of domestic milk powder by agricultural cooperatives and dairy companies that divert milk powder to feed use or to replace imports of prepared dairy products.

The objective was to increase the use of domestic milk in view of the reduced demand due to the closure of schools and loss of food services sales during the pandemic. The program also has provisions to support promotional sales activities for domestically produced agricultural products, to increase retails sales, and exports of domestic products.

The United Kingdom of Great Britain and Northern Ireland (the UK): measures related to COVID-19

On 27 March 2020, the government passed the Competition Act 1998 Order 2020, excluding the application of the Chapter I prohibition on anticompetitive agreements between suppliers, logistics providers and grocery retailers for the duration of the coronavirus COVID-19 pandemic, covering groceries (food, pet food, drinks, cleaning products, toiletries, household goods and non-prescription drugs). Under this relaxation, suppliers and retailers are able to coordinate: to limit customer purchases; on the range of groceries being supplied; temporary closure or restricted opening hours; assistance for critical workers; and to supply groceries to consumers in areas that are vulnerable to shortages.

On 17 April 2020, the government further relaxed competition rules, enabling further collaboration between farmers and producers during the pandemic by adapting to changes in the supply chain, thereby avoiding waste, maintaining productive capacity, decreased demand from the food services sector and reduced collection by retailers. For example, this allowed farmers and producers to identify hidden capacity in the supply chain for processing milk into other dairy products such as cheese and butter. The relaxation of competition rules allowed agents working in the dairy value chain, including dairy farmers, logistics services suppliers, manufacturers and retailers to work together. Among others, the collaboration may include sharing labour and facilities, cooperating to temporarily reduce production or identifying where there is hidden capacity in the supply chain for processing milk into other dairy products such as cheese and butter. It envisaged that the government, through the Dairy UK, producer led organization representing farmer co-operatives and companies, and the Agriculture and Horticulture Development Board (AHDB), facilitate collaboration across different actors to identify spare processing capacity, ways to stimulate demand and augmenting production temporarily when necessary.

On 6 May 2020, the UK enacted new funding supports for dairy farmers facing hardship due to the COVID-19 outbreak. Under the scheme, dairy farmers were given access up to GBP 10 000 (USD 12 000) each to cover 70 percent of their lost income between April and May to ensure their capacity to remain operational and sustain production, while also sustaining animal welfare standards. The government also backed a GBP 1 million (USD 1.2 million) campaign to boost milk consumption and help producers use their surplus stock.

The United States of America (the US): measures related to COVID-19

On 19 May 2020, the government announced details of the Coronavirus Food Assistance Program (CFAP) with a budget of USD 16 billion in direct payments to provide relief to farmers and ranchers impacted by the coronavirus pandemic. In addition, USDA’s Farmers to Families Food Box program has partnered with regional and local distributors to purchase USD 3 billion in fresh produce, dairy, and meat and deliver food to Americans in need, to provide relief to workforces who have been impacted by the closure of food services such as restaurants, hotels and other food service entities.

The CFAP payment to dairy farmers is based on two components: a producer’s certification of milk production for the first quarter of calendar year 2020 multiplied by a national price decline during the same quarter; and a national adjustment to each producer’s production in the first quarter. Payments are subject to a ceiling of USD 250 000 per person or entity for all commodities combined. Corporations, limited liability companies or limited partnerships may qualify for additional payment limits where members actively provide personal labour or personal management for the farming operation. Producers will also have to certify they meet the Adjusted Gross Income limitation of USD 900 000 unless at least 75 percent or more of their income is derived from farming, ranching or forestry-related activities.

Producers must also be in compliance with Highly Erodible Land and Wetland Conservation provisions.

The US is increasing its budget for dairy purchases in order to distribute dairy products to the most vulnerable population. The government has already announced a grant of USD 317 million for dairy purchases, part of the Farmers to Families Food Box program, with the aim of reducing dairy stocks and promoting a recovery of futures in the Chicago market. As part of the Coronavirus Farm Assistance Program (CFAP Act, 2020), the government has announced under the Families First Coronavirus Response Act (CARES Act, 2020) the purchase and distribution to those in need of up to USD 3 million worth of agricultural products.

Turkey: measures related to COVID-19

On 28 April, the Ministry of Finance announced the postponement of farmers’ loans for six months, backed by the treasury, in the wake of COVID-19. The total debt eligible for this measure was estimated at 6 billion Turkish liras (USD 858.1 million).

Ukraine: measures related to COVID-19

On 15 April 2020, the government introduced state regulation for prices of 20 products, including butter (72.5 percent fat content), until the end of the COVID-19 emergency period. The government communique indicated that if retailers intend to raise their sale prices, they must inform the States Food and Beverage Service. The measure is not applicable for manufacturers and supplies, but the agency is mandated to study the reasoning behind price increases and take appropriate action.

Measures-related to trade

Australia: measures related to COVID-19

On 1 April 2020, the government announced an International Freight Assistance Mechanism (IFAM), worth AUD 110 million (USD 69 million), as a temporary measure to help restore critical global supply chains that have been heavily impacted by COVID-19 containment measures around the world. The establishment of IFAM was considered essential to ensure sustaining the flow of imports such as medicines and medical supplies while providing opportunity, on the outbound legs, for producers of high-value products such as seafood, premium red meat, dairy (milk and yoghurt) and horticulture (fruits and packaged salads and vegetables) to resume servicing supply contracts with their international customers. IFAM supported several destinations as priority including Abu Dhabi, Dubai, Hong Kong SAR of China, Los Angeles, New Zealand, Singapore and Tokyo.

China: import tariffs

In December 2019, China announced import tariff reductions for 850 products, including whey and cheese products (processed, grated and powdered, blue and hard and semi-hard cheeses), effective January 2020.

Ecuador: trade agreement

In April 2020, the government approved the Economic Association Agreement with the European Free Trade Association (EFTA), a regional trade organization and free trade area consisting of four European countries (Iceland, Liechtenstein, Norway, and Switzerland). Negotiations for the agreement began in 2012 and concluded with the signing of the Inclusive Economic Association Agreement, complementing the multi-party agreement that the country signed with the countries of the European Union in 2016, which has been in force since 2017. The agreement allows Ecuadorian products to enter EFTA countries at a 0 percent duty from year zero, while Ecuador has been granted zero to 17 years for progressively reducing tariffs for EFTA products. EFTA has a trade defence mechanism that allows EFTA countries to impose bilateral safeguard measures in the event of increased imports that affect the local industry.

Dairy categories in the tariff-free movements include liquid milk, SMP, condensed milk, fermented dairy and yogurt, whey, butter, cheese (fresh, processed, grated or powdered, blue) and infant milk formula (IMF).

The European Union: rules supplementing import tariff quota regulations

On 12 June 2020, the European Commission issued new set of rules supplementing Regulation (EU) No 1306/2013 on import and export tariff quotas subject to licenses, applicable for: a) the conditions and eligibility requirements that an operator has to fulfil to submit an application within the tariff quotas listed in the Implementing Regulation (EU) 2020/761; b) rules on the transfer of rights between operators; c) the lodging and release of securities; d) providing, where necessary, for any particular specific characteristics, requirements or restrictions applicable to the tariff quota; and e) the specific tariff quotas provided for in Article 185 of Regulation (EU) No.1308/2013.

Japan: tariff rate quota

In April 2020, the government announced tariff-rate quota (TRQ) volumes for dairy products that will be effective during the country’s 2020 fiscal year (April 2020 – March 2021). All TRQ volumes remained at the same level as in the fiscal year 2019 except for the natural cheese for processed cheese production for which the TRQ volume was raised from 1 900 tonnes to 48 100 tonnes.

New Zealand: measures related to COVID-19

In March 2020, New Zealand announced a NZD 12.1 billion (USD 7.33 billion) COVID-19 support package which included NZD 600 million (USD 366 million) aviation support package. The government allocated NZD 330 million (USD 201.3 million) for Essential Transport Connectivity (ETC) scheme, which provides support for transport providers over the short to medium term to ensure the maintenance of capacity, regional connectivity and essential services in the wake of the COVID-19. Airports and airlines (both regional and international), aviation support services, and nonaviation support services under certain conditions were identified as eligible for funding under the scheme. IAFC scheme adds capacity to maintain trade links with global markets, to enable essential imports such as medical supplies and for high value export cargo. Contracts were awarded under phase one of the scheme, restoring capacity to the market with 58 weekly flights from New Zealand.

Russian Federation: import ban lifted

In April 2020, the Russian Federation lifted the embargo on whey imports for infant formula production from all countries, valid until December 31, 2020. The resolution amended the annex to the government decree of August 7, 2014, which established a list of products that fall under the agri-food embargo.